- United States

- /

- Hospitality

- /

- NasdaqGS:LNW

The 3.6% return this week takes Light & Wonder's (NASDAQ:LNW) shareholders three-year gains to 139%

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But in contrast you can make much more than 100% if the company does well. For example, the Light & Wonder, Inc. (NASDAQ:LNW) share price has soared 139% in the last three years. That sort of return is as solid as granite. Also pleasing for shareholders was the 21% gain in the last three months. But this could be related to the strong market, which is up 12% in the last three months.

Since the stock has added US$216m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Light & Wonder

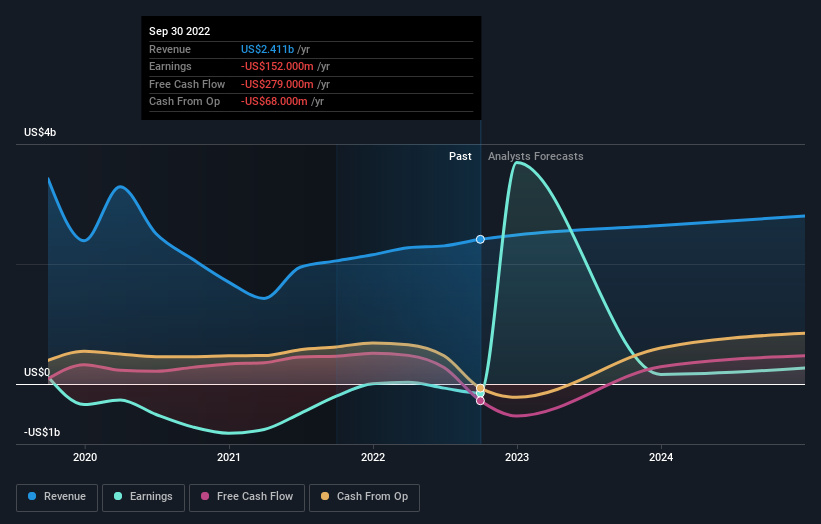

Light & Wonder wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 3 years Light & Wonder saw its revenue shrink by 11% per year. So the share price gain of 34% per year is quite surprising. It's a good reminder that expectations about the future, not the past history, always impact share prices.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Light & Wonder will earn in the future (free profit forecasts).

A Different Perspective

We're pleased to report that Light & Wonder shareholders have received a total shareholder return of 14% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 10% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Light & Wonder has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LNW

Light & Wonder

Operates as a cross-platform games company in the United States and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives