- United States

- /

- Hospitality

- /

- NasdaqGS:SOND

Slammed 42% Sonder Holdings Inc. (NASDAQ:SOND) Screens Well Here But There Might Be A Catch

Unfortunately for some shareholders, the Sonder Holdings Inc. (NASDAQ:SOND) share price has dived 42% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 89% share price decline.

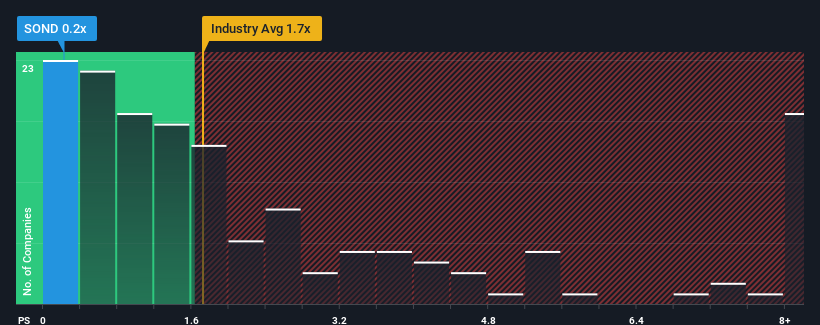

Following the heavy fall in price, Sonder Holdings may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Hospitality industry in the United States have P/S ratios greater than 1.7x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Sonder Holdings

How Has Sonder Holdings Performed Recently?

With revenue growth that's superior to most other companies of late, Sonder Holdings has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Sonder Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is Sonder Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Sonder Holdings would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 98%. The strong recent performance means it was also able to grow revenue by 223% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 28% per annum during the coming three years according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 17% each year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Sonder Holdings' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Sonder Holdings' P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Sonder Holdings' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Sonder Holdings (at least 2 which shouldn't be ignored), and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SOND

Sonder Holdings

Engages in the hospitality business in the United States, Europe, the Middle East, the United Arab Emirates, and internationally.

Undervalued slight.