- United States

- /

- Hospitality

- /

- NasdaqGS:TXRH

Texas Roadhouse (TXRH): Valuation Insight as Brazilian Beef Tariff Cuts Signal a Boost to Margins

Reviewed by Simply Wall St

Texas Roadhouse (TXRH) is drawing attention after tariff cuts on Brazilian beef signaled potential relief on input costs. Investors are curious to see how these changes might impact the company’s overall profitability and gross margins.

See our latest analysis for Texas Roadhouse.

Alongside anticipated margin gains, Texas Roadhouse recently named a new CFO and reorganized senior leadership, marking a busy end to the year. While the stock is down 6.2% year-to-date, its three-year total shareholder return of nearly 87% shows resilient long-term momentum has not gone unnoticed.

Looking for more ideas beyond steakhouse stocks? Take the next step and uncover other fast-growing companies with strong insider backing. Here is your chance to discover fast growing stocks with high insider ownership

But does this margin upside mean Texas Roadhouse shares are still undervalued, or have investors already priced in these positive developments? Is there a true buying opportunity here, or is the market taking future growth into consideration?

Most Popular Narrative: 10.1% Undervalued

Texas Roadhouse’s narrative-based fair value estimate is $189.08, which is nearly $19 above the last close of $169.92. This suggests market participants may be overlooking optimism on future earnings and strategic moves, shaping a compelling case for further upside.

Expansion of Bubba's 33 and Jaggers brands, with a sizable pipeline of openings planned and a proven infrastructure and leadership team, supports sustained unit growth and future revenue acceleration as new stores mature. Successful digital integration, enhancements to the mobile app, improved waitlist and to-go experience, and broad rollout of digital kitchen technology are boosting operational efficiency and guest convenience, which is likely to drive both sales growth and margin improvement.

What fuels this bullish view? The narrative bases its fair value on ambitious improvements in earnings power and profit margins, along with calculated confidence in operational enhancements driving sales. Want to know which forward-looking projections shape this outlook? Uncover the specifics and see the full playbook behind the numbers.

Result: Fair Value of $189.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent beef inflation and slowing core demand could quickly shift the outlook if cost pressures increase or sales growth slows further.

Find out about the key risks to this Texas Roadhouse narrative.

Another View: Valuation Through Earnings Multiples

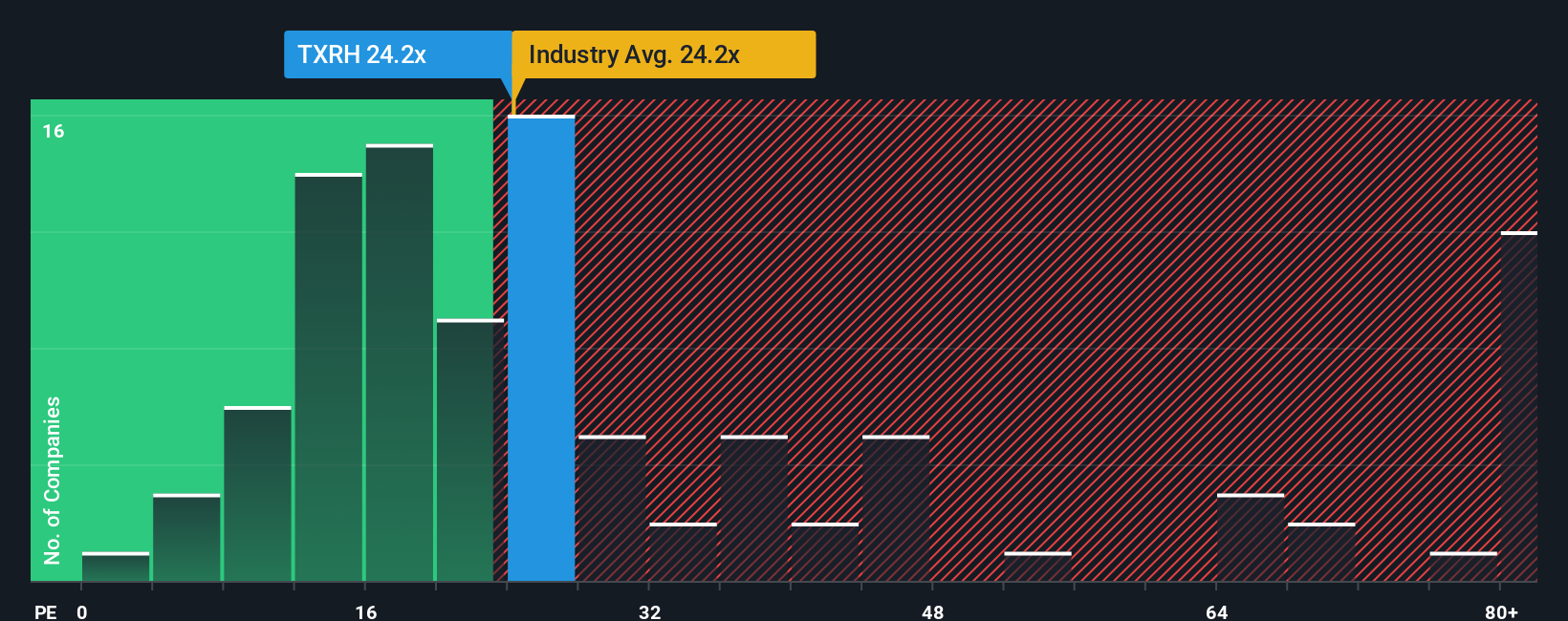

Looking through the lens of earnings multiples, Texas Roadhouse currently trades at 25.9x, which is more expensive than both the US Hospitality industry’s average of 21.3x and its own fair ratio of 21.2x. While it appears cheaper than peers at 47.7x, this higher-than-fair multiple indicates there may be less margin for error if growth slows. Does this premium reflect confidence, or is caution warranted for future returns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Texas Roadhouse Narrative

If you see the story unfolding differently or want to dig into the data yourself, you can build a fresh take in just a few minutes. Do it your way

A great starting point for your Texas Roadhouse research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

You could be missing out on the next big trend by sticking to the usual names. Use the Simply Wall Street Screener to uncover unique stocks and strategies that match your investing goals.

- Capture reliable income potential and steady growth by checking out these 14 dividend stocks with yields > 3% with attractive yields exceeding 3%.

- Accelerate your portfolio with innovation. Jump into these 25 AI penny stocks making breakthroughs in artificial intelligence and disruptive technology sectors.

- Position yourself ahead of the market by targeting remarkable value through these 930 undervalued stocks based on cash flows based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Roadhouse might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXRH

Texas Roadhouse

Operates casual dining restaurants in the United States and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026