Quote of the Week: “The best time to plant a tree was 20 years ago. The second-best time is now.” – Chinese proverb.

Last’s week’s Market Insight covered the remarkable growth of GLP-1 diabetes and weight-loss treatments. For now the market is dominated by Novo Nordisk, but at least a dozen other companies are developing and testing similar drugs.

This week we are taking a look at some of those companies. We are also highlighting some of the industries and companies that could win or lose if GLP-1 use continues to increase.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple podcasts or Youtube!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

🥇 Gold price holds on to gains as the price of a gold bar reaches $1 million ( Reuters )

- What’s our take?

- Economic uncertainty, geopolitical risks and anticipation of rate cuts, make this the ideal environment for gold. Gold is seen as a ‘safe haven asset’ and when economic policy uncertainty increases, there’s usually an appreciation in gold prices as investors look to investing in something that is relatively more stable.

- With the gold price up 21% this year, and trading around $2,500 per ounce, a 4000 ounce bar will now cost you $1 million.

- Gold has usually proved to be a great hedge against market downturns and volatility. However, the three factors driving demand could, or will eventually, change, in which case it will no longer be the ideal environment. We would still regard it as a hedge, rather than something to go all in on.

- What’s our take?

-

🛍️ PDD sinks as competition amongst discount e-tailers intensifies ( Yahoo Finance )

- What’s our take?

- It’s the age-old tale in any emerging industry, profits attract competitors, and competition brings margins down.

- PDD Holdings, which owns the Temu ecommerce platform, reported results that were for the most part better than expected. However, their guidance and comments about the future spooked investors. The management team mentioned intensifying competition, slowing revenue growth, and likely pressure on margins.

- The company also plans to invest more aggressively in growth, and focus on premium brands. So, lower margins may actually come as a result of higher spending, rather than lower gross margins.

- This could also be a sign that the company doesn’t have confidence in the current model, which is focussed on low-priced, white-label products.

- What’s our take?

-

📉 Super Micro Computer shares fall 19% after delaying results filing, short seller report ( CNBC )

- What’s our take?

- The higher they fly, the further they fall!

- On Tuesday, Hindenburg Research published a report alleging ‘accounting manipulation’, and disclosed a short position. The next day, the company said it would have to delay the filing of its annual report.

- Short sellers like Hindenburg have been known to exaggerate, and even to be completely wrong. But the delayed filing seemed to add credibility to the claims.

- It’s quite possible the company wanted to address the claims, and will be able to convince investors that there isn’t a problem - only time will tell.

- 19% is a big move, but it shouldn't be surprising for a stock that gained 1,000% in a year. Position sizing and diversification are the best way to mitigate risks like this.

- What’s our take?

-

📈 Buffett’s Berkshire Hathaway joins the $1 trillion market cap club ( FT )

- What’s our take?

- Warren Buffett’s company hit the milestone on Wednesday and broke a record in doing so by becoming the first non-tech company to trade at a market cap of over $1 trillion.

- There’s a reason why we endorse his investing ethos! His methodical approach to investing has transformed the once-textile company into the largest multinational conglomerate in the world.

- The Oracle of Omaha has spent much of the year increasing the company’s cash reserves, including a noticeable $50 billion trim of its holdings in Apple holding. While the sell-off was significant, Apple still remains the company’s largest holding.

- Berkshire Hathaway’s cash holdings sit at a staggering $277 Billion, as Buffett mentioned he struggled to find a more appealing prospect on the market.

- What’s our take?

-

💻 Nvidia fails to impress the market, despite a stellar earnings report ( Reuters )

- What’s our take?

- Despite delivering some excellent headline figures like a 122% increase in revenues year-on-year, investors were left wanting more as Nvidia traded down 6% after hours.

- Nvidia beat earnings expectations and subsequent guidance for the following quarter was also raised, but it seems earnings didn’t exceed estimates by enough in the eyes of the market, who have been used to Nvidia absolutely crushing analyst expectations.

- Nvidia’s guidance of 80% YoY growth for the next quarter seems to be what’s disappointed investors the most, as it signals a potential ‘cooling off’ of the AI hype train. Can you imagine being disappointed with 80% revenue growth!? It seems a little ridiculous to expect triple-digit growth to continue in perpetuity.

- Nvidia also announced a $50 Billion share buyback plan, a step up from the $25 Billion share buyback plan they announced in August 2023.

- At current prices, this would be representative of around 2% of the current shares on issue.

- What’s our take?

-

🏦 Powell hopes the Fed hasn’t waited too long to cut rates ( Barron’s )

- What’s our take?

- This week, the Federal Reserve met at Jackson Hole for the Monetary Policy Symposium to discuss the next phase of monetary policy.

- The Fed’s messaging was clear. With inflation edging towards the 2% target and with the labor market cooling, the market should expect a rate cut in September.

- Powell seems confident in being able to deliver a soft-landing with the first rate-cut since March 2020.

- Anticipation of a rate-cut has seen the US dollar drop to its yearly low against other G1 currencies.

- The futures market now expects the Fed to cut its federal funds rate by 100 basis points or more before the end of the year, a move which could spur on more weakness in the US dollar.

- There’s been a lot of talk about whether this rate cut is coming “too late”, but time will tell. A bigger concern would be to come in too aggressively with rate cuts and have inflation start heating up again.

- What’s our take?

💉 The GLP-1 Pipeline

Most of the large pharmaceutical companies have been developing GLP-1 variants for a number of years. Following the successes of Novo Nordisk’s Ozempic and Wegovy, these companies have accelerated their development and testing of these treatments.

New treatments are being developed for other diseases and conditions and to reduce side effects. Both Eli Lilly and Novo Nordisk are both developing variants, including ones that can be taken orally, or injected less often.

Other notable companies include:

-

Amgen is developing MariTide, a GLP-1 drug that only needs to be injected monthly, unlike current treatments that require weekly injections. The treatment has shown very promising results during phase 2 clinical trials. Final results from the phase 2 trial are only expected later in the year, but the company is already preparing for a broad phase 3 trial.

-

Roche Holding is working on a several l GLP-1 treatment which it acquired via an acquisition of Carmot Therapeutics for its CT-996 drug which is taken orally. The treatment has only completed a phase 1 trial, but resulted in 6% weight loss after 4 weeks.

-

AstraZeneca has acquired the license to produce a GLP-1 from Eccogene. The company is testing a treatment regime combining this with its own therapies to treat obesity and its comorbidities.

-

Zealand Pharma is far smaller than the companies mentioned above. Zealand is developing a long-acting amylin analog, which is slightly different from a GLP-1. Recent tests showed promising weight loss and a “better patient experience” .

-

Viking Therapeutics is developing several treatments, one of which is expected to begin phase 3 trials soon. Its most promising candidate is being developed to be injected weekly, or taken orally.

Some of the other companies developing their own GLP1s include:

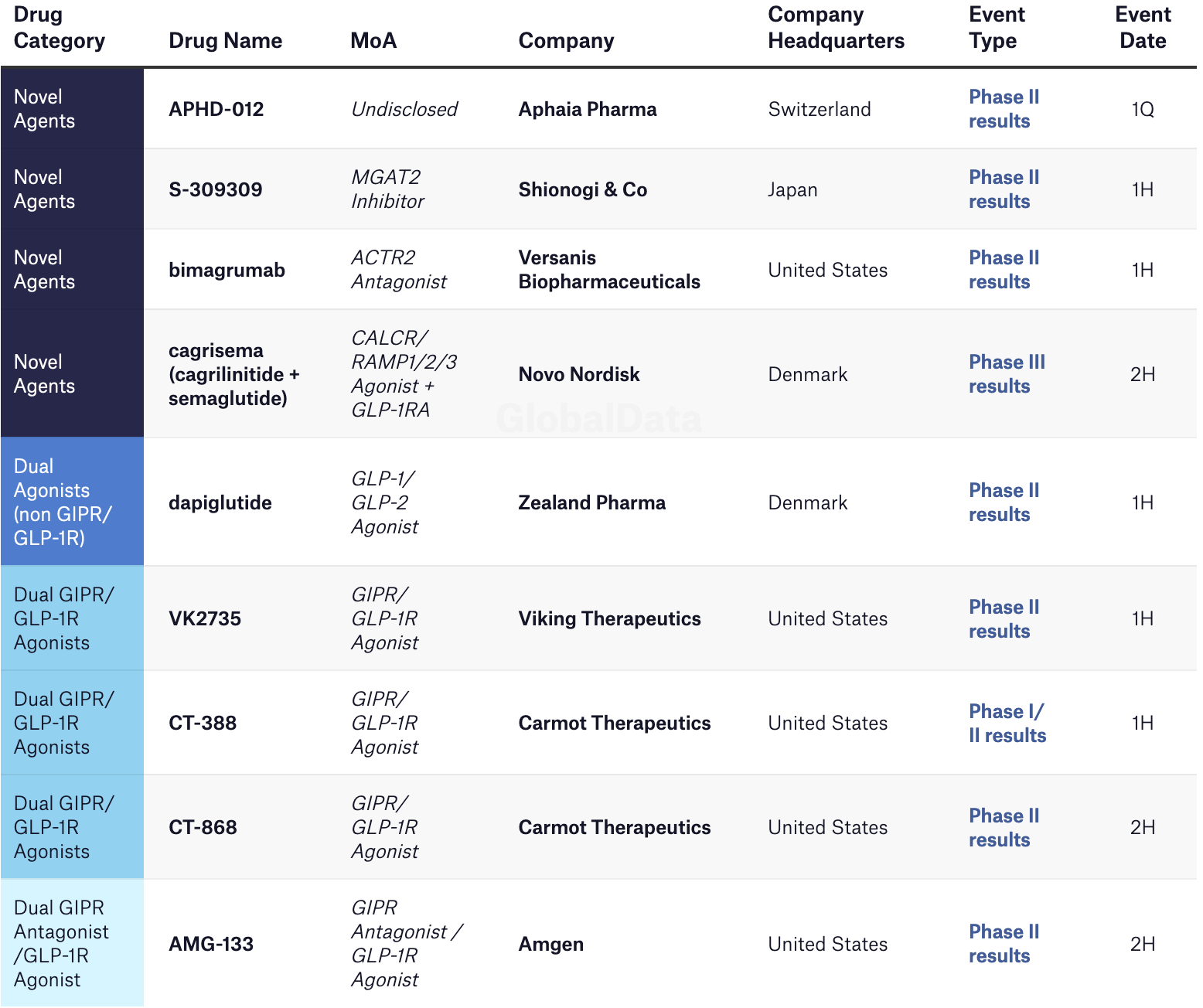

This is a more comprehensive breakdown of GLP-1s in various stages of testing.

✨ When trial results are released, a lot of attention is paid to weight loss percentages relative to the drugs that are currently approved. However, when it comes to weight management, the side effects and how easy they are to use could ultimately be just as important.

📈 GLP-1 ETFs

It didn’t take long for ETF issuers to respond to investor interest in GLP-1 drugs. In May, two new funds that focus specifically on the companies manufacturing and developing GLP-1 treatments were launched:

-

The Roundhill GLP 1 And Weight Loss ETF (OZEM) has 40% invested in Novo Nordisk and Eli Lilly, with the rest invested in companies developing new treatments.

-

The Amplify Weight Loss Drug & Treatment ETF (THNR) is less concentrated in the two large manufactures, and also includes other companies in the supply chain.

Another ETF, the Tema GLP-1, Obesity & Cardiometabolic ETF (HRTS) was launched in December 2023. This fund takes a broader view of the potential treatment of diabetes, obesity and cardiovascular disease. The fund is also actively managed, which could give it more flexibility.

These ETFs offer diversified exposure to the industry, but there are a few things to keep in mind:

- All three have quite a lot of exposure to companies with drugs that are years away from coming to market. At the same time, many of those companies have large portfolios of completely different drugs on the market.

- These funds are still quite small, so liquidity could be an issue.

- The expense ratios are quite high, though about average for thematic funds.

🪙 The Other Side of The Coin: Which Industries Are Likely To Be Disrupted?

The successes of Ozempic and other GLP-1 treatments potentially means trouble for other companies, particularly those in the ‘medtech’ and food and beverage industries. In the second half of 2023 valuations for these companies came under pressure.

