- United States

- /

- Hospitality

- /

- NasdaqCM:RAVE

Shareholders May Be More Conservative With Rave Restaurant Group, Inc.'s (NASDAQ:RAVE) CEO Compensation For Now

Key Insights

- Rave Restaurant Group's Annual General Meeting to take place on 5th of December

- Salary of US$350.0k is part of CEO Brandon Solano's total remuneration

- Total compensation is 55% above industry average

- Rave Restaurant Group's EPS grew by 77% over the past three years while total shareholder return over the past three years was 176%

CEO Brandon Solano has done a decent job of delivering relatively good performance at Rave Restaurant Group, Inc. (NASDAQ:RAVE) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 5th of December. However, some shareholders will still be cautious of paying the CEO excessively.

See our latest analysis for Rave Restaurant Group

How Does Total Compensation For Brandon Solano Compare With Other Companies In The Industry?

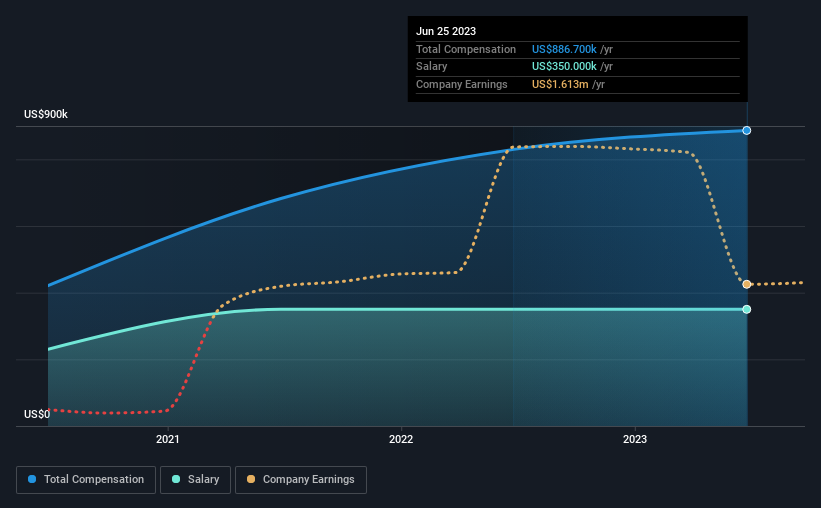

At the time of writing, our data shows that Rave Restaurant Group, Inc. has a market capitalization of US$35m, and reported total annual CEO compensation of US$887k for the year to June 2023. That's just a smallish increase of 6.8% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$350k.

On comparing similar-sized companies in the American Hospitality industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$572k. Accordingly, our analysis reveals that Rave Restaurant Group, Inc. pays Brandon Solano north of the industry median. What's more, Brandon Solano holds US$1.1m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$350k | US$350k | 39% |

| Other | US$537k | US$480k | 61% |

| Total Compensation | US$887k | US$830k | 100% |

Speaking on an industry level, nearly 21% of total compensation represents salary, while the remainder of 79% is other remuneration. Rave Restaurant Group is paying a higher share of its remuneration through a salary in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Rave Restaurant Group, Inc.'s Growth Numbers

Over the past three years, Rave Restaurant Group, Inc. has seen its earnings per share (EPS) grow by 77% per year. In the last year, its revenue is up 7.5%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Rave Restaurant Group, Inc. Been A Good Investment?

We think that the total shareholder return of 176%, over three years, would leave most Rave Restaurant Group, Inc. shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for Rave Restaurant Group that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RAVE

Rave Restaurant Group

Through its subsidiaries, engages in the operation and franchising of pizza buffet, delivery/carry-out, express restaurants, and ghost kitchens under the Pizza Inn and Pie Five trademarks in the United States and internationally.

Flawless balance sheet with proven track record.