- United States

- /

- Hospitality

- /

- NasdaqGS:SOND

A Piece Of The Puzzle Missing From Sonder Holdings Inc.'s (NASDAQ:SOND) 165% Share Price Climb

Sonder Holdings Inc. (NASDAQ:SOND) shares have had a really impressive month, gaining 165% after a shaky period beforehand. But the last month did very little to improve the 66% share price decline over the last year.

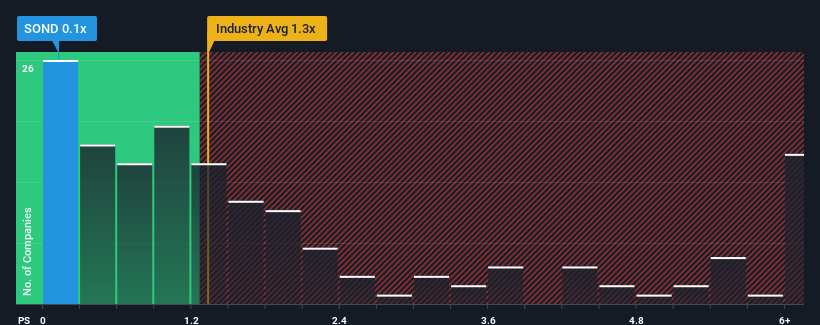

Even after such a large jump in price, it would still be understandable if you think Sonder Holdings is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in the United States' Hospitality industry have P/S ratios above 1.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Sonder Holdings

How Has Sonder Holdings Performed Recently?

Recent revenue growth for Sonder Holdings has been in line with the industry. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Sonder Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Sonder Holdings?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Sonder Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 39% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 26% over the next year. With the industry only predicted to deliver 13%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Sonder Holdings' P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Sonder Holdings' P/S

The latest share price surge wasn't enough to lift Sonder Holdings' P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems Sonder Holdings currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Sonder Holdings is showing 4 warning signs in our investment analysis, and 2 of those are a bit unpleasant.

If you're unsure about the strength of Sonder Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SOND

Sonder Holdings

Engages in the hospitality business in the United States, Europe, the Middle East, the United Arab Emirates, and internationally.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives