- United States

- /

- Hospitality

- /

- NYSE:FLUT

3 Stocks Estimated To Be Trading At A Discount Of Up To 48.1%

Reviewed by Simply Wall St

The United States market remained flat over the last week but has experienced a 9.9% increase over the past year, with earnings forecasted to grow by 14% annually. In this context, identifying stocks that are potentially undervalued can offer investors opportunities to capitalize on future growth while benefiting from current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Viking Holdings (VIK) | $46.56 | $93.10 | 50% |

| Peoples Financial Services (PFIS) | $47.70 | $93.66 | 49.1% |

| Mid Penn Bancorp (MPB) | $26.25 | $52.26 | 49.8% |

| Lincoln Educational Services (LINC) | $22.46 | $44.26 | 49.3% |

| Horizon Bancorp (HBNC) | $14.60 | $29.10 | 49.8% |

| First Reliance Bancshares (FSRL) | $9.10 | $17.83 | 49% |

| Expand Energy (EXE) | $116.46 | $232.06 | 49.8% |

| Clearfield (CLFD) | $38.01 | $75.13 | 49.4% |

| Central Pacific Financial (CPF) | $26.47 | $51.99 | 49.1% |

| Arrow Financial (AROW) | $25.32 | $49.74 | 49.1% |

Let's take a closer look at a couple of our picks from the screened companies.

DoorDash (DASH)

Overview: DoorDash, Inc. operates a commerce platform linking merchants, consumers, and independent contractors both in the United States and internationally, with a market cap of approximately $92.78 billion.

Operations: The company generates revenue primarily from its Internet Information Providers segment, amounting to $11.24 billion.

Estimated Discount To Fair Value: 36.3%

DoorDash's recent acquisition of Symbiosys for US$175 million and the launch of AI-powered advertising tools highlight its strategic push into ad tech, potentially boosting cash flows. With earnings now profitable and forecasted to grow significantly faster than the US market, DoorDash trades at 36.3% below its estimated fair value. Despite insider selling concerns, the company's strong revenue growth potential and undervaluation based on discounted cash flow analysis present an intriguing case for investors focused on cash flow metrics.

- Our earnings growth report unveils the potential for significant increases in DoorDash's future results.

- Take a closer look at DoorDash's balance sheet health here in our report.

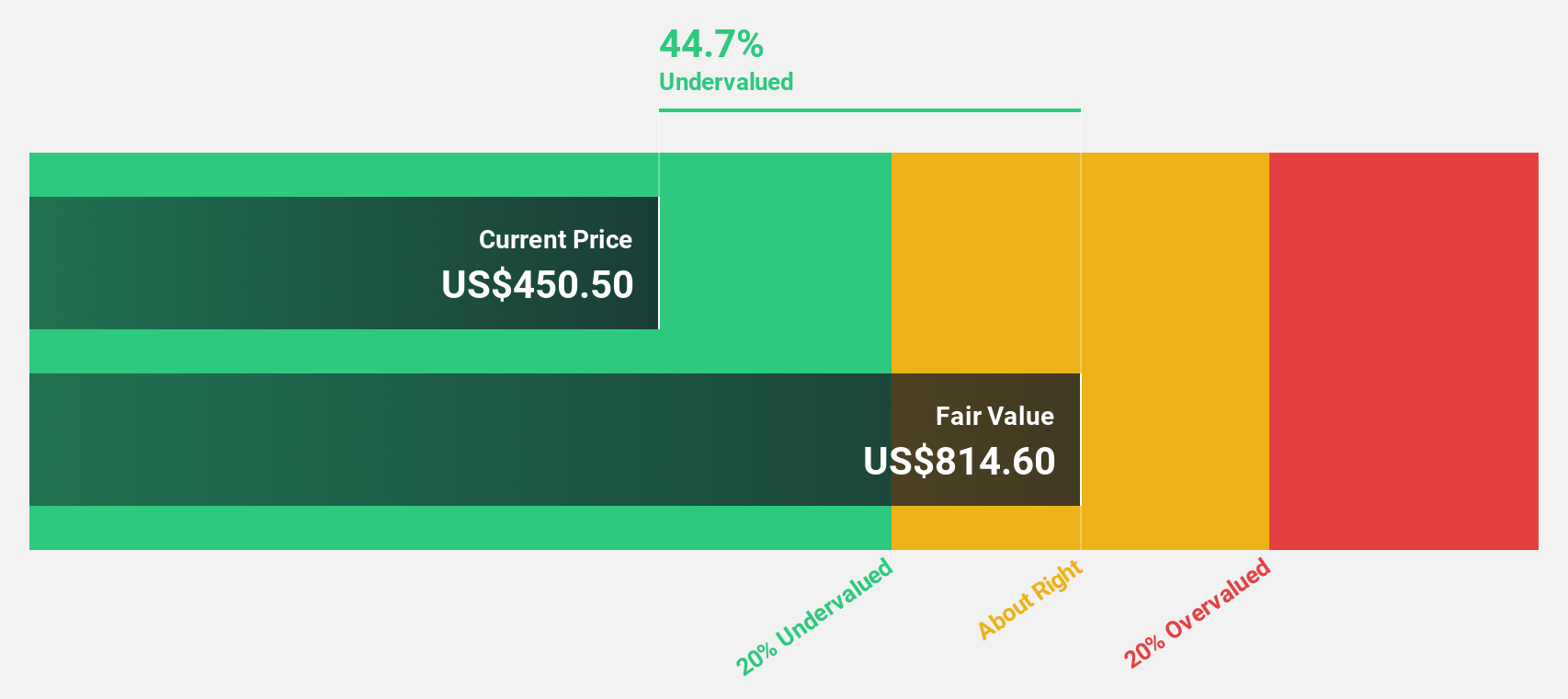

Vertex Pharmaceuticals (VRTX)

Overview: Vertex Pharmaceuticals Incorporated is a biotechnology company focused on developing and commercializing therapies for cystic fibrosis, with a market cap of approximately $116.96 billion.

Operations: The company's revenue is primarily derived from its pharmaceuticals segment, which generated approximately $11.10 billion.

Estimated Discount To Fair Value: 44.1%

Vertex Pharmaceuticals' recent positive clinical data on ALYFTREK® and strategic product developments bolster its cash flow prospects. Despite a significant impairment charge, Vertex's revenue guidance for 2025 remains strong at US$11.85 billion to US$12 billion. Trading at 44.1% below its estimated fair value of US$814.6, the stock appears undervalued based on discounted cash flow analysis, presenting potential opportunities for investors focused on cash flows amidst ongoing legal challenges and regulatory advancements.

- Our expertly prepared growth report on Vertex Pharmaceuticals implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Vertex Pharmaceuticals stock in this financial health report.

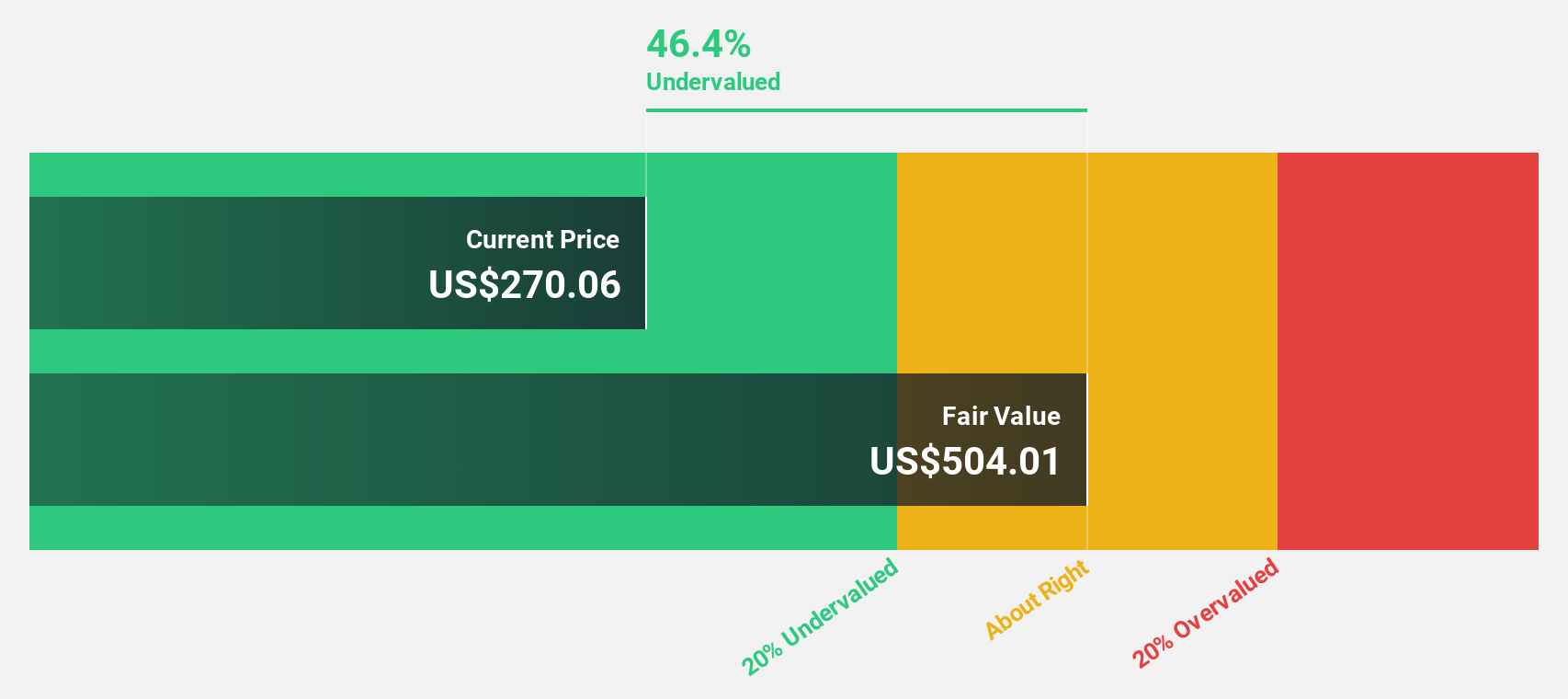

Flutter Entertainment (FLUT)

Overview: Flutter Entertainment plc is a sports betting and gaming company with operations in the United States, the United Kingdom, Ireland, Australia, Italy, and internationally; it has a market cap of approximately $46.72 billion.

Operations: The company's revenue segments include $6.05 billion from the US and $3.62 billion from the UK and Ireland, with a segment adjustment of $4.64 billion.

Estimated Discount To Fair Value: 48.1%

Flutter Entertainment's first-quarter earnings report shows a transition to profitability with net income of US$283 million, contrasting last year's loss. The stock trades at 48.1% below its fair value of US$510.26, presenting an undervaluation opportunity based on discounted cash flow analysis. Recent debt financing initiatives and revised revenue guidance between US$16.63 billion and US$17.53 billion for 2025 highlight robust cash flow prospects despite slower revenue growth forecasts compared to the industry benchmark.

- In light of our recent growth report, it seems possible that Flutter Entertainment's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Flutter Entertainment.

Key Takeaways

- Take a closer look at our Undervalued US Stocks Based On Cash Flows list of 173 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLUT

Flutter Entertainment

Operates as a sports betting and gaming company in the United States, the United Kingdom, Ireland, Australia, Italy, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives