- United States

- /

- Hospitality

- /

- NasdaqGS:RRGB

Red Robin Gourmet Burgers, Inc. (NASDAQ:RRGB) Stock Catapults 32% Though Its Price And Business Still Lag The Industry

Despite an already strong run, Red Robin Gourmet Burgers, Inc. (NASDAQ:RRGB) shares have been powering on, with a gain of 32% in the last thirty days. The last month tops off a massive increase of 106% in the last year.

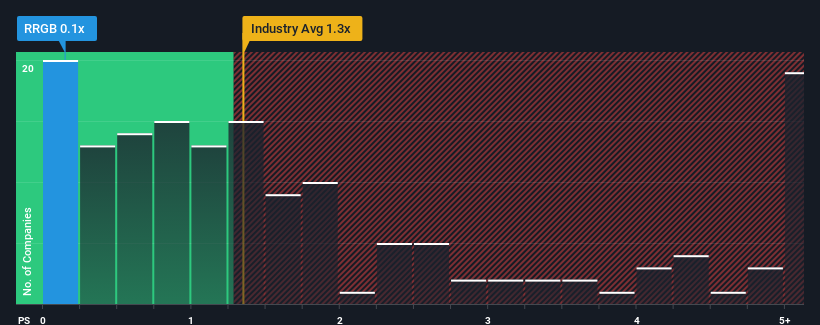

In spite of the firm bounce in price, it would still be understandable if you think Red Robin Gourmet Burgers is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in the United States' Hospitality industry have P/S ratios above 1.3x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Red Robin Gourmet Burgers

How Has Red Robin Gourmet Burgers Performed Recently?

Red Robin Gourmet Burgers could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Red Robin Gourmet Burgers' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Red Robin Gourmet Burgers' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 32% in aggregate from three years ago, notwithstanding the last 12 months. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 0.05% over the next year. Meanwhile, the rest of the industry is forecast to expand by 16%, which is noticeably more attractive.

In light of this, it's understandable that Red Robin Gourmet Burgers' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Red Robin Gourmet Burgers' P/S?

Red Robin Gourmet Burgers' stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Red Robin Gourmet Burgers maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Red Robin Gourmet Burgers, and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RRGB

Red Robin Gourmet Burgers

Develops, operates, and franchises casual dining restaurants in North America and one Canadian province.

Undervalued moderate.

Similar Companies

Market Insights

Community Narratives