- United States

- /

- Hospitality

- /

- NasdaqCM:RAVE

Does Rave Restaurant Group (NASDAQ:RAVE) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Rave Restaurant Group (NASDAQ:RAVE). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Our analysis indicates that RAVE is potentially undervalued!

Rave Restaurant Group's Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. Which is why EPS growth is looked upon so favourably. Commendations have to be given in seeing that Rave Restaurant Group grew its EPS from US$0.087 to US$0.49, in one short year. Even though that growth rate may not be repeated, that looks like a breakout improvement. Could this be a sign that the business has reached an inflection point?

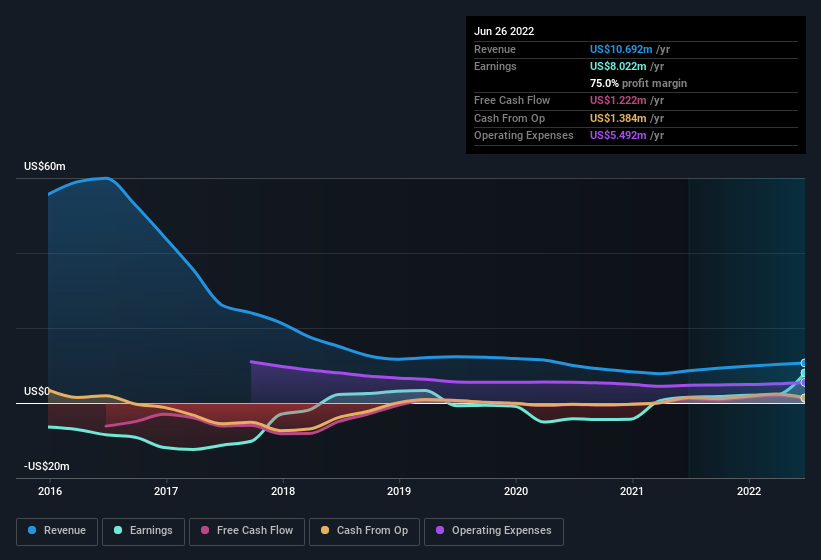

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Rave Restaurant Group shareholders can take confidence from the fact that EBIT margins are up from 12% to 16%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Rave Restaurant Group is no giant, with a market capitalisation of US$29m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Rave Restaurant Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did Rave Restaurant Group insiders refrain from selling stock during the year, but they also spent US$81k buying it. This is a good look for the company as it paints an optimistic picture for the future. Zooming in, we can see that the biggest insider purchase was by Chairman of the Board Mark Schwarz for US$35k worth of shares, at about US$0.87 per share.

It's reassuring that Rave Restaurant Group insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. To be specific, the CEO is paid modestly when compared to company peers of the same size. Our analysis has discovered that the median total compensation for the CEOs of companies like Rave Restaurant Group with market caps under US$200m is about US$777k.

Rave Restaurant Group offered total compensation worth US$682k to its CEO in the year to June 2021. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Rave Restaurant Group Worth Keeping An Eye On?

Rave Restaurant Group's earnings have taken off in quite an impressive fashion. Not to mention the company's insiders have been adding to their portfolios and the CEO's remuneration policy looks to have had shareholders in mind seeing as it's quite modest for the company size. It could be that Rave Restaurant Group is at an inflection point, given the EPS growth. For those attracted to fast growth, we'd suggest this stock merits monitoring. What about risks? Every company has them, and we've spotted 2 warning signs for Rave Restaurant Group you should know about.

The good news is that Rave Restaurant Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RAVE

Rave Restaurant Group

Through its subsidiaries, engages in the operation and franchising of pizza buffet, delivery/carry-out, express restaurants, and ghost kitchens under the Pizza Inn and Pie Five trademarks in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives