- United States

- /

- Hospitality

- /

- NasdaqGS:CHDN

What Churchill Downs (CHDN)'s Fintech Partnership With Everi Means for Shareholders

Reviewed by Sasha Jovanovic

- Everi recently announced a seven-year agreement with Churchill Downs Incorporated to roll out its CashClub and other financial technology solutions at Churchill Downs’ racing and gaming venues, including payments processing and compliance technology.

- This collaboration focuses on modernizing transaction processes and enhancing compliance, with the aim of delivering a more efficient and personalized patron experience across Churchill Downs’ entertainment properties.

- We’ll explore how this major fintech partnership could strengthen Churchill Downs’ efficiency and compliance within its investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Churchill Downs Investment Narrative Recap

To own Churchill Downs shares, you have to believe in the long-term resilience of live racing, HRM gaming, and marquee experiences like the Kentucky Derby, despite changing consumer tastes and a crowded gaming market. The Everi partnership brings advanced fintech to Churchill Downs venues, aiming to strengthen operational efficiency and compliance; however, it does not materially change the high near-term focus on scaling new gaming properties or address the immediate risk of ongoing revenue volatility linked to racing and HRM concentration.

Amidst a push to modernize and expand, Churchill Downs recently announced the opening of Owensboro Racing & Gaming, a high-tech venue with 600 historical racing machines. While the Everi deal provides back-end upgrades for payments and compliance, performance at these new gaming sites remains central to the company’s growth prospects, especially as it contends with evolving regional gaming competition and shifting entertainment preferences.

Yet investors also need to watch for the lingering risk of declining interest in horse racing and HRM venues should...

Read the full narrative on Churchill Downs (it's free!)

Churchill Downs is projected to reach $3.2 billion in revenue and $541.1 million in earnings by 2028. This outlook assumes a 4.2% annual revenue growth rate and a $111.2 million increase in earnings from the current $429.9 million.

Uncover how Churchill Downs' forecasts yield a $137.45 fair value, a 53% upside to its current price.

Exploring Other Perspectives

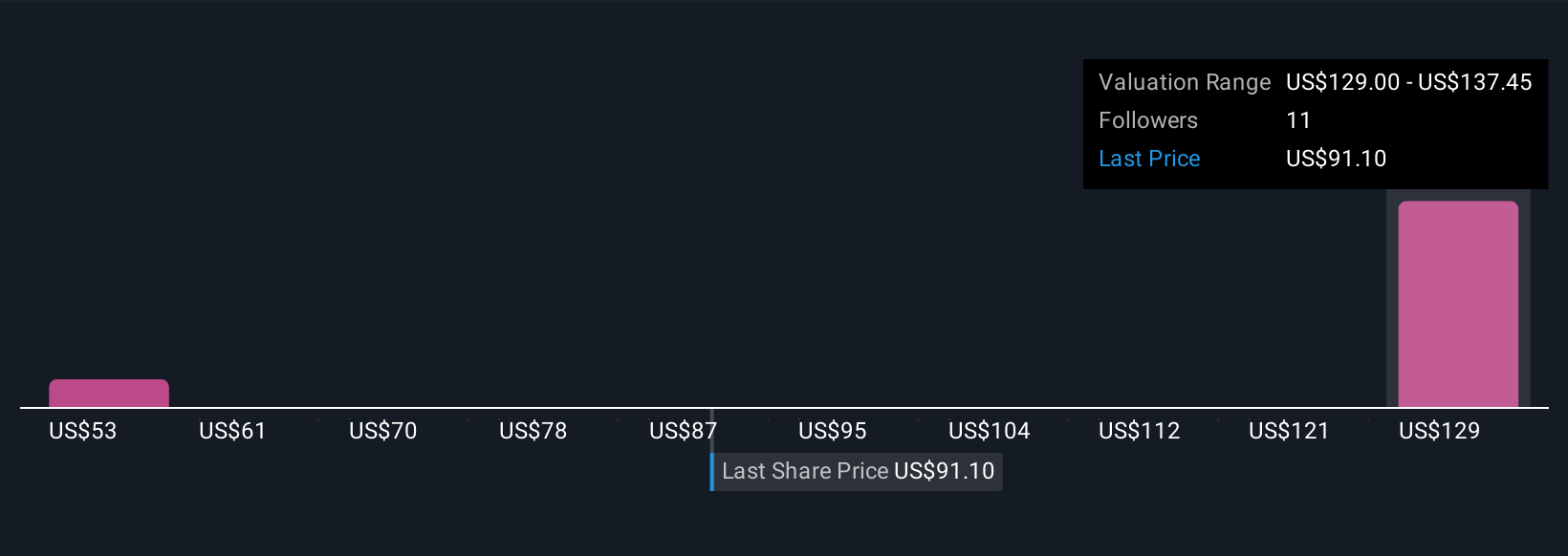

Four estimates from the Simply Wall St Community put Churchill Downs’ fair value between US$52.87 and US$137.45 per share. While opinions are split, the concentration in horse racing and historical gaming leaves the business exposed if these segments face headwinds, explore these contrasting viewpoints to inform your outlook.

Explore 4 other fair value estimates on Churchill Downs - why the stock might be worth as much as 53% more than the current price!

Build Your Own Churchill Downs Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Churchill Downs research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Churchill Downs research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Churchill Downs' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHDN

Churchill Downs

Operates live and historical racing entertainment venues, online wagering businesses, and regional casino gaming properties in the United States.

Very undervalued with limited growth.

Similar Companies

Market Insights

Community Narratives