- United States

- /

- Hospitality

- /

- NasdaqGS:DKNG

DraftKings (DKNG): Examining Valuation After Recent Volatility and Momentum in the Stock

Reviewed by Simply Wall St

If you have been tracking DraftKings (DKNG), you may have noticed the stock’s recent movement and are likely wondering what is next. While there is no clear event driving the action right now, the current volatility still raises interesting questions for anyone considering a position. Sometimes, it is moves without direct catalysts that signal shifts in market sentiment or present valuation mismatches worth a closer look.

Looking at the bigger picture, DraftKings has seen its share price climb roughly 28% over the past year, with gains accelerating in the past 3 months. Short-term momentum appears to be building again after a modest pullback last week. These swings come amid ongoing revenue growth and, notably, a substantial improvement in net income. These factors continue to shape expectations for the company’s path toward profitability.

So, after a year of sharp gains and a strong fundamental backdrop, is DraftKings trading at a discount to fair value, or is the market already pricing in the next wave of growth?

Most Popular Narrative: 15.6% Undervalued

According to the most widely followed narrative, DraftKings is currently trading at a discount to its intrinsic value, with a fair value estimate higher than the prevailing market price. This suggests that analysts see fundamental upside not yet reflected in the current share price.

DraftKings' proprietary technology, enhanced by the acquisition of Simplebet and in-house developments, is enabling unique betting formats and vertical integration. This is expected to support higher gross margins and strengthen competitive positioning, positively impacting long-term earnings and operating leverage.

Curious what helps DraftKings stand apart in the rapidly evolving world of online betting? Underneath this valuation lies a powerful bet on future growth, expanding margins, and strategic tech moves that could shake up the industry. Want to know which financial assumptions are driving these bullish targets? The details may surprise you. Discover what’s fueling this enthusiastic outlook.

Result: Fair Value of $54.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, DraftKings faces mounting regulatory risk and rising state-level tax policies. These factors could challenge the optimistic outlook if conditions worsen.

Find out about the key risks to this DraftKings narrative.Another View: Looking at the Market Multiple

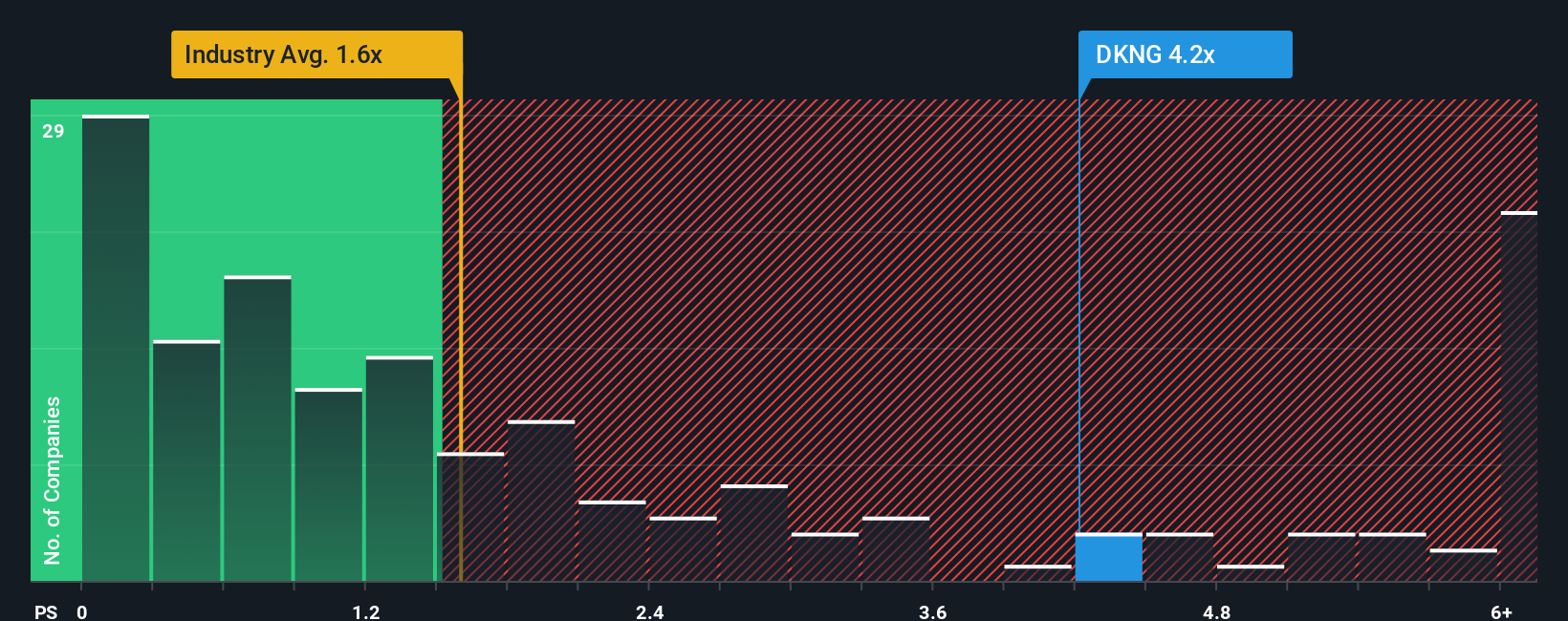

While some see DraftKings as undervalued based on future cash flows, comparing its price-to-sales against the industry average suggests the opposite. Could market enthusiasm be pushing shares ahead of what fundamentals support?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DraftKings Narrative

If you see things differently or want to dive into your own research, it is quick and easy to build your own valuation story. Do it your way

A great starting point for your DraftKings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for Your Next Winning Stock?

Why limit your portfolio to just one contender? Use the Simply Wall Street Screener to uncover standout stocks and fresh opportunities that fit your unique investment strategy.

- Tap into untapped growth by checking out penny stocks with strong financials through penny stocks with strong financials, and spot companies often overlooked by the market.

- Supercharge your watchlist with the latest AI breakthroughs by searching for AI penny stocks, and get ahead in the fast-evolving world of artificial intelligence.

- Secure greater value for your money by finding undervalued stocks based on cash flows using fundamental analysis to highlight promising investments that may be trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:DKNG

DraftKings

Operates as a digital sports entertainment and gaming company in the United States and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion