- United States

- /

- Semiconductors

- /

- NasdaqGM:NVTS

3 Promising US Penny Stocks With Market Caps Under $900M

Reviewed by Simply Wall St

As the U.S. stock market continues to rally following President Trump's return to office, investors are closely watching the impact of new policies on various sectors. In this context, penny stocks remain an intriguing area for those looking for potential growth opportunities. Though often associated with speculative trading, these smaller or newer companies can offer significant returns when they possess strong financial fundamentals. We'll highlight three such penny stocks that stand out due to their financial health and potential for long-term success.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $108.36M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.88224 | $6.46M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $4.00 | $11.73M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.75 | $2.08B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2998 | $10.12M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.49 | $52.14M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.41 | $61.94M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.25 | $20.04M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9174 | $80.38M | ★★★★★☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Navitas Semiconductor (NasdaqGM:NVTS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Navitas Semiconductor Corporation designs, develops, and markets gallium nitride power integrated circuits and related technologies for power conversion and charging, with a market cap of approximately $609 million.

Operations: Navitas Semiconductor generates revenue primarily from its semiconductors segment, totaling $91.38 million.

Market Cap: $608.96M

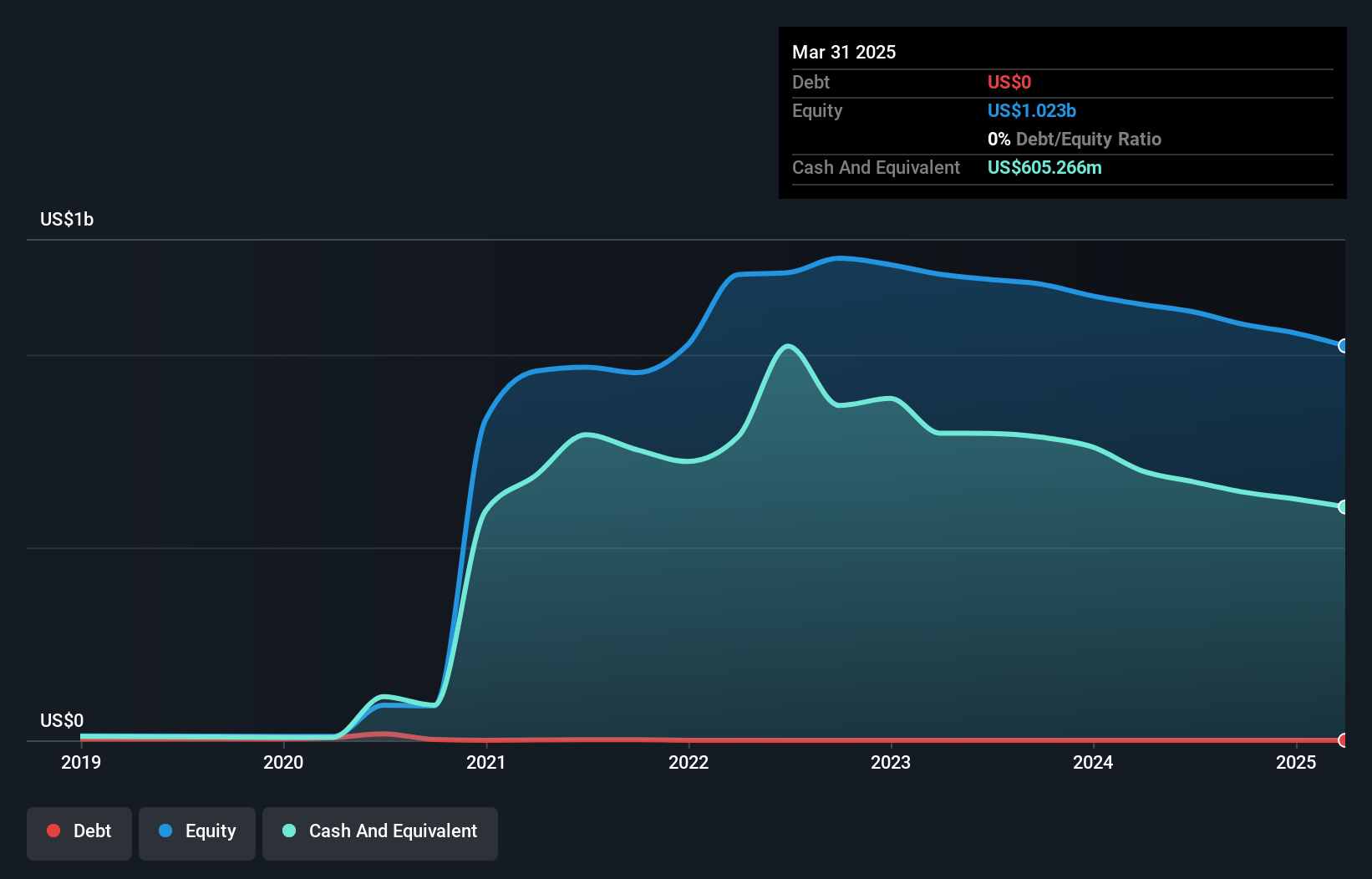

Navitas Semiconductor, with a market cap of approximately US$609 million, is navigating the volatile landscape typical of penny stocks. Despite its unprofitability and forecasted earnings decline over the next three years, Navitas is positioned in high-growth sectors like AI data centers and EVs. Its revenue growth forecast at 19.22% annually contrasts with its negative return on equity (-20.3%). The company has no debt and a cash runway extending beyond two years, though recent insider selling raises concerns. Recent innovations in GaN and SiC technologies underscore potential for efficiency improvements and carbon footprint reduction in emerging markets.

- Navigate through the intricacies of Navitas Semiconductor with our comprehensive balance sheet health report here.

- Assess Navitas Semiconductor's future earnings estimates with our detailed growth reports.

AbCellera Biologics (NasdaqGS:ABCL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AbCellera Biologics Inc. focuses on creating an engine for antibody drug discovery and development, with a market cap of approximately $877.24 million.

Operations: The company's revenue is primarily derived from the discovery and development of antibodies, amounting to $32.96 million.

Market Cap: $877.24M

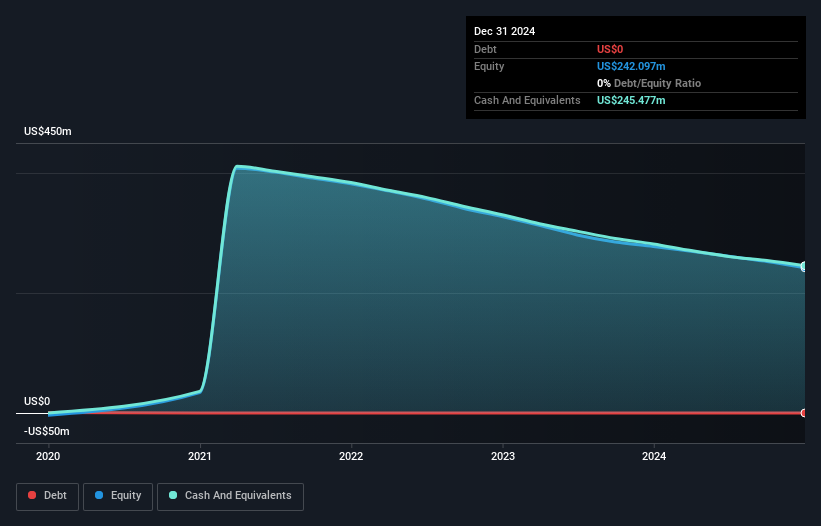

AbCellera Biologics, with a market cap of approximately US$877.24 million, operates in the challenging biotech sector, focusing on antibody drug discovery. Despite being unprofitable and experiencing an increase in losses over the past five years, its short-term assets significantly exceed liabilities. The company is debt-free and forecasts a 15.85% annual revenue growth despite anticipated earnings decline. Recent strategic expansion with AbbVie for T-cell engagers highlights potential future revenue streams through milestone and royalty payments. However, it reported substantial net losses for recent quarters, reflecting ongoing financial challenges typical of penny stocks in this sector.

- Dive into the specifics of AbCellera Biologics here with our thorough balance sheet health report.

- Evaluate AbCellera Biologics' prospects by accessing our earnings growth report.

Design Therapeutics (NasdaqGS:DSGN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Design Therapeutics, Inc. is a biopharmaceutical company focused on researching, designing, developing, and commercializing small molecule therapeutic drugs for genetic diseases in the United States with a market cap of $286.50 million.

