- United States

- /

- Hospitality

- /

- NasdaqGS:FWRG

First Watch (FWRG): Evaluating Valuation After Major Share Sale and Mixed Q2 Earnings

Reviewed by Simply Wall St

If you’ve been following First Watch Restaurant Group (FWRG), this week’s developments may have left you rethinking your next move. Advent International, one of the company’s largest shareholders, offloaded 4,400,000 shares through a secondary offering just days after First Watch posted mixed financial results for the second quarter. Between this sizable share sale and a headline-grabbing earnings report, investors are paying close attention to what comes next for the stock.

Over the past year, First Watch Restaurant Group’s share price has grown by 11%, but that journey has not been a straight line. The stock is down roughly 9% year to date, reflecting a string of ups and downs that have tracked everything from quarterly reports to broader sector sentiment. Momentum seemed to pick up in the past three months, with shares rising nearly 12%. However, the latest share sale and earnings disappointment introduce fresh questions about whether the rally can continue.

With major shareholders lightening their load and the earnings picture a bit cloudy, some investors may be wondering whether the market is offering a rare buying window or if all the growth potential of First Watch Restaurant Group has already been priced in.

Most Popular Narrative: 22.6% Undervalued

According to the most widely followed valuation narrative, First Watch Restaurant Group is currently trading well below its estimated fair value, suggesting a potential opportunity for investors seeking growth in the hospitality sector.

Accelerating unit expansion into new markets, especially in fast-growing Sun Belt and suburban areas, leverages broad demographic shifts and significant untapped real estate opportunities. This positions First Watch for sustained double-digit revenue growth and market share gains.

Curious what’s driving this bullish target? The narrative hinges on ambitious growth strategies, bold market assumptions, and a powerful financial forecast that sets this valuation apart from typical restaurant stocks. Want to know which growth levers analysts believe will power nearly unmatched financial gains? The answers behind this high conviction call just might surprise you.

Result: Fair Value of $22.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent cost inflation and First Watch's focus on daytime-only dining could challenge its long-term profit margins and limit growth potential.

Find out about the key risks to this First Watch Restaurant Group narrative.Another View: Our DCF Model Sends a Warning

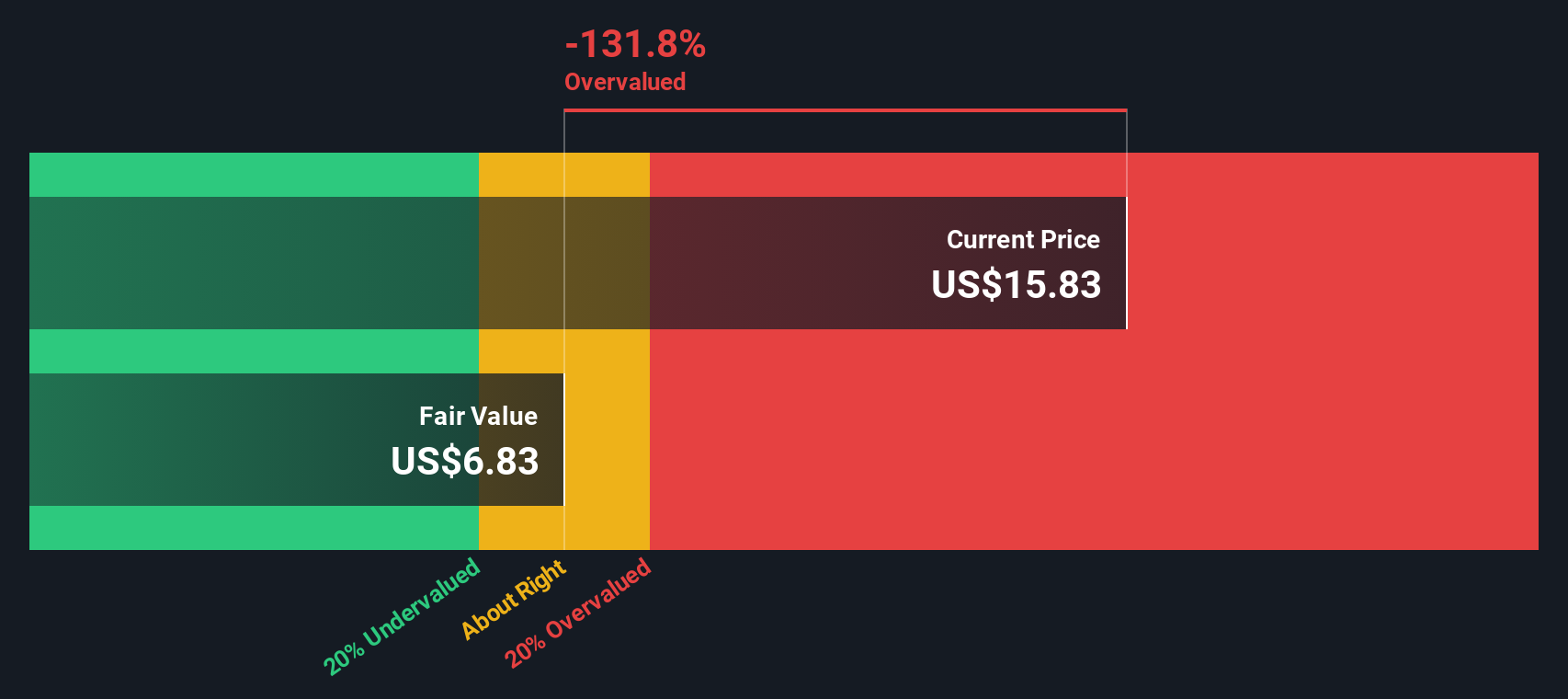

While the market’s favorite story paints First Watch as undervalued, our SWS DCF model indicates the current price is actually above fair value. Could the growth narrative overlook hidden risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own First Watch Restaurant Group Narrative

If you have a different perspective or want to dig into the details, crafting your own outlook takes just a few minutes. Do it your way

A great starting point for your First Watch Restaurant Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities slip by. Level up your strategy with these stock ideas, each curated to tap into powerful market trends you shouldn’t ignore.

- Turbocharge your portfolio with companies at the forefront of digital asset innovation using cryptocurrency and blockchain stocks. This spotlights blockchain trends and game-changing technologies.

- Capture consistent income streams when you scout dividend stocks with yields > 3% for reliable payers offering yields above 3%. This is ideal for building steady wealth.

- Capitalize on untapped potential by reviewing undervalued stocks based on cash flows. This highlights companies flying below the radar but showing strength based on real cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FWRG

First Watch Restaurant Group

Through its subsidiaries, operates and franchises restaurants under the First Watch trade name in the United States.

Good value with reasonable growth potential.

Market Insights

Community Narratives