- United States

- /

- Hospitality

- /

- NasdaqGM:RICK

Here's Why RCI Hospitality Holdings (NASDAQ:RICK) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like RCI Hospitality Holdings (NASDAQ:RICK), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for RCI Hospitality Holdings

RCI Hospitality Holdings' Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. To the delight of shareholders, RCI Hospitality Holdings has achieved impressive annual EPS growth of 37%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

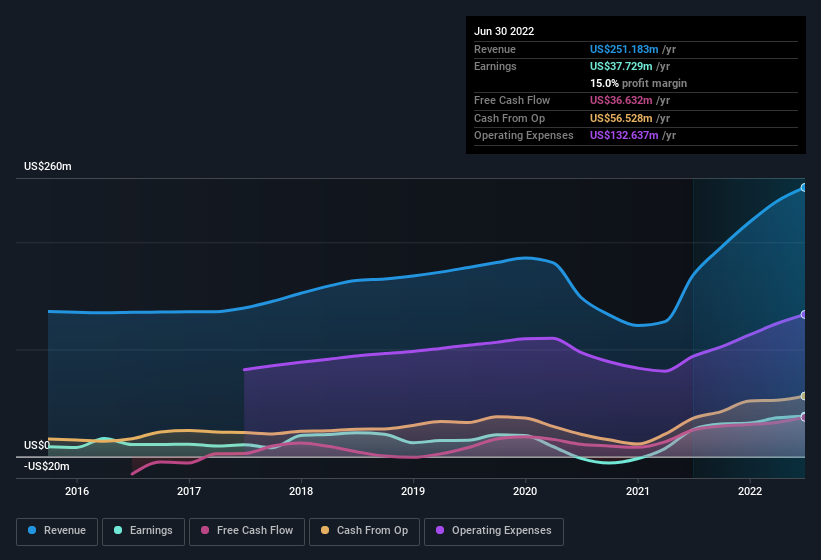

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that RCI Hospitality Holdings' revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. The music to the ears of RCI Hospitality Holdings shareholders is that EBIT margins have grown from 23% to 28% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for RCI Hospitality Holdings?

Are RCI Hospitality Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's good to see RCI Hospitality Holdings insiders walking the walk, by spending US$352k on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to be brimming with joyful expectancy. It is also worth noting that it was Chairman Eric Langan who made the biggest single purchase, worth US$79k, paying US$78.76 per share.

The good news, alongside the insider buying, for RCI Hospitality Holdings bulls is that insiders (collectively) have a meaningful investment in the stock. Given insiders own a significant chunk of shares, currently valued at US$51m, they have plenty of motivation to push the business to succeed. Amounting to 8.5% of the outstanding shares, indicating that insiders are also significantly impacted by the decisions they make on the behalf of the business.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because RCI Hospitality Holdings' CEO, Eric Langan, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations between US$400m and US$1.6b, like RCI Hospitality Holdings, the median CEO pay is around US$4.1m.

RCI Hospitality Holdings' CEO took home a total compensation package of US$1.5m in the year prior to September 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is RCI Hospitality Holdings Worth Keeping An Eye On?

RCI Hospitality Holdings' earnings have taken off in quite an impressive fashion. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest RCI Hospitality Holdings belongs near the top of your watchlist. We should say that we've discovered 3 warning signs for RCI Hospitality Holdings that you should be aware of before investing here.

The good news is that RCI Hospitality Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:RICK

RCI Hospitality Holdings

Through its subsidiaries, engages in the hospitality and related businesses in the United States.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives