- United States

- /

- Consumer Services

- /

- NasdaqGS:DUOL

Duolingo (DUOL) Reports Q2 2025 Sales Surge to US$252 Million

Reviewed by Simply Wall St

Duolingo (DUOL) reported strong financial results for Q2 2025 with sales rising to $252 million and net income reaching nearly $45 million, a significant increase from the prior year. Despite these positive earnings, Duolingo's stock experienced an 11% decline over the past week. This drop contrasts with the general market trend, as major indices such as the S&P 500 and Nasdaq recorded gains during the same period. The market's optimism, buoyed by favorable labor data and potential interest rate cuts, potentially lessened the impact of Duolingo's earnings growth on its share price performance.

You should learn about the 1 warning sign we've spotted with Duolingo.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

The recent news about Duolingo's Q2 2025 financial performance highlights a strong revenue of US$252 million and a net income of nearly US$45 million. Despite these figures, the stock's 11% decline over the past week appears inconsistent with the positive earnings results. Such a drop contrasts with the broader market trends where major indices showed gains. While market optimism from favorable economic data might have tempered reactions to Duolingo's earnings, it underscores investors' concerns about areas highlighted in the narrative such as potential saturation in mature markets and increased regulatory challenges abroad.

Looking at the longer term, Duolingo's total return over the past three years was 200.71%, indicating significant growth compared to the US Consumer Services industry, which returned 21.1% over the past year. This suggests strong performance relative to the sector, although recent fluctuations may reflect temporary setbacks in investor sentiment.

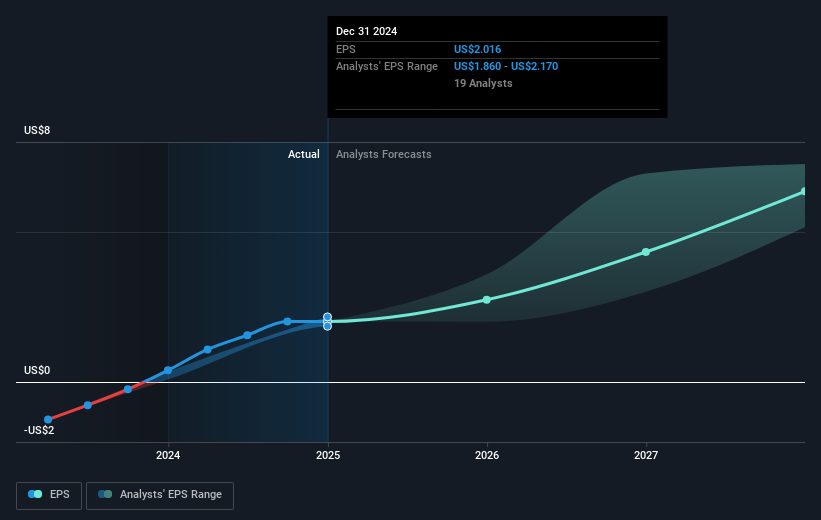

The recent performance doesn't necessarily alter revenue or earnings forecasts significantly. Analysts anticipate revenue growth of 23.2% per year and profit margin expansion from 13.2% to 21.1% over the next three years. The narrative's discussion on AI-driven personalization and international expansion remains a cornerstone of these forecasts. However, the stock trading at US$282.52, considerably below the consensus analyst price target of US$489.76, suggests a belief that Duolingo’s growth potential may not yet be fully recognized in the current price. Given the extent of this price disparity, investors might have room to reconsider the company's valuation as the long-term growth story unfolds.

Our valuation report here indicates Duolingo may be undervalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DUOL

Duolingo

Operates as a mobile learning platform in the United States, the United Kingdom, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives