- United States

- /

- Hospitality

- /

- NYSE:CMG

Chipotle (CMG): Assessing Valuation After $500M Buyback and First Asia Expansion Deal

Reviewed by Simply Wall St

If you’ve had your eye on Chipotle Mexican Grill (CMG) lately, you’re probably aware of the headline-grabbing moves the company just made. Not only did the board greenlight an extra $500 million in share repurchases, but management also announced a joint venture to break into the Asian market for the first time next year. For investors still deciding whether to stick with or reconsider their position, it’s worth digging into what these big moves might mean for Chipotle’s value, especially given the stock’s recent ups and downs.

The past year has been anything but smooth for Chipotle’s share price, with a sharp drop of around 33% underscoring the market’s shifting mood and raising questions about future growth. There’s been more volatility over the past month, but some see glimmers of opportunity as the company pushes for international expansion and puts fresh capital toward buying back shares. Chipotle’s commitment to long-term strategies, including opening in South Korea and Singapore, signals that leadership is aiming for more than just quick fixes, despite consumer headwinds and leadership changes in the rearview mirror.

With so much swirling around Chipotle right now, the real question is whether the recent dip hints at a genuine buying opportunity, or if investors are already pricing in all the future growth the company can deliver.

Most Popular Narrative: 31.9% Undervalued

According to the most widely followed narrative, Chipotle Mexican Grill appears undervalued with nearly a third upside potential based on optimistic assumptions about its future growth and profitability.

Chipotle is expanding its international presence with plans to open restaurants in Mexico by 2026 and exploring further expansion in Latin America and Europe. This international expansion is expected to drive future revenue growth.

Ready to see what is powering this bullish outlook? This narrative highlights an ambitious expansion story, bold financial forecasts, and valuation multiples more commonly seen in Silicon Valley. Wondering what it would take for Chipotle’s earnings and margins to hit those targets? The answers, along with some eye-popping future assumptions, are just beneath the surface.

Result: Fair Value of $57.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a slowdown in consumer spending or new tariffs on key ingredients could quickly challenge the optimistic outlook for Chipotle’s expansion narrative.

Find out about the key risks to this Chipotle Mexican Grill narrative.Another View: What Do Market Multiples Suggest?

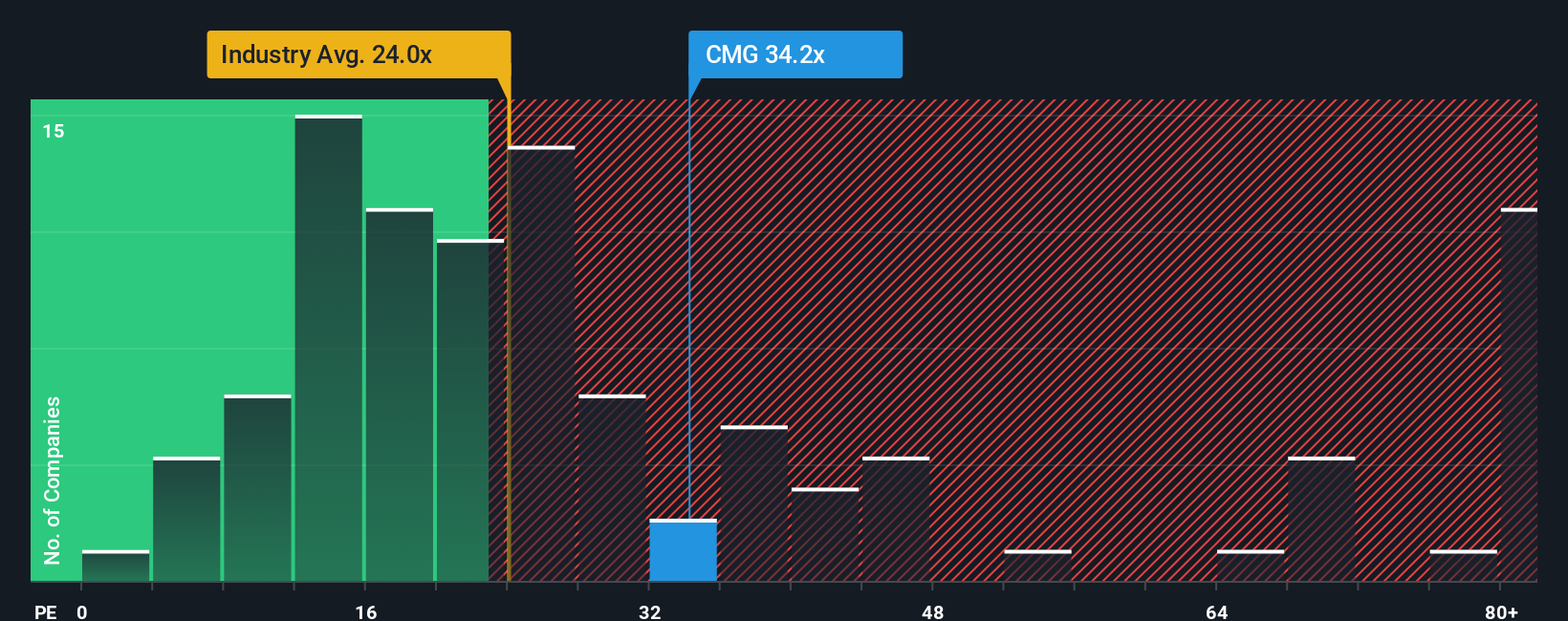

Looking through a different lens, Chipotle appears expensive compared to the broader US restaurant industry when using today’s price-to-earnings ratio. Does this mean investors are overestimating its growth story, or is the premium justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chipotle Mexican Grill Narrative

If you’re not convinced by these narratives or want to dig into the numbers yourself, you can build your own view with just a few clicks. Do it your way.

A great starting point for your Chipotle Mexican Grill research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Every market swing creates new pockets of potential. Don’t let winning stocks slip through your fingers when you can act now and spot the next big mover using Simply Wall Street’s powerful screeners:

- Pinpoint undervalued gems trading below their true worth with opportunities found in undervalued stocks based on cash flows.

- Tap into breakthrough innovation by tracking companies driving the future of medicine through advancements in artificial intelligence via healthcare AI stocks.

- Boost your portfolio’s cash flow with stocks consistently paying out strong yields by unlocking dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMG

Chipotle Mexican Grill

Owns and operates Chipotle Mexican Grill restaurants.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives