- United States

- /

- Hospitality

- /

- NYSE:CAVA

CAVA (CAVA): Reassessing Valuation After Insider Sale and More Cautious Analyst Outlook

Reviewed by Simply Wall St

CAVA Group (CAVA) is back in focus after Chief Legal Officer Kenneth Robert Bertram sold 3,788 shares, just as analysts turned more cautious amid macroeconomic pressure on same restaurant sales and rising operating costs.

See our latest analysis for CAVA Group.

The stock has been volatile since its post IPO enthusiasm, with a recent 7 day share price return of 8.6 percent partly reversing a 90 day share price decline of 20 percent. This may signal that momentum is stabilizing even as macro worries linger.

If this kind of sentiment shift has you reassessing your options, it could be a good moment to explore fast growing stocks with high insider ownership for other fast moving, founder backed names.

With the shares still roughly 29 percent below the average analyst price target, but weighed down by softer same restaurant trends and higher costs, the key question is whether CAVA is now a buying opportunity or if the market is already pricing in its future growth.

Most Popular Narrative Narrative: 22.3% Undervalued

With CAVA Group last closing at $52.73 against a narrative fair value of $67.89, the story leans toward upside, hinging on specific long term growth drivers.

Rapid geographic expansion into new and underserved markets, supported by strong new unit performance and a robust target of at least 1,000 restaurants by 2032, is likely to accelerate systemwide sales and drive higher topline revenue growth.

Want to see how bold expansion plans, changing consumer tastes, and future profit margins all connect into a single valuation story? The narrative leans on aggressive revenue growth, shifting margins, and a striking future earnings multiple that would usually turn heads in higher growth sectors. Curious which specific assumptions make that fair value possible and how they fit together over time? Dive in to uncover the full blueprint behind this pricing view.

Result: Fair Value of $67.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic pressures and aggressive expansion that risks saturating key markets could derail growth expectations and challenge the current undervaluation case.

Find out about the key risks to this CAVA Group narrative.

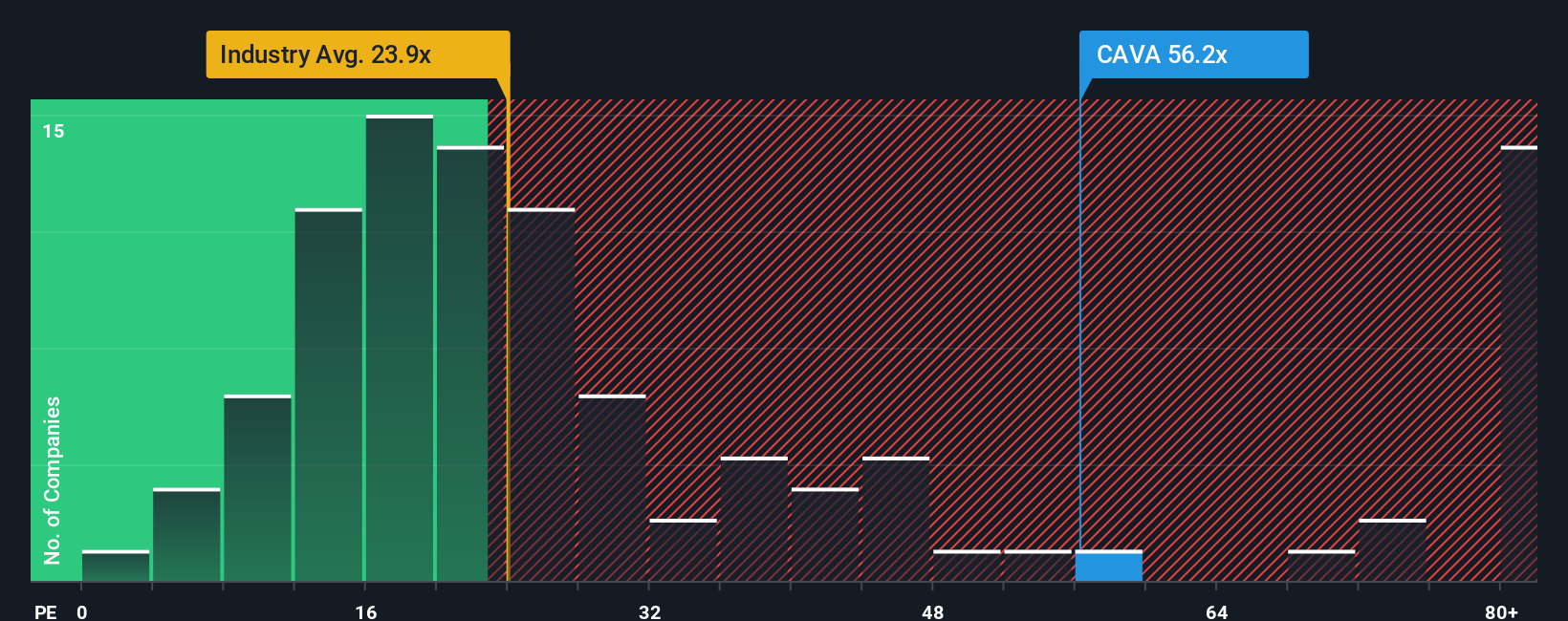

Another View: Market Multiples Flash a Caution Signal

While the narrative fair value suggests upside, a simple earnings based lens is less generous. CAVA trades on about 44.5 times earnings, more than double the US Hospitality average of 21.3 times and far above a fair ratio of 15.9 times, hinting at meaningful downside risk if sentiment cools. Which story do you trust when growth expectations reset?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CAVA Group Narrative

If you want to challenge these assumptions or dig into the numbers yourself, you can build a custom CAVA view in minutes: Do it your way.

A great starting point for your CAVA Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next potential opportunity with data backed stock ideas from our screener so you are not reacting after the move happens.

- Capture mispriced potential by running through these 928 undervalued stocks based on cash flows to find companies where future cash flows may not yet be reflected in the share price.

- Ride structural themes in healthcare innovation with these 30 healthcare AI stocks, focusing on businesses using artificial intelligence to reshape diagnostics, treatments, and patient outcomes.

- Position for developments in digital finance with these 81 cryptocurrency and blockchain stocks, highlighting listed plays on blockchain infrastructure, payment networks, and the broader crypto ecosystem.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAVA

CAVA Group

Owns and operates a chain of restaurants under the CAVA brand in the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026