Operations: Design Therapeutics, Inc. does not have any reported revenue segments.

Market Cap: $286.5M

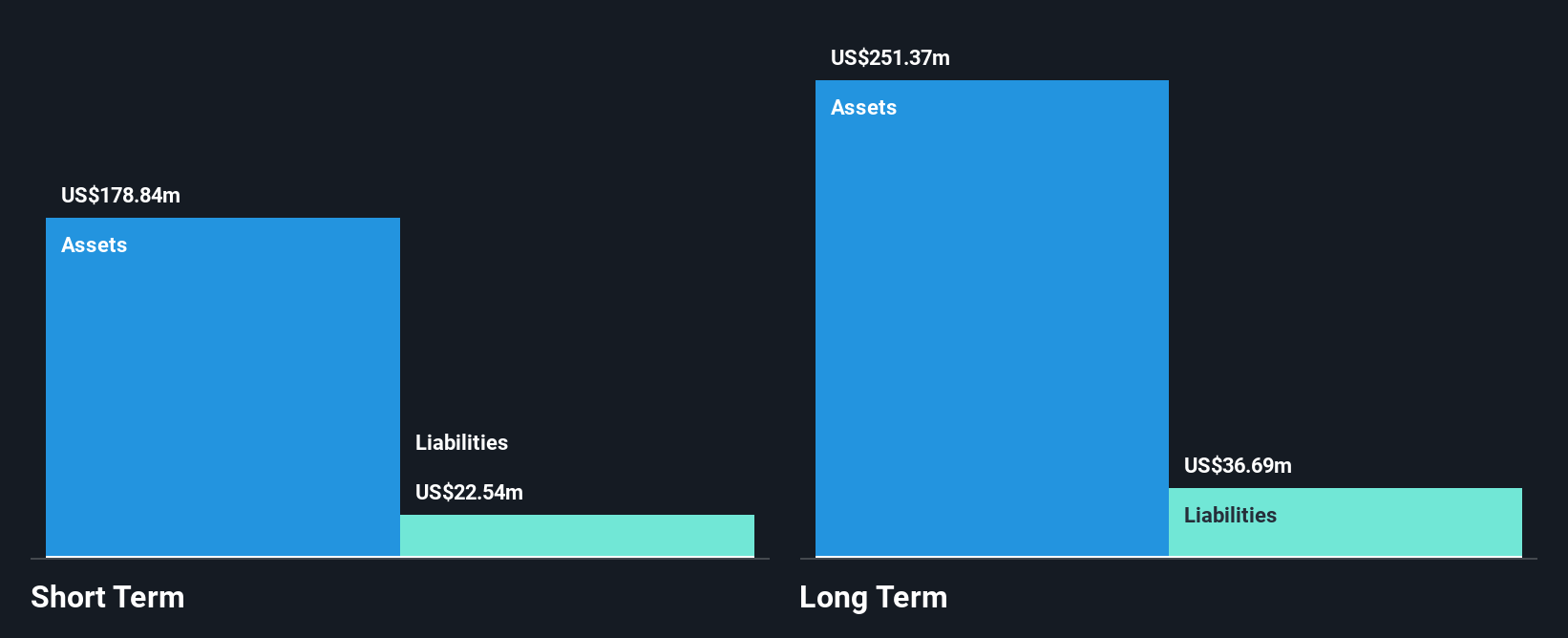

Design Therapeutics, Inc., with a market cap of US$286.50 million, is pre-revenue and debt-free, highlighting its early-stage biotech profile. The company has sufficient cash runway for over three years despite historical reductions in free cash flow. Its short-term assets significantly exceed both short and long-term liabilities. However, it remains unprofitable with increasing losses over the past five years at 31.9% annually and earnings forecasted to decline by 10.4% per year for the next three years. Recent inclusion in the NASDAQ Biotechnology Index may enhance visibility but doesn't mitigate high share price volatility or financial challenges typical of penny stocks.

- Unlock comprehensive insights into our analysis of Design Therapeutics stock in this financial health report.

- Examine Design Therapeutics' earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Take a closer look at our US Penny Stocks list of 709 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navitas Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NVTS

Navitas Semiconductor

Designs, develops, and markets power semiconductors in the United States, Europe, China, rest of Asia, and internationally.

Flawless balance sheet with limited growth.