- United States

- /

- Hospitality

- /

- NasdaqCM:DENN

Denny's (NASDAQ:DENN) sheds US$41m, company earnings and investor returns have been trending downwards for past five years

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We really hate to see fellow investors lose their hard-earned money. For example, we sympathize with anyone who was caught holding Denny's Corporation (NASDAQ:DENN) during the five years that saw its share price drop a whopping 74%. We also note that the stock has performed poorly over the last year, with the share price down 46%. On top of that, the share price is down 12% in the last week.

After losing 12% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Denny's

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

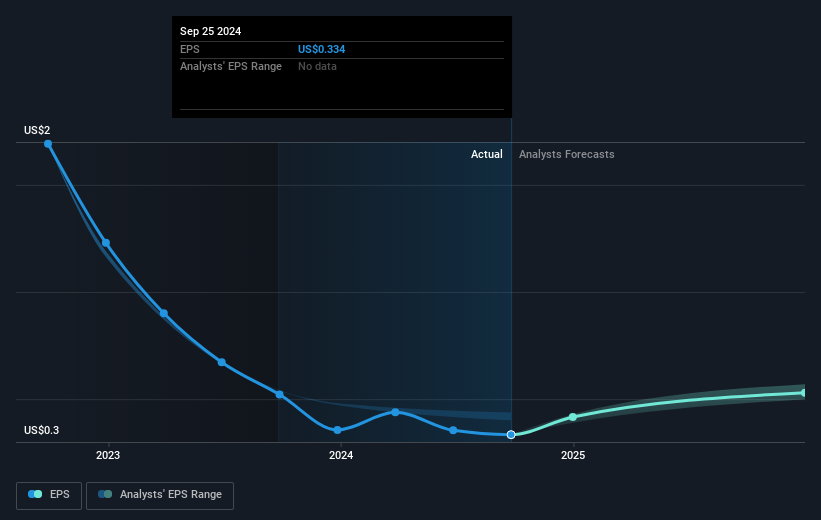

Looking back five years, both Denny's' share price and EPS declined; the latter at a rate of 28% per year. This fall in the EPS is worse than the 23% compound annual share price fall. So the market may previously have expected a drop, or else it expects the situation will improve.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on Denny's' earnings, revenue and cash flow.

A Different Perspective

Investors in Denny's had a tough year, with a total loss of 46%, against a market gain of about 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Denny's better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Denny's you should be aware of, and 2 of them are significant.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:DENN

Denny's

Through its subsidiaries, owns and operates franchised full-service restaurant chains under the Denny's and Keke’s Breakfast Cafe brand names in the United States and internationally.

Very undervalued with proven track record.

Market Insights

Community Narratives