- United States

- /

- Hospitality

- /

- NasdaqGS:NAVN

Navan (NAVN) Valuation Check After 19% Monthly Slide and 30% Year-to-Date Share Price Drop

Reviewed by Simply Wall St

Navan (NAVN) has been under pressure lately, with the stock sliding about 19% over the past month and roughly 30% year to date. This has raised fresh questions about how investors should value its AI-driven travel platform.

See our latest analysis for Navan.

Zooming out, that sharp recent slide in Navan’s share price sits on top of an already weak year to date share price return. This suggests momentum has clearly cooled as investors reassess both growth runway and execution risk.

If Navan’s volatility has you rethinking your watchlist, this could be a good moment to explore other travel and experience oriented names via fast growing stocks with high insider ownership.

With shares now trading well below analyst targets despite double digit revenue and profit growth, the key question is whether Navan has been unfairly marked down or if markets are already pricing in its next leg of expansion.

Price-to-Sales of 5.6x: Is it justified?

Navan’s stock last closed at $13.92, which equates to a price-to-sales ratio of 5.6 times, putting it well above peers and industry averages.

The price-to-sales multiple compares the company’s market value to its trailing revenue, a common lens for high growth, loss making software and platform businesses like Navan.

At 5.6 times sales, investors are paying a substantial premium versus both direct peers at 2.2 times and the broader US hospitality space at 1.7 times. This implies the market still bakes in a materially stronger growth and monetisation profile for Navan’s AI powered travel platform than for more traditional operators.

Relative to the US hospitality industry, that premium is stark. Navan’s 5.6 times sales multiple is more than three times the sector average of 1.7 times even as the company remains unprofitable and is not forecast to break even within the next three years.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 5.6x (OVERVALUED)

However, lingering losses and no clear path to near term profitability mean that any slowdown in enterprise travel demand or AI adoption could quickly challenge this premium.

Find out about the key risks to this Navan narrative.

Another angle on value

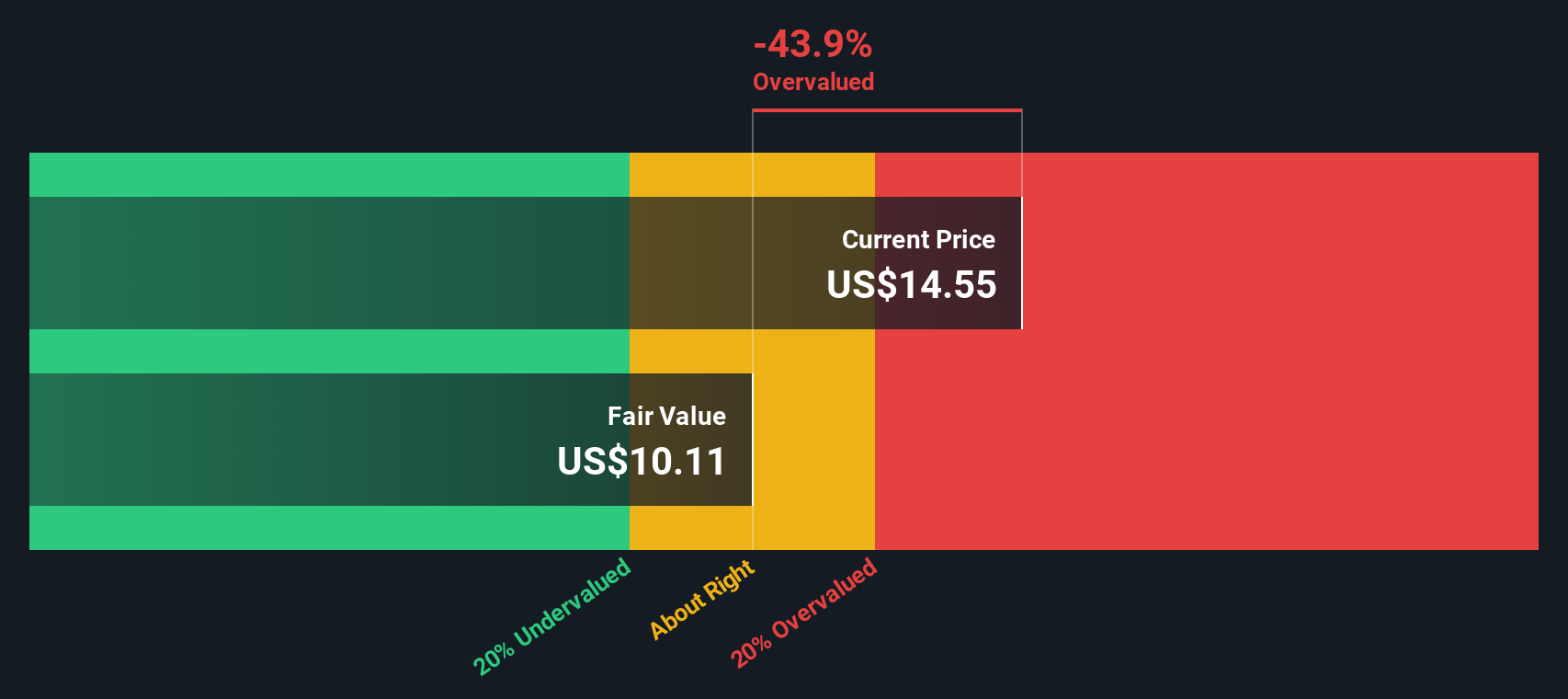

Our DCF model paints a different picture, suggesting Navan’s fair value is closer to $10.20. This would make the current $13.92 share price look overvalued despite rich growth expectations. Is the market overestimating the runway, or is the model too cautious on AI travel demand?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Navan for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Navan Narrative

If you see the story differently, or want to dig into the numbers yourself, you can quickly build a personalized view in just a few minutes: Do it your way.

A great starting point for your Navan research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next move by scanning a few high conviction themes on Simply Wall Street, so you are not leaving opportunities on the table.

- Capture early momentum and target potential multibaggers with these 3604 penny stocks with strong financials built around strong fundamentals, not just hype.

- Position yourself at the forefront of automation and machine learning by using these 25 AI penny stocks to zero in on companies powering the AI shift.

- Lock in value opportunities others overlook by filtering for businesses trading below their estimated cash flow worth through these 904 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Navan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NAVN

Navan

Operates an AI-powered software platform to simplify the travel and expense experience, benefiting users, customers, and suppliers.

Imperfect balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion