- United States

- /

- Hospitality

- /

- NasdaqGS:EXPE

How Joining ChatGPT’s App SDK As a Launch Partner Has Changed Expedia Group’s (EXPE) Investment Story

Reviewed by Sasha Jovanovic

- At OpenAI's annual developer conference, Expedia Group was announced as a launch partner for the App SDK, enabling users to access Expedia’s services directly within ChatGPT, which reaches an estimated 800 million weekly users. This collaboration highlights Expedia’s position among leading technology partners integrating with the rapidly expanding generative AI ecosystem.

- As Expedia becomes accessible via ChatGPT, we'll explore how this milestone could influence the company's growth prospects in AI-powered travel experiences.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

Expedia Group Investment Narrative Recap

To own Expedia Group, you need confidence in the company’s ability to leverage technology-led innovations and increased AI integration to drive higher booking growth, retention, and margin expansion, even as traditional travel trends and consumer price sensitivity keep the outlook uncertain. The OpenAI partnership creates a highly visible channel for customer acquisition, but it may not meaningfully offset the risk that ongoing weakness among US consumers or in key brands like Vrbo could challenge the company’s near-term momentum.

Expedia’s launch partnership with OpenAI’s App SDK brings significant attention, but a recent product enhancement in Vrbo involving new AI-powered features and an improved guest review experience directly addresses some of the core risks tied to maintaining consumer appeal and driving retention across major brands. This move demonstrates Expedia’s ongoing commitment to improving its platform experience and operational efficiency, both of which are among the business’s most important growth drivers today.

Yet, amid this wave of AI-driven innovation, investors must watch for signs that persistent margin pressure from supplier promotions or shifting consumer behaviors…

Read the full narrative on Expedia Group (it's free!)

Expedia Group's outlook anticipates $16.9 billion in revenue and $2.1 billion in earnings by 2028. This is based on a 6.4% annual revenue growth rate and a $1.0 billion earnings increase from the current $1.1 billion.

Uncover how Expedia Group's forecasts yield a $222.00 fair value, in line with its current price.

Exploring Other Perspectives

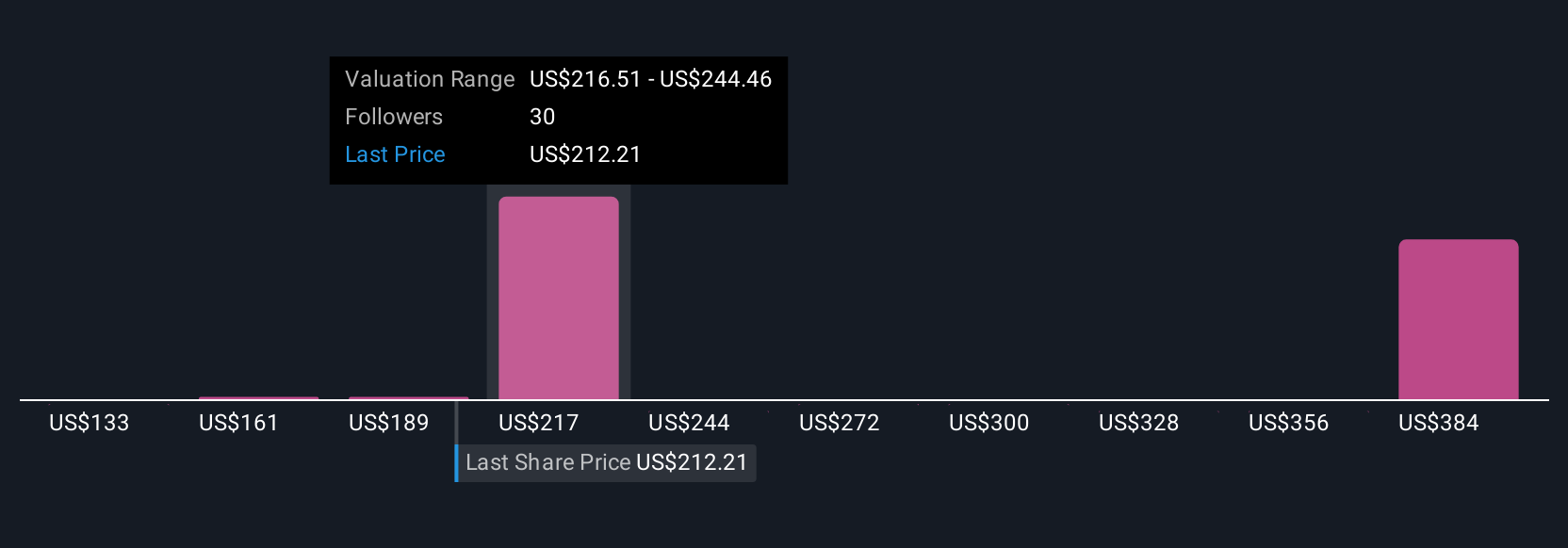

Ten fair value estimates from the Simply Wall St Community span from US$132.67 to US$423.89 per share. While community opinions vary, margin pressure due to heavy supplier-driven promotions remains a concern for Expedia’s future earnings power.

Explore 10 other fair value estimates on Expedia Group - why the stock might be worth as much as 89% more than the current price!

Build Your Own Expedia Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Expedia Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Expedia Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Expedia Group's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expedia Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXPE

Expedia Group

Operates as an online travel company in the United States and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives