Nathan's Famous, Inc. (NASDAQ:NATH) will pay a dividend of US$0.35 on the 25th of June. This means that the annual payment will be 2.0% of the current stock price, which is in line with the average for the industry.

Check out our latest analysis for Nathan's Famous

Nathan's Famous' Dividend Is Well Covered By Earnings

We aren't too impressed by dividend yields unless they can be sustained over time. Based on the last payment, Nathan's Famous was quite comfortably earning enough to cover the dividend. This means that a large portion of its earnings are being retained to grow the business.

Over the next year, EPS could expand by 14.4% if recent trends continue. If the dividend continues along recent trends, we estimate the payout ratio will be 46%, which is in the range that makes us comfortable with the sustainability of the dividend.

Nathan's Famous Doesn't Have A Long Payment History

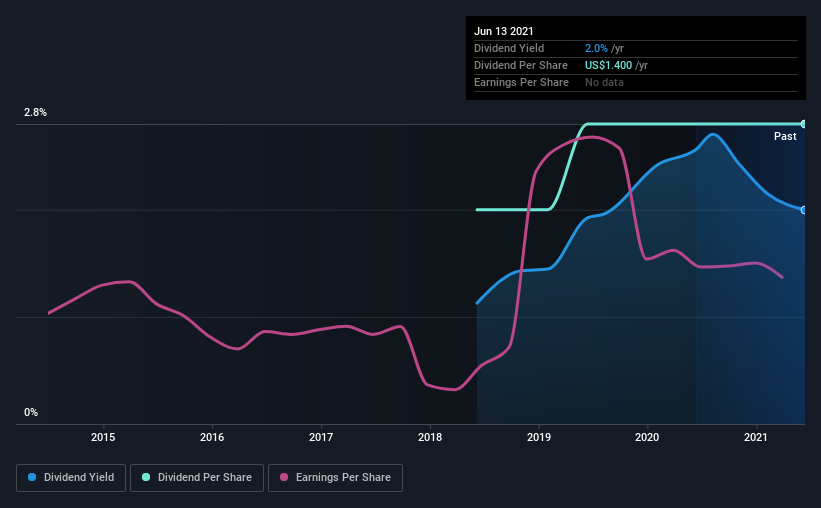

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. The dividend has gone from US$1.00 in 2018 to the most recent annual payment of US$1.40. This means that it has been growing its distributions at 12% per annum over that time. We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. It's encouraging to see Nathan's Famous has been growing its earnings per share at 14% a year over the past five years. Since earnings per share is growing at an acceptable rate, and the payout policy is balanced, we think the company is positioning itself well to grow earnings and dividends in the future.

Nathan's Famous Looks Like A Great Dividend Stock

In summary, it is good to see that the dividend is staying consistent, and we don't think there is any reason to suspect this might change over the medium term. Earnings are easily covering distributions, and the company is generating plenty of cash. All of these factors considered, we think this has solid potential as a dividend stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 3 warning signs for Nathan's Famous you should be aware of, and 1 of them is concerning. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

When trading Nathan's Famous or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nathan's Famous might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:NATH

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives