- United States

- /

- Hospitality

- /

- NasdaqGS:TXRH

Subdued Growth No Barrier To Texas Roadhouse, Inc.'s (NASDAQ:TXRH) Price

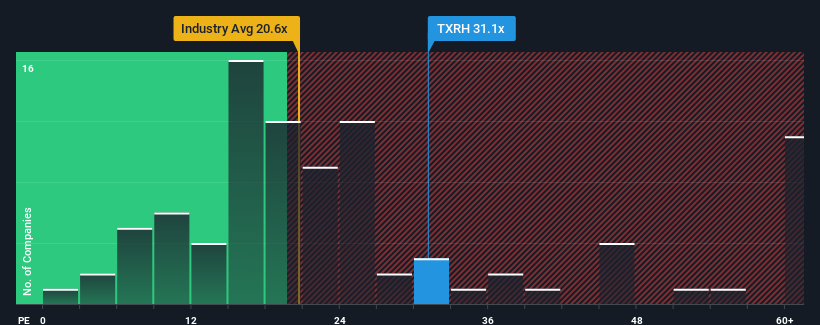

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 18x, you may consider Texas Roadhouse, Inc. (NASDAQ:TXRH) as a stock to avoid entirely with its 31.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Texas Roadhouse has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Texas Roadhouse

How Is Texas Roadhouse's Growth Trending?

Texas Roadhouse's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered an exceptional 27% gain to the company's bottom line. Pleasingly, EPS has also lifted 105% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 12% each year during the coming three years according to the analysts following the company. With the market predicted to deliver 10% growth each year, the company is positioned for a comparable earnings result.

With this information, we find it interesting that Texas Roadhouse is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Bottom Line On Texas Roadhouse's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Texas Roadhouse currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Texas Roadhouse with six simple checks will allow you to discover any risks that could be an issue.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Texas Roadhouse, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Texas Roadhouse might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TXRH

Texas Roadhouse

Operates casual dining restaurants in the United States and internationally.

Outstanding track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives