- United States

- /

- Hospitality

- /

- NasdaqGS:WEN

Is Expansion Into Italy and Armenia Altering The Investment Case For Wendy's (WEN)?

Reviewed by Simply Wall St

- In July 2025, The Wendy's Company finalized exclusive franchise agreements to open up to 190 new restaurants across Italy and Armenia, with the first locations planned for Yerevan and Milan.

- This international expansion signals a significant acceleration of Wendy's overseas growth strategy, supporting its objective to reach 2,000 restaurants outside the United States by 2028.

- We'll explore how Wendy's aggressive move into Italy and Armenia could impact its long-term international growth outlook and investment narrative.

Wendy's Investment Narrative Recap

To be a shareholder in Wendy’s, you have to buy into its vision for robust international expansion, especially as it pushes to reach 2,000 restaurants outside the US by 2028. The recent Italy and Armenia franchise agreements reinforce this growth approach, yet in the short term, they may not immediately offset current pressures like soft consumer demand or margin challenges in the US, which remain the main factors influencing performance right now.

Among recent announcements, the finalized Italy and Armenia franchise deals are the most directly relevant, underpinning Wendy’s catalyst of accelerating global net unit growth. While these deals strengthen the brand’s presence in Europe and Eurasia, the biggest catalyst ahead still rests on the company’s execution and ability to drive consistent sales growth outside its core US market, an ambition that could redefine its revenue mix over the next several years.

On the other hand, investors should be aware of the potential risk if headwinds like margin pressure and global systemwide sales trends persist...

Read the full narrative on Wendy's (it's free!)

Wendy's narrative projects $2.4 billion revenue and $224.7 million earnings by 2028. This requires 2.3% yearly revenue growth and a $33.1 million earnings increase from $191.6 million.

Uncover how Wendy's forecasts yield a $14.97 fair value, a 38% upside to its current price.

Exploring Other Perspectives

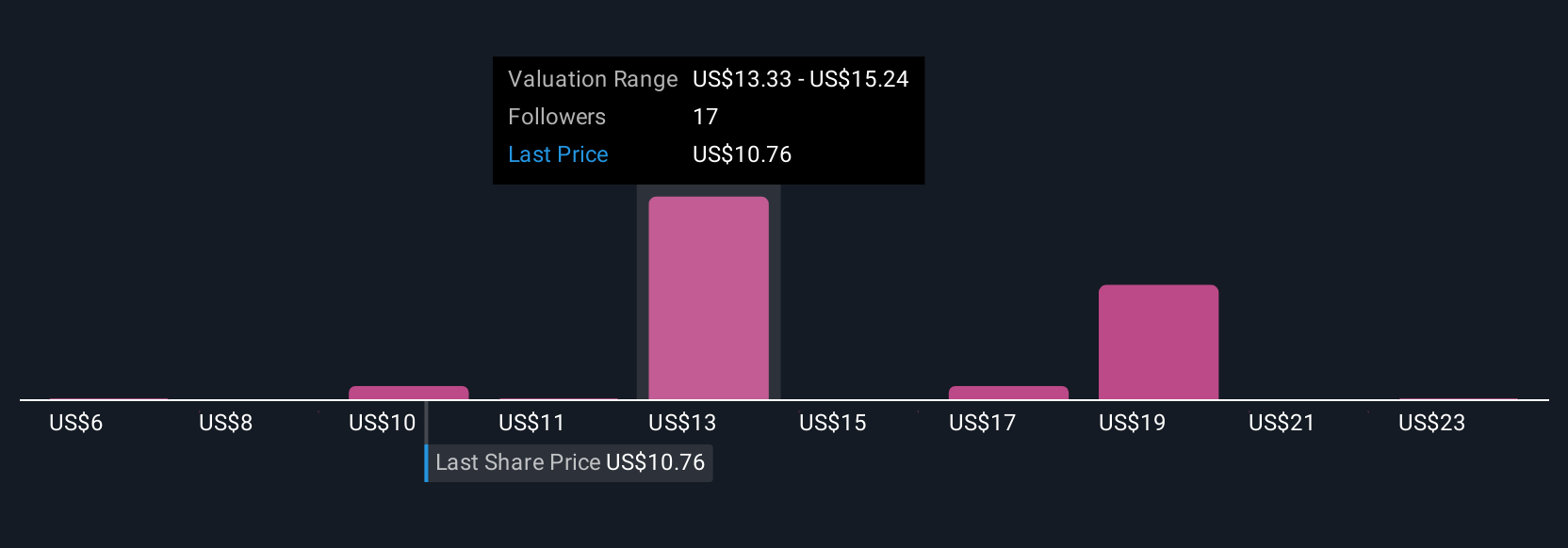

Ten perspectives from the Simply Wall St Community put Wendy’s fair value anywhere between US$5.69 and US$24.79. With this latest push into international markets, the variety in valuations serves as a reminder that expectations for global growth can be sharply divided, prompting you to consider a range of scenarios before making any conclusions.

Build Your Own Wendy's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wendy's research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Wendy's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wendy's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wendy's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WEN

Wendy's

Operates as a quick-service restaurant company in the United States and internationally.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives