- United States

- /

- Consumer Services

- /

- NasdaqCM:OSW

OneSpaWorld Holdings (OSW): Evaluating Valuation as Shares Deliver 23% Annual Return

Reviewed by Simply Wall St

OneSpaWorld Holdings (OSW) has delivered consistent gains for investors over the past year, with its stock up nearly 23%. This comes despite showing slight dips over the month and past 3 months. The company’s financials show healthy revenue and net income growth, sparking interest in its valuation compared to recent performance.

See our latest analysis for OneSpaWorld Holdings.

Momentum has been cooling a bit after a solid climb, but the big picture for OneSpaWorld Holdings remains impressive. The one-year total shareholder return is nearing 23%, and the total return over three years stands at 136%, which hints at robust long-term growth. Short-term share price moves may reflect shifts in investor enthusiasm; however, the stronger total returns show the company has rewarded patient holders handsomely.

If you're curious about where else this kind of momentum meets growth potential, it's worth taking a look at fast growing stocks with high insider ownership.

With shares still trading below average analyst price targets despite recent gains, the question is whether OneSpaWorld Holdings offers compelling value at current levels or if the market has already factored in its growth potential.

Most Popular Narrative: 13.9% Undervalued

With OneSpaWorld Holdings trading well below the narrative’s fair value estimate, there is a clear discrepancy between share price and future potential. This sets the scene for a closer look at what is driving this optimistic outlook.

Strategic rollout of next-generation technologies and AI-driven initiatives, although not yet fully reflected in results, is expected to boost operational efficiency and service personalization by 2026, reducing SG&A and supporting future EBITDA and earnings growth.

Curious how big the shift could be if these tech bets pay off? There is a bold bet built on future margin gains and a profit multiple you would not expect for a cruise spa operator. Want to see what bullish assumptions are stacked up to justify the fair value? The narrative’s model has some surprises. Discover the details driving this price target.

Result: Fair Value of $24.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as slow uptake of new cruise partnerships or unproven AI benefits could limit the long-term upside reflected in today’s bullish outlook.

Find out about the key risks to this OneSpaWorld Holdings narrative.

Another View: Valuation by Earnings Multiple

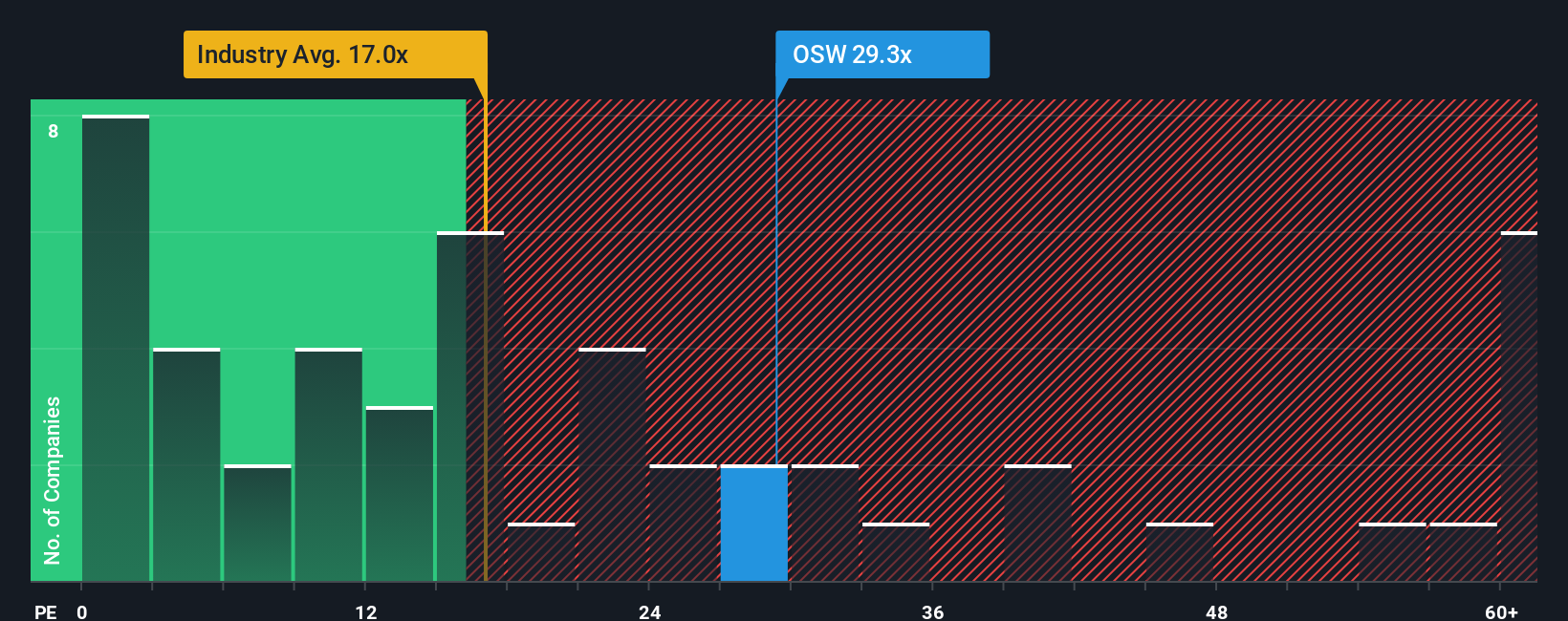

Looking at earnings multiples, OneSpaWorld trades at a price-to-earnings ratio of 30.6x. This stands out compared to both the US Consumer Services industry's average of 18.9x and its peer group’s 15.8x. The fair ratio is estimated to be 21x, suggesting the current price is on the expensive side. This raises the question: will investors continue to pay a premium for future growth, or has most of the upside been priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own OneSpaWorld Holdings Narrative

If you see the story differently or want to dig deeper into the numbers yourself, you can easily craft your own take in just minutes. Do it your way

A great starting point for your OneSpaWorld Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit themselves to just one opportunity. Take charge of your financial journey by checking out these unique ways to uncover tomorrow's highest-potential stocks today.

- Capitalize on tech’s next wave by exploring these 27 AI penny stocks, where innovative companies are reshaping entire industries through cutting-edge artificial intelligence.

- Lock in steady returns and grow your portfolio with these 17 dividend stocks with yields > 3%, spotlighting companies offering attractive yields over 3% for income-driven investors.

- Get ahead of the curve by evaluating these 80 cryptocurrency and blockchain stocks, featuring businesses advancing secure payment solutions and blockchain-powered services for the digital future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:OSW

OneSpaWorld Holdings

Operates health and wellness centers onboard cruise ships and at destination resorts in the United States and internationally.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)