- United States

- /

- Hospitality

- /

- NYSE:LUCK

Bowlero Corp. (NYSE:BOWL) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

Bowlero Corp. (NYSE:BOWL) shares have continued their recent momentum with a 26% gain in the last month alone. Unfortunately, despite the strong performance over the last month, the full year gain of 6.9% isn't as attractive.

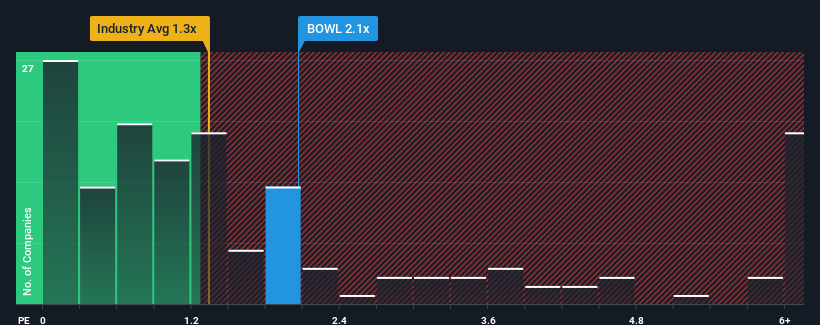

After such a large jump in price, given close to half the companies operating in the United States' Hospitality industry have price-to-sales ratios (or "P/S") below 1.3x, you may consider Bowlero as a stock to potentially avoid with its 2.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Bowlero

How Bowlero Has Been Performing

With revenue growth that's inferior to most other companies of late, Bowlero has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bowlero.Is There Enough Revenue Growth Forecasted For Bowlero?

In order to justify its P/S ratio, Bowlero would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a decent 5.8% gain to the company's revenues. While this performance is only fair, the company was still able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 8.3% per year over the next three years. With the industry predicted to deliver 12% growth per annum, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Bowlero's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

The large bounce in Bowlero's shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Bowlero, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You need to take note of risks, for example - Bowlero has 2 warning signs (and 1 which can't be ignored) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LUCK

Lucky Strike Entertainment

Provides location-based entertainment platforms under the AMF, Bowlero, Lucky X Strike, Boomers, and PBA brand names in North America.

Good value with moderate growth potential.

Market Insights

Community Narratives