- United States

- /

- Hospitality

- /

- NasdaqGS:SBUX

Is Starbucks a Good Value After Record-Breaking Sales From the Fall Drink Launch?

Reviewed by Bailey Pemberton

Trying to make sense of Starbucks stock lately? You are definitely not alone. Investors have had quite a bit to sip on, with shares recently closing at $78.46 after a bumpy ride. In just the past week, Starbucks dropped 9.2% and is now off nearly 15% this year. Even if you zoom out to three and five years, performance is still a touch negative, which might surprise those who think of the coffee giant as a reliable long-term winner.

So, what’s behind the headlines? Some recent leadership changes, like the resignation of their CTO and shifts in their tech strategy, have added uncertainty. Operational moves are also in focus, with the CEO making aggressive pushes to speed up orders and launch new products, like the recent fall drink lineup that actually helped spark record-breaking U.S. store sales. This shows that loyal fans still line up for those limited-time offerings. However, supply chain tweaks, including production cuts at several U.S. roasting plants, and upcoming changes to the China business strategy, keep investor nerves on edge about future growth and global expansion.

Whenever a big-name stock like Starbucks sours in the near term, valuation becomes even more important. According to our six check system, Starbucks scores a 3 for value, meaning it looks undervalued in 3 out of 6 key metrics. Is that enough for investors to consider jumping in now, or is caution still brewing? Let’s break down how these valuation methods stack up, and stick with me because there is an even sharper lens we will use at the end to see whether Starbucks is a buy, sell, or just a stock to watch.

Why Starbucks is lagging behind its peers

Approach 1: Starbucks Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its expected cash flows into the future and then discounting those amounts back to their present value. This approach gives investors a sense of what Starbucks might be worth based on future profit potential, rather than just focusing on today’s market moves.

Looking at Starbucks, its last twelve months’ Free Cash Flow came in at approximately $2.36 billion. Analysts forecast steady growth, with estimates rising to around $3.05 billion by 2026 and $3.83 billion in 2028. Beyond 2028, Simply Wall St extrapolates these projections and forecasts Starbucks’ Free Cash Flow could reach roughly $5.11 billion by 2035. All figures are in U.S. dollars.

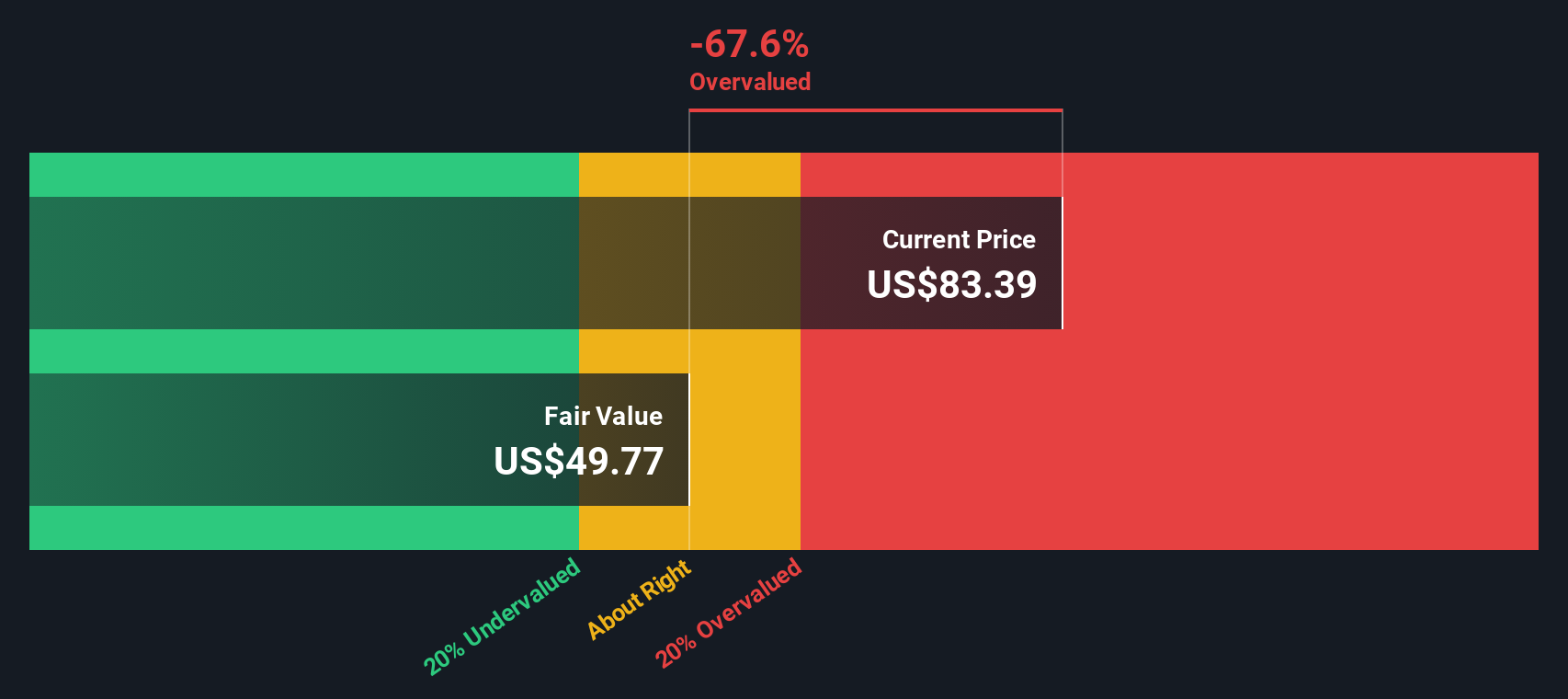

After discounting all of these future cash flows back to today, the DCF model arrives at an intrinsic share value of $54.81. Compared to the recent closing price of $78.46, this indicates Starbucks stock is about 43.1% overvalued according to this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Starbucks may be overvalued by 43.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Starbucks Price vs Earnings (P/E Ratio)

For established, profitable companies like Starbucks, the Price-to-Earnings (P/E) ratio is a widely accepted way to value the business. Unlike other multiples, the P/E ratio directly relates a company’s stock price to its underlying earnings, offering investors a practical gauge of what the market is willing to pay for each dollar of profit. Higher growth prospects or lower risk typically justify a higher P/E, while cyclical or uncertain companies tend to trade at lower P/E ratios.

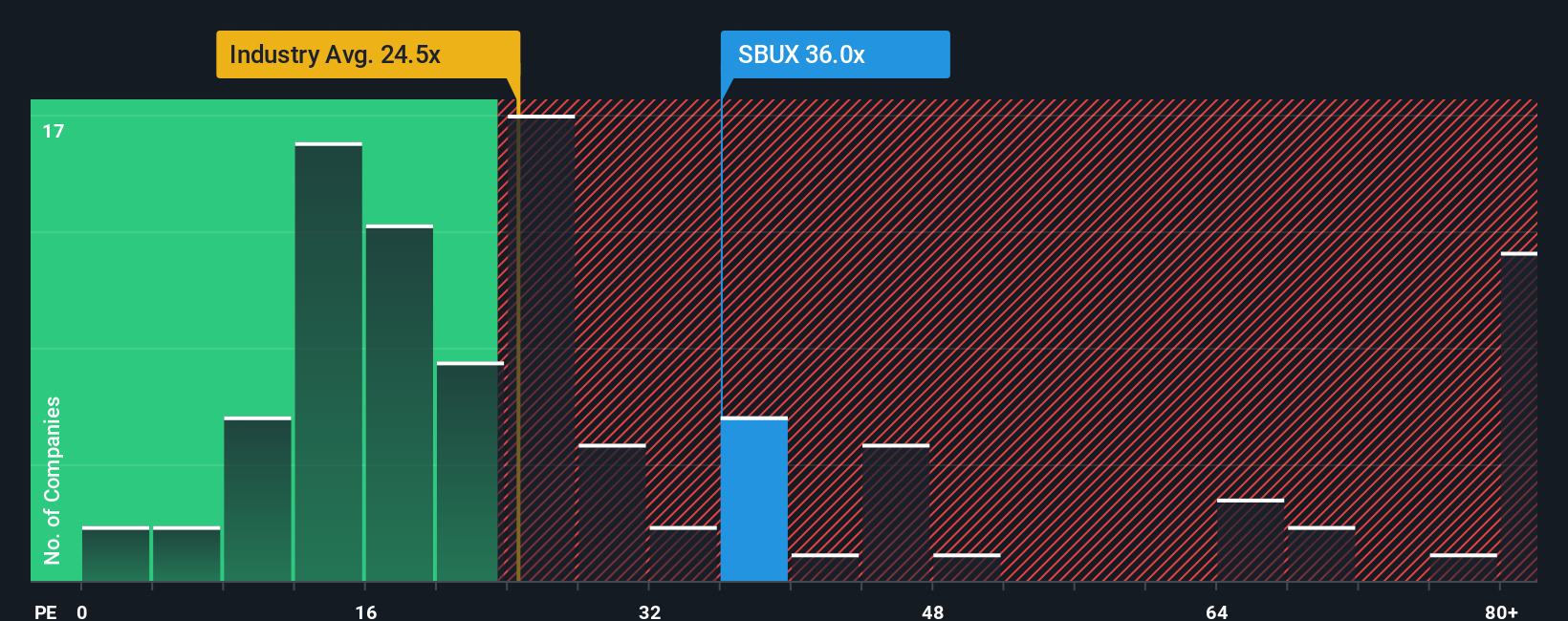

Currently, Starbucks trades at a P/E ratio of 33.88x. That is well above the Hospitality industry average of 23.12x and also falls short in comparison to its peer average, which comes in at a lofty 58.20x. From a pure industry or peer perspective, Starbucks looks expensive compared to its sector but more reasonably priced compared to direct competitors.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio for Starbucks is calculated at 35.04x, taking into account not just industry averages, but the company’s specific growth prospects, profit margins, risk profile, and market cap. By tailoring the benchmark to Starbucks' unique situation rather than using broad averages, the Fair Ratio gives investors a more accurate sense of what the multiple should be today.

With Starbucks trading at 33.88x, just a hair below its Fair Ratio of 35.04x, the difference is negligible. This suggests the stock is being valued by the market about as you would expect, considering all the moving pieces, neither too hot nor too cold at these levels.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Starbucks Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a user-friendly tool that lets you go beyond the numbers by connecting a company’s story and your own investment perspective to the financial forecasts behind its fair value.

Narratives work by summarizing your view of a business. For example, you might consider how you expect Starbucks’ new leadership, growth strategy, or global expansion plans to play out, and then link that story to specific estimates like future revenues, profit margins, and valuation multiples. The result is a clear, data-driven roadmap that makes it easy to sense-check the reasoning behind a Buy, Hold, or Sell decision.

Best of all, Narratives are available right now on Simply Wall St’s Community page, where millions of investors share and refine their viewpoints. As new developments occur, such as fresh earnings reports, supply chain updates, or industry shifts, Narratives update automatically with any changes to assumptions or forecasts, helping you stay ahead of the news.

For example, some investors see Starbucks’ future as bright, projecting a fair value of $97.59 per share, while others are more cautious, seeing it closer to $86.27. Whichever side you identify with, Narratives help you track how your expectations of revenue, margins, and growth compare to today’s price so you can make smarter long-term decisions.

Do you think there's more to the story for Starbucks? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBUX

Starbucks

Operates as a roaster, marketer, and retailer of coffee worldwide.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives