- United States

- /

- Hospitality

- /

- NasdaqGS:CAKE

How Recent Share Price Volatility is Shaping The Cheesecake Factory’s Valuation in 2025

Reviewed by Bailey Pemberton

If you have been keeping an eye on Cheesecake Factory stock, you might be wondering whether now is the right time to act, hold, or simply enjoy a slice of the market drama from the sidelines. With the shares closing recently at $53.34, investors have seen more than a fair share of ups and downs. Just last week, the stock dipped by 2.4%, and over the last month, it is down 11.3% as well. Still, if you zoom out, year-to-date returns stand at a solid 10.0%, while a one-year return delivers an impressive 37.7%. Over even longer stretches, gains stack up: a three-year return of 79.2% and a five-year performance of 95.4% really drive home just how resilient Cheesecake Factory has been, especially amid shifting consumer trends and broader market volatility fueled by changing sentiment about restaurant and leisure stocks.

Of course, seeing all these numbers can raise the question, is Cheesecake Factory actually undervalued or is all the upside already on the table? Looking at the valuation score, Cheesecake Factory clocks in at 4 out of 6. That means the stock looks undervalued based on four key checks and fair to slightly rich on two, so there is room for a closer look at what is driving those signals. Next, we will break down the different ways analysts and investors try to measure a stock's value, plus hint at a more insightful approach to valuation that could change the way you look at this company altogether.

Approach 1: Cheesecake Factory Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and discounting them back to the present. This approach provides a sense of the company’s intrinsic value based on expectations of its future performance.

For Cheesecake Factory, the DCF model relies on a 2 Stage Free Cash Flow to Equity method. The company’s latest reported Free Cash Flow stands at $148.1 million. Analysts provide annual FCF projections up to 2027, with an estimate of $132 million by that year. Looking further ahead, extrapolated forecasts suggest free cash flow could approach $155.8 million in 2035, although projections beyond five years involve more educated guesswork than hard data.

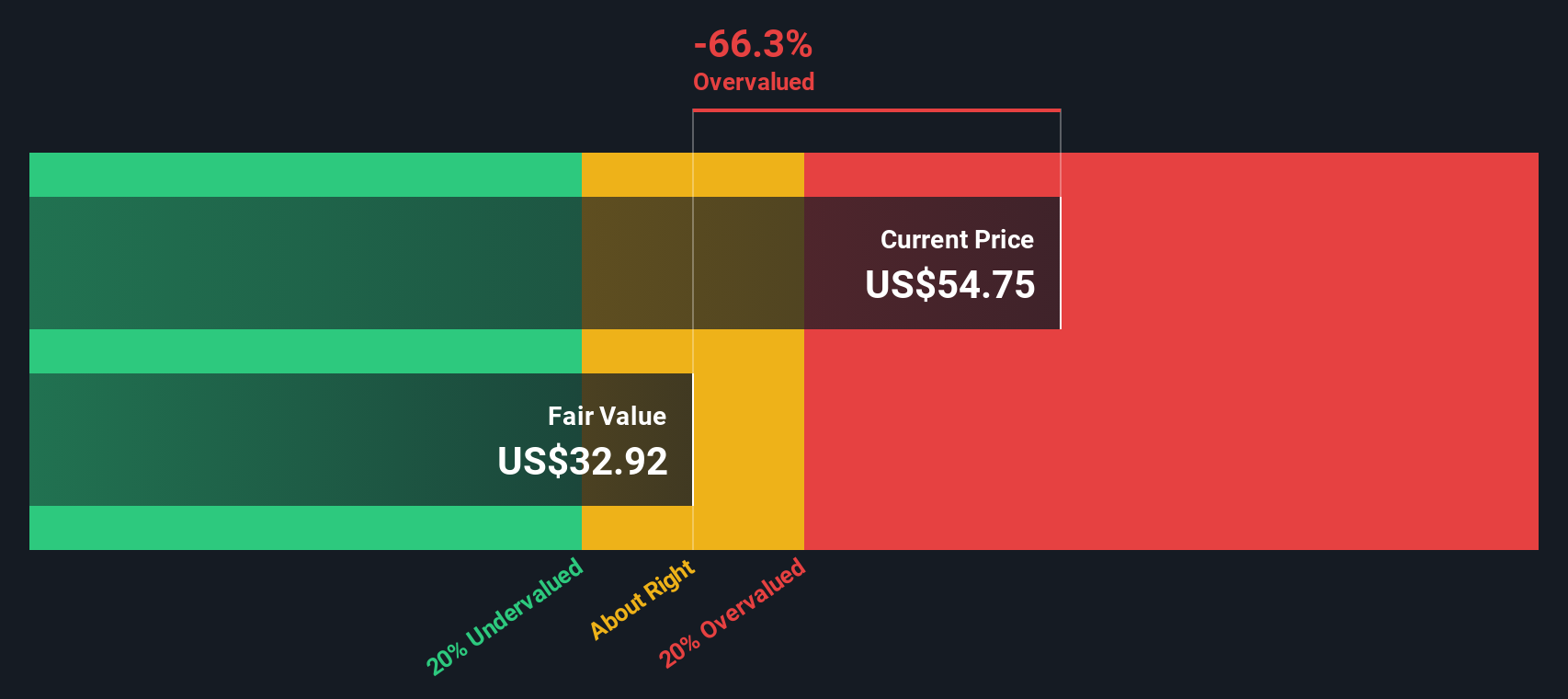

This model estimates