- United States

- /

- Hospitality

- /

- NasdaqGS:TCOM

Trip.com Group (NasdaqGS:TCOM): Evaluating Valuation After Strong Share Price Recovery

Reviewed by Simply Wall St

Trip.com Group (NasdaqGS:TCOM) has quietly caught investors’ attention after a steady recovery from pandemic lows, capped by a rise of nearly 58% over the past year. While there is no single headline grabbing the spotlight this week, the climb in share price may have left many shareholders wondering if the market’s optimism is sustainable or if this is simply a return to the company’s growth narrative as global travel demand rebounds.

Looking at the bigger picture, Trip.com Group’s performance has outpaced most industry peers, with momentum building not just over the past year but also across the last three and even five years. The stock edged up by 3% in the past day and logged a 9% gain this week, reinforcing an upward trend that has quietly gained strength. Annual revenue and net income growth rates above 11% and 9%, respectively, add another layer to the reopening theme investors have been watching since mid-2023.

With all this upward movement, the key question is whether Trip.com Group is a bargain right now or if the recent price gains mean the market is already looking ahead. Are you willing to expect more upside, or has the opportunity already been priced in?

Most Popular Narrative: 15% Undervalued

According to community narrative, Trip.com Group appears undervalued by 15% relative to its fair value, based on future earnings growth, net margins, and revenue projections. The consensus analyst price target reflects optimism in Trip.com's medium- and long-term expansion strategies.

Trip.com Group is focusing on AI innovation to enhance user engagement through personalized and efficient travel planning tools. This initiative has the potential to drive increased customer acquisition and retention, which could positively impact revenue growth.

Curious what’s powering this bullish price target? The narrative centers on a blend of rapid expansion, margin dynamics, and a forward PE multiple that exceeds the broader industry average. Interested in the specific assumptions and notable numbers driving the projected upside? The raw growth forecasts and margin assumptions behind this fair value could change how you look at Trip.com Group.

Result: Fair Value of $76.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, the story could change if global travel demand falters, or if rising operational costs eat into Trip.com's margins and earnings momentum.

Find out about the key risks to this Trip.com Group narrative.Another View: Discounted Cash Flow Approach

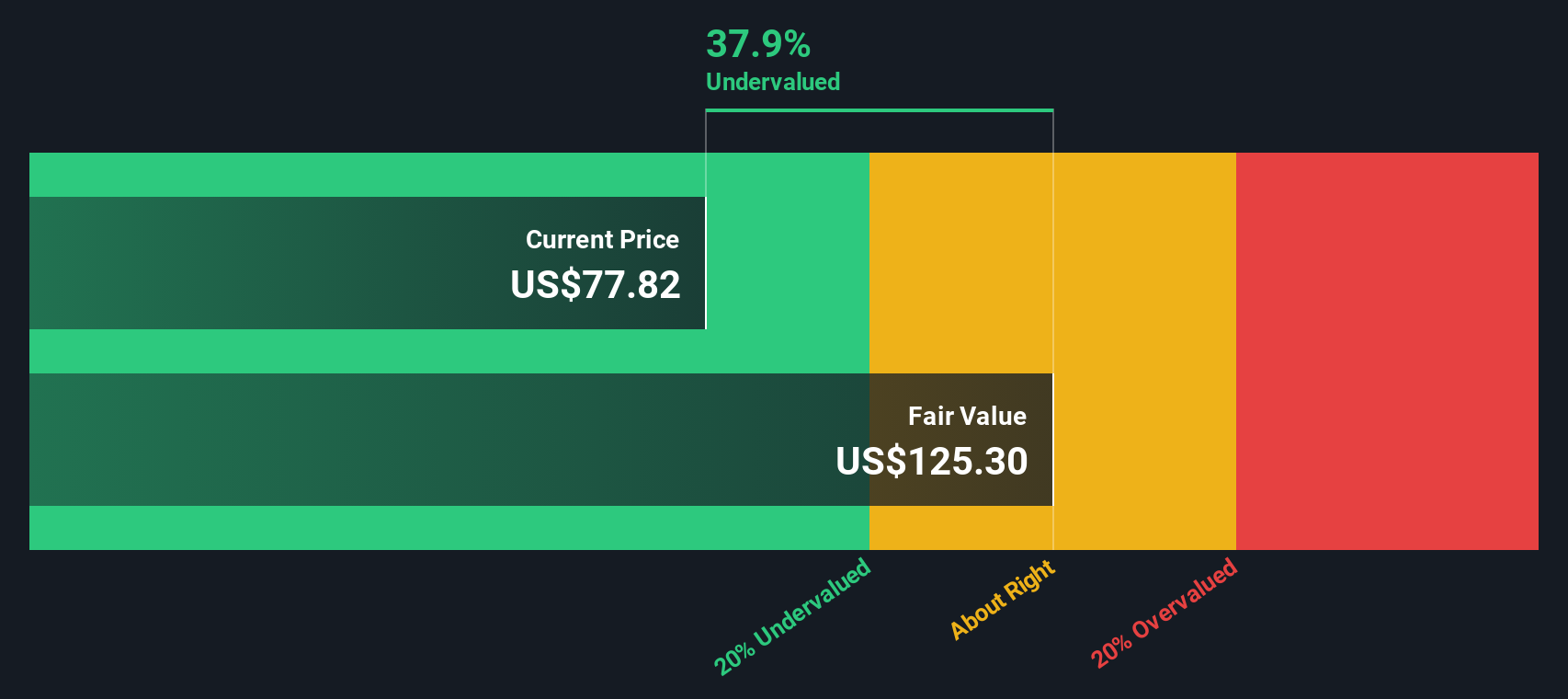

Looking through a different lens, our DCF model also indicates Trip.com Group may be undervalued. This approach uses future cash flow estimates instead of market multiples to reach its result. Could these deeper fundamentals tell a fuller story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Trip.com Group Narrative

If you'd rather form your own perspective or dive deeper into the underlying data, you can easily craft your own narrative in just a few minutes. So why not do it your way?

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Trip.com Group.

Looking for More Smart Investment Opportunities?

Why stop at just one exciting pick when there are so many other high-potential stocks waiting to be uncovered? Make the most of your next move and seize the chance to build a standout portfolio. Here are powerful ways to unearth your next winner. Skip the FOMO and get started now:

- Target stable returns by checking out the top dividend payers offering yields above 3% through dividend stocks with yields > 3% for consistent income potential.

- Tap into cutting-edge innovation by exploring healthcare companies harnessing AI with healthcare AI stocks and see which stocks are making breakthroughs you won't want to miss.

- Spot hidden gems with strong fundamentals by browsing penny stocks with strong financials, where you might uncover tomorrow's standouts before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trip.com Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TCOM

Trip.com Group

Through its subsidiaries, operates as a travel service provider for accommodation reservation, transportation ticketing, packaged tours, in-destination, corporate travel management, and other travel-related services in China and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives