- United States

- /

- Hospitality

- /

- NasdaqGS:DASH

3 US Stocks Estimated To Be Trading At Discounts Of Up To 50%

Reviewed by Simply Wall St

As the U.S. stock market continues its rally, with the S&P 500 and Nasdaq Composite closing higher for the fourth consecutive day, investors are keenly observing opportunities that may be trading at significant discounts. Despite recent gains, concerns about economic health and market volatility have left certain stocks undervalued by up to 50%. In this environment, identifying stocks that are fundamentally strong but temporarily mispriced can offer substantial upside potential for investors looking to capitalize on current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First Solar (NasdaqGS:FSLR) | $235.95 | $466.35 | 49.4% |

| Peoples Financial Services (NasdaqGS:PFIS) | $44.51 | $87.09 | 48.9% |

| Amdocs (NasdaqGS:DOX) | $85.05 | $167.23 | 49.1% |

| Bridge Investment Group Holdings (NYSE:BRDG) | $8.59 | $16.97 | 49.4% |

| EVERTEC (NYSE:EVTC) | $33.14 | $65.97 | 49.8% |

| WEX (NYSE:WEX) | $193.73 | $379.07 | 48.9% |

| Vertex Pharmaceuticals (NasdaqGS:VRTX) | $478.65 | $956.80 | 50% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | $261.73 | $511.94 | 48.9% |

| Vasta Platform (NasdaqGS:VSTA) | $2.52 | $4.93 | 48.9% |

| SunOpta (NasdaqGS:STKL) | $6.41 | $12.65 | 49.3% |

We're going to check out a few of the best picks from our screener tool.

DoorDash (NasdaqGS:DASH)

Overview: DoorDash, Inc., along with its subsidiaries, operates a commerce platform connecting merchants, consumers, and independent contractors in the U.S. and internationally, with a market cap of approximately $53.51 billion.

Operations: Revenue from the Internet Information Providers segment totals $9.61 billion.

Estimated Discount To Fair Value: 43%

DoorDash, trading at US$130.19, is significantly undervalued compared to its estimated fair value of US$228.47. Despite recent insider selling and past shareholder dilution, DoorDash's revenue growth forecast of 13.2% annually outpaces the broader U.S. market's 8.8%. The company is expected to become profitable within three years and shows a high return on equity forecast at 25.9%. Recent strategic partnerships with Mattress Firm and Meals on Wheels enhance its market reach and service diversification.

- Our comprehensive growth report raises the possibility that DoorDash is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of DoorDash.

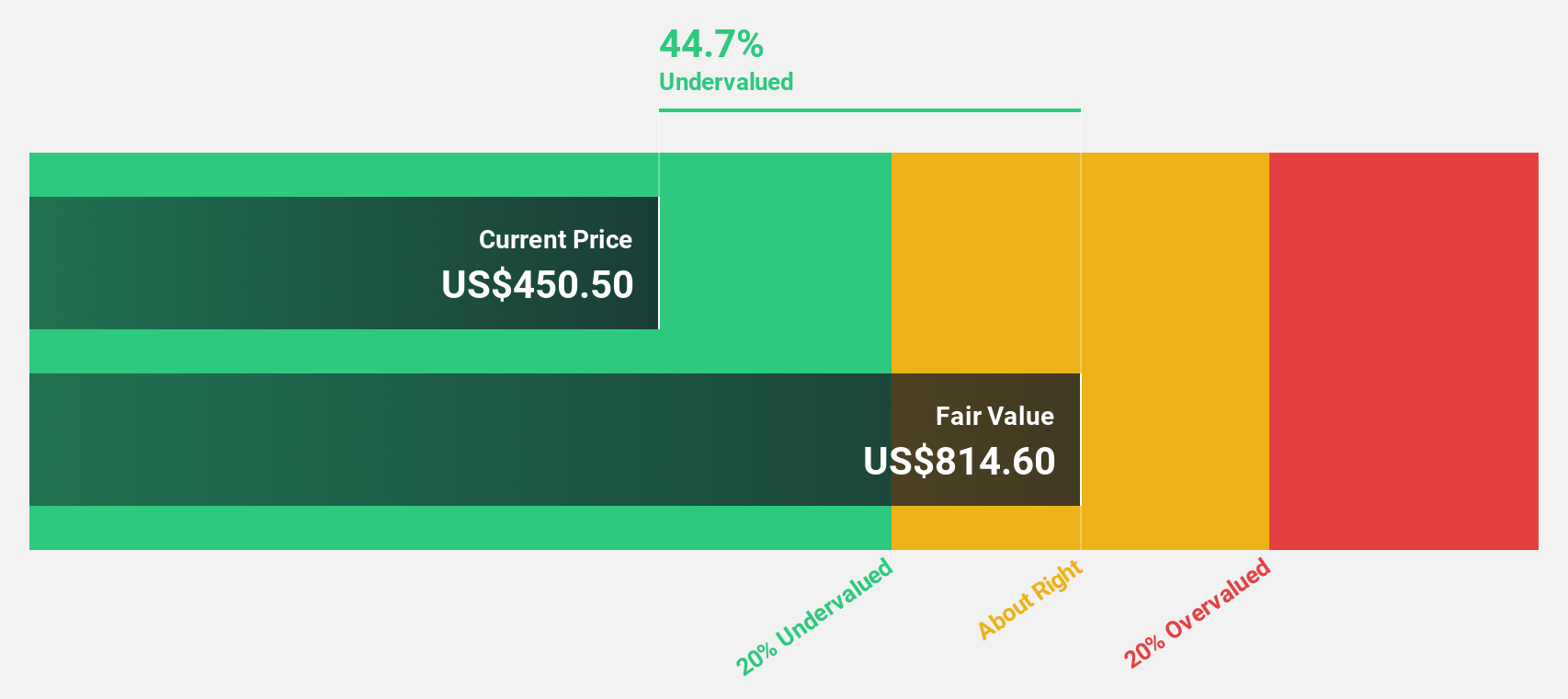

Vertex Pharmaceuticals (NasdaqGS:VRTX)

Overview: Vertex Pharmaceuticals Incorporated is a biotechnology company focused on developing and commercializing therapies for treating cystic fibrosis, with a market cap of $122.53 billion.

Operations: The company's revenue primarily comes from its pharmaceuticals segment, which generated $10.34 billion.

Estimated Discount To Fair Value: 50%

Vertex Pharmaceuticals appears undervalued, trading at US$478.65 against an estimated fair value of US$956.80. Despite reporting a recent net loss of US$3.59 billion for Q2 2024, Vertex raised its full-year revenue guidance to between US$10.65 billion and US$10.85 billion, reflecting strong product performance and new drug launches like CASGEVY®. The company’s strategic buybacks and promising pipeline developments, including the FDA priority review for suzetrigine, bolster its long-term growth prospects based on cash flows.

- Our growth report here indicates Vertex Pharmaceuticals may be poised for an improving outlook.

- Dive into the specifics of Vertex Pharmaceuticals here with our thorough financial health report.

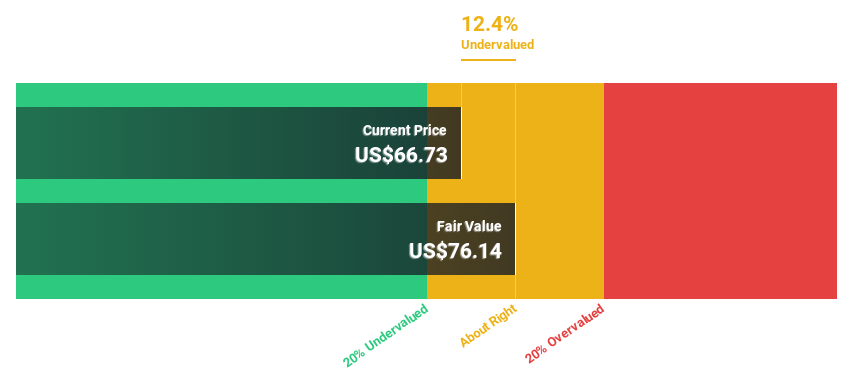

Shopify (NYSE:SHOP)

Overview: Shopify Inc. is a commerce company that offers a comprehensive platform and services for businesses across various regions globally, with a market cap of approximately $92.29 billion.

Operations: The company generates $7.76 billion in revenue from its Internet Software & Services segment.

Estimated Discount To Fair Value: 16.3%

Shopify is trading at US$71.31, below its estimated fair value of US$85.15, indicating it may be undervalued based on cash flows. Earnings are forecast to grow 19.7% annually, outpacing the US market's 15.2%. Recent partnerships with Zaelab and Pivotree enhance its B2B capabilities and digital commerce solutions, while Q2 2024 saw significant revenue growth to US$2.05 billion from US$1.69 billion a year ago, turning a net income of US$171 million from a previous loss.

- The growth report we've compiled suggests that Shopify's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Shopify stock in this financial health report.

Where To Now?

- Investigate our full lineup of 183 Undervalued US Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DASH

DoorDash

Operates a commerce platform that connects merchants, consumers, and independent contractors in the United States and internationally.

Flawless balance sheet with high growth potential.