- United States

- /

- Hospitality

- /

- NasdaqGS:LNW

There's Reason For Concern Over Light & Wonder, Inc.'s (NASDAQ:LNW) Price

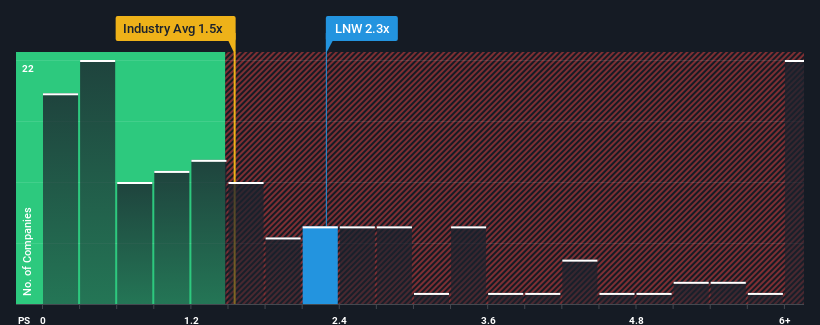

Light & Wonder, Inc.'s (NASDAQ:LNW) price-to-sales (or "P/S") ratio of 2.3x may not look like an appealing investment opportunity when you consider close to half the companies in the Hospitality industry in the United States have P/S ratios below 1.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Light & Wonder

What Does Light & Wonder's P/S Mean For Shareholders?

Light & Wonder could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Light & Wonder will help you uncover what's on the horizon.How Is Light & Wonder's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Light & Wonder's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 15% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 21% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 7.1% during the coming year according to the nine analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 27%, which is noticeably more attractive.

With this information, we find it concerning that Light & Wonder is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Light & Wonder's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see Light & Wonder trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Light & Wonder with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LNW

Light & Wonder

Operates as a cross-platform games company in the United States and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives