- United States

- /

- Hospitality

- /

- NasdaqGS:SRAD

How Bundesliga's AI Data Expansion Could Shape Sportradar Group's (SRAD) Earnings Resilience

Reviewed by Simply Wall St

- Bundesliga International recently announced it has expanded its longstanding partnership with Sportradar Group to launch advanced AI-powered data and streaming products for the global betting and gaming industry, ahead of the 2025-26 Bundesliga season.

- This collaboration enables Sportradar to leverage real-time tracking and proprietary technology to provide clients with next-generation digital experiences and over 240 new in-play betting opportunities per match.

- We'll explore how Sportradar's new AI-enabled Bundesliga offerings could strengthen recurring revenue growth and earnings quality within its broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Sportradar Group Investment Narrative Recap

Investors in Sportradar Group must believe in the continued global expansion of sports betting and increasing demand for advanced, real-time data. The Bundesliga International partnership extends Sportradar’s product suite and client integration, potentially supporting short-term revenue catalysts, but rising competition from direct data distribution by leagues remains a key risk that may limit long-term pricing power and onboarding fees, dampening the impact of this news in the near term.

The recent partnership with DAZN, securing exclusive ultra-low latency data rights for the FIFA Club World Cup 2025, is exceptionally relevant as it further strengthens Sportradar’s global portfolio of premium sports data, amplifying the recurring revenue catalyst represented by its Bundesliga product launches and supporting its growth ambitions in emerging markets.

However, it’s worth highlighting that rapid innovation by sports leagues and new entrants could erode Sportradar’s negotiating leverage if exclusive rights are renegotiated, which is something investors should be aware of...

Read the full narrative on Sportradar Group (it's free!)

Sportradar Group's narrative projects €1.8 billion revenue and €262.9 million earnings by 2028. This requires 15.5% yearly revenue growth and an increase in earnings of about €153 million from the current €109.6 million.

Uncover how Sportradar Group's forecasts yield a $32.62 fair value, a 3% upside to its current price.

Exploring Other Perspectives

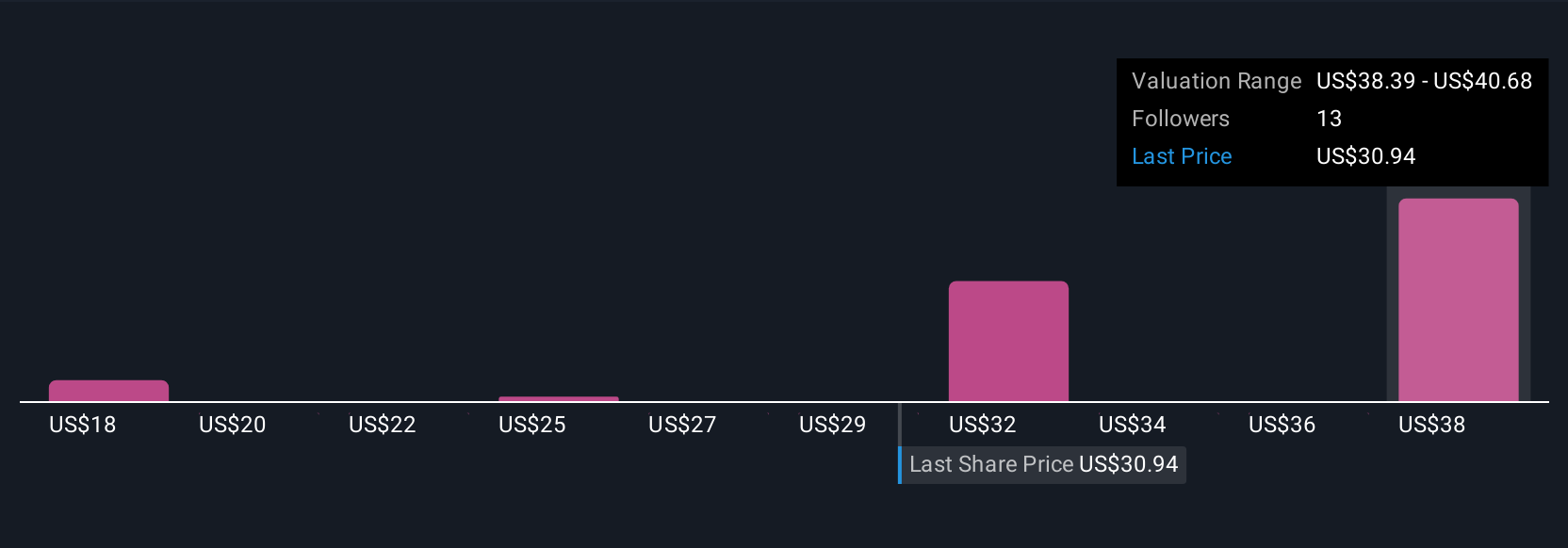

Five retail investors in the Simply Wall St Community estimate Sportradar’s fair value from US$17.81 to US$40.80 per share. While you weigh these views, consider that persistent competition from leagues moving into data distribution could have wide-ranging impacts on expectations for revenue growth and margins, making it essential to assess several perspectives before drawing conclusions.

Explore 5 other fair value estimates on Sportradar Group - why the stock might be worth 44% less than the current price!

Build Your Own Sportradar Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sportradar Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Sportradar Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sportradar Group's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRAD

Sportradar Group

Provides sports data services for the sports betting and media industries in Switzerland, the United States, North America, Africa, the Asia Pacific, the Middle East, Europe, Latin America, and the Caribbean.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026