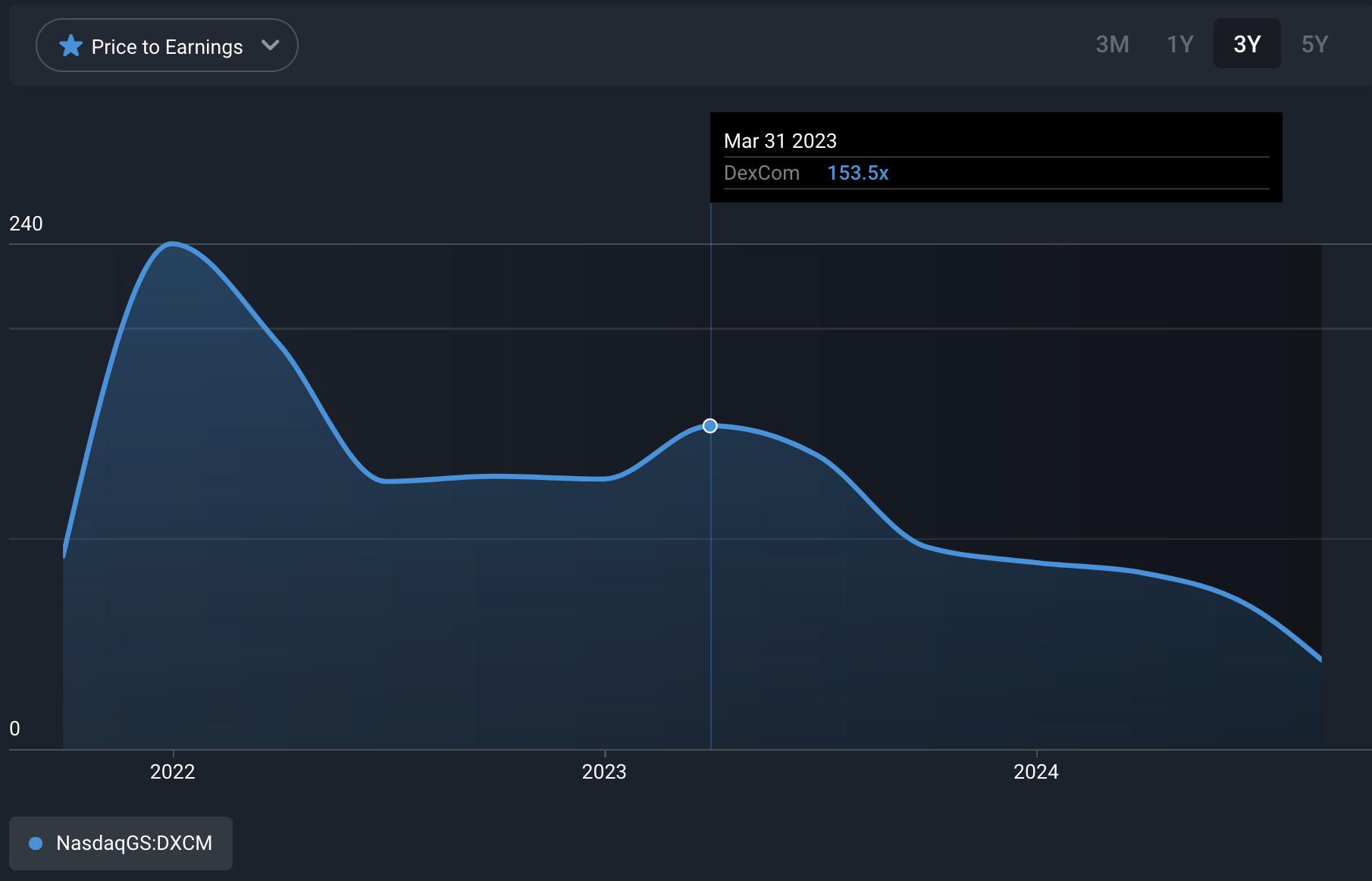

The chart below shows the P/E ratio for DexCom which manufactures continuous glucose monitoring (CGM) systems. The valuations of other companies that may be affected follow a similar pattern, though some have recovered slightly.

🩺 MedTech

If GLP-1 treatments are very successful at scale, there could in theory be less demand for the products and services provided by several medical technology companies. Examples include:

- DexCom glucose monitoring systems are widely used by patients with diabetes. GLP-1 treatment could lower the incidence of type-2 diabetes, or make it possible to manage diabetes without monitoring systems.

- Baxter Intl and DaVita provide dialysis equipment and services. GLP-1 drugs are currently being tested as a treatment for chronic kidney disease. Furthermore, using them to treat obesity and diabetes could reduce the incidence of kidney disease.

- ResMed sells equipment to treat sleep apnea. Lower rates of obesity could reduce the incidences of sleep apnea.

- Intuitive Surgical sells equipment used for metabolic surgery. The demand for this surgery has reportedly already fallen due to GLP-1 drugs.

✨ Analysts and doctors believe that it’s more likely that GLP-1 drugs will be used alongside other forms of treatment. Nevertheless, widespread use of GLP-1s is likely to result in lower demand for the types of equipment these companies use.

☕ Food and Beverage Companies

If GLP-1 use becomes very widespread, there could be very real implications for food and beverage producers, retailers and restaurants.

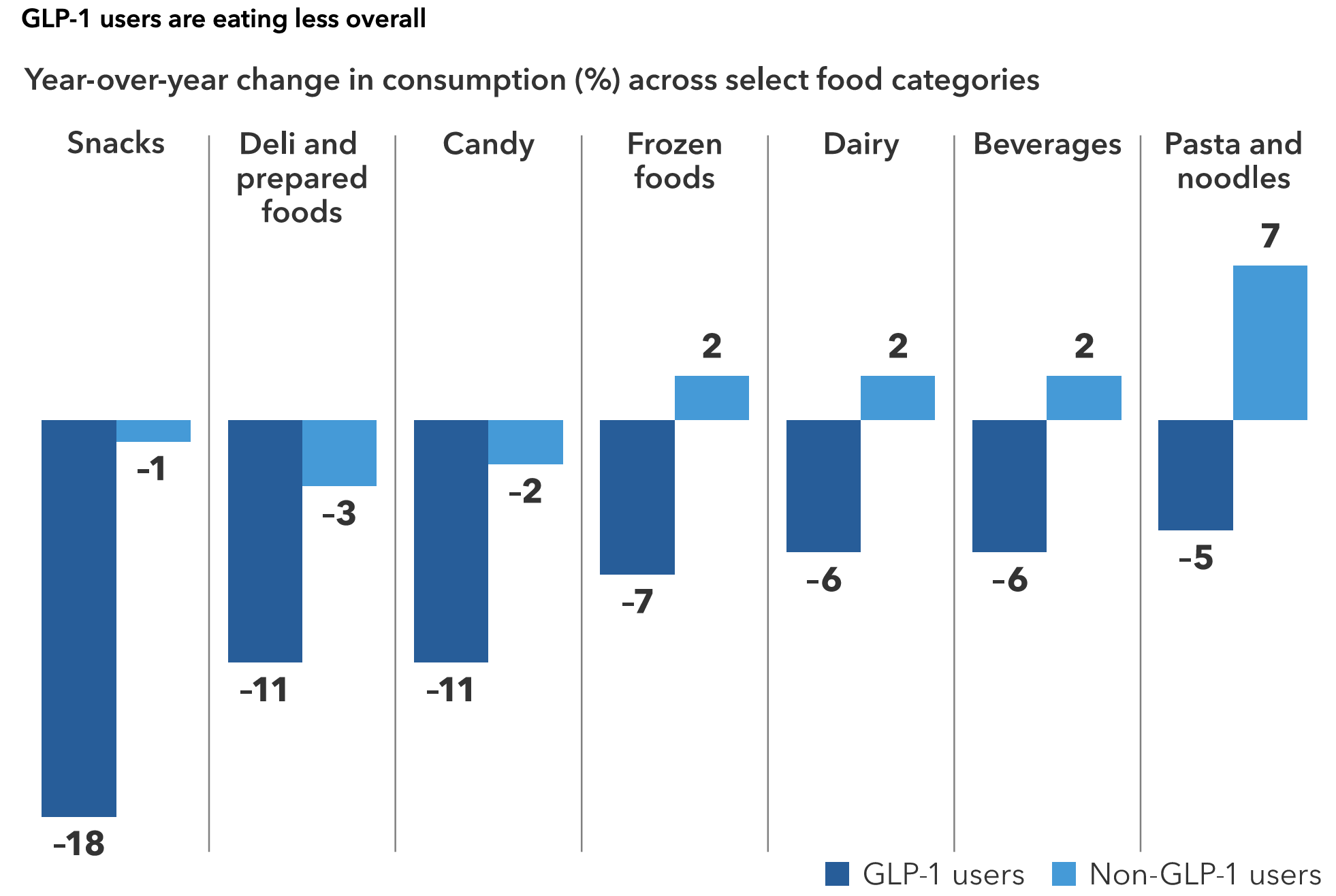

J.P. Morgan Research found that GLP-1 users purchased around 8% less food to consume at home. In particular, these consumers bought less high carb foods like snacks and soft drinks. The chart below from Capital Group shows a meaningful drop in consumption of high carb foods by GLP-1 patients.

This could have a very real impact on companies like Coca-Cola, Kraft Heinz, McDonald’s and even Walmart - if a large percentage of their customers use GLP-1 drugs. The silver lining is that these companies could adapt by selling more products high in protein, rather than high in carbohydrates. In fact. Nestle is already doing so with a new range of frozen ready meals designed for users of GLP-1 medication.

Both food and beverage companies and medtech companies could be negatively affected if enough people use and find success with GLP-1 drugs. But as mentioned last week, there are some hurdles to overcome before hundreds of millions of people use them on an ongoing basis. In particular, they need to be affordable, and the side effects need to be manageable.

Other industries that are likely to be impacted in various ways - both positive and negative - are health and life insurers. Weight management with GLP-1 drugs could reduce the incidences of diabetes, cardiovascular disease, and other conditions that end up costing health insurers more in the long run. But the numbers need to make sense. At the moment, health insurers are cutting back on coverage due to the high cost and the number of patients stopping treatment early.

💡 The Insight: Do You Know How Much You Are Paying For Optionality?

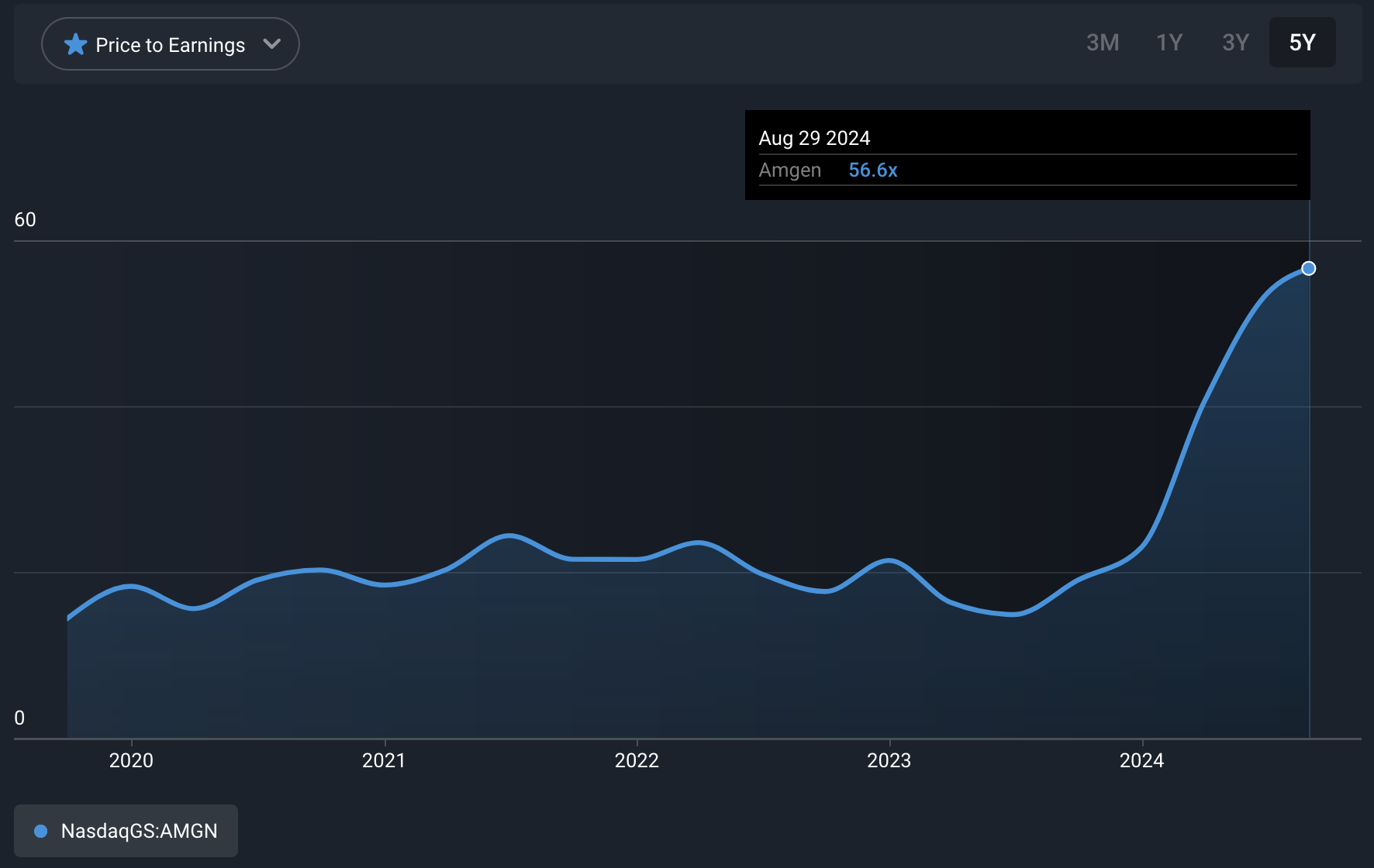

With all the hype around GLP-1 drugs, the valuations of some of the companies developing competing drugs are rising fast. Case in point is Amgen’s P/E ratio (below) which has jumped from 19x to 56x. That increase isn’t all related to the GLP-1 drug it's testing, but the optimism about these drugs has certainly played a part.

A company has optionality when future innovations, products or new market opportunities could result in significant gains relative to the cost and risk. Most companies have some level of optionality, but in some it plays a much larger part in the valuation.

Perhaps the best example right now is Tesla and its plan for robotaxis. If you estimate the fair value of Tesla as an EV maker alone, it will probably appear massively overvalued. But, if you assume the robotaxi business will be successful, the valuation may seem far more reasonable. The difference between those two values is the price you are paying for a business that doesn’t exist yet, and you can’t be 100% certain if or when it will exist.

✨ Ideally, you want to pay a fair price for the existing business, and get the optionality for free. But to invest in disruptive innovations and trends, you may have to pay a premium for that optionality.

When you buy shares in pharmaceutical companies like Amgen and Roche, you are investing in a portfolio of existing drugs which generate fairly predictable cash flows, and you are also investing in a pipeline of drugs at various stages of development and testing. Of the treatments being developed, some will make it through clinical trials, while others won’t. Most treatments don’t make it to clinical trials, while about 10% of the ones that do are ultimately approved.

If you are investing in a company with optionality, it’s worth knowing the premium you are paying for that optionality. You can do that by estimating the fair value based on the cash flows you are fairly certain of, and subtracting that from the current share price.

The difference between those values is the premium you are paying for potential cash flows. Whether the premium is reasonable or not depends on two things:

- What is the probability of success or failure? The potential return needs to compensate you for the risk of failure.

- When are the cash flows likely to materialize? The further into the future those cash flows occur, the lower they are worth today.

The bottom line is that the premium you pay for optionality needs to be discounted to account for the probability and timing of success. During periods of optimism, investors often overpay for optionality, as inflated valuations will result in larger optionality premiums. On the other hand, in periods of pessimism, savvy investors can sometimes get the optionality for free.

Key Events During the Next Week

Monday

- 🇨🇳 China’s Caixin Manufacturing PM for the month of August will be published. Economists expect to see a slight decline from 49.8 to 49.6.

Tuesday

- 🇺🇸 The US ISM Manufacturing PMI is forecast to rise from 46.8 to 47.5.

Wednesday

- 🇦🇺 Australia’s GDP growth rate is forecast to show the economy growing 0.3% during the second quarter, compared to 0.1% during the first quarter. Year-on-year growth is expected to be flat at 1.1%.

- 🇨🇦 Canada's trade data will be published. The trade surplus is forecast to widen to $1.6 billion.

- 🇨🇦 The Bank of Canada will announce its interest rate decision, and is expected to keep rates at 4.5%.

- 🇺🇸 The US JOLTs report is due. Job openings are forecast to fall marginally to 8.08 million.

Thursday

- 🇦🇺 Australia’s trade balance will be released.

- 🇺🇸 US initial jobless claims are forecast to rise from 231k to 247k.

- 🇺🇸 The US ISM Services PMI is forecast to fall marginally, from 51.4 to 51.2.

Friday

- 🇨🇦 Canada’s unemployment rate is expected to remain at 6.4%

- 🇺🇸 US non-farm payrolls are expected to fall from 114k to 100k. The unemployment rate is forecast to remain at 4.3%.

Earnings season is winding down, but there are still a few popular companies due to report, including:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments.We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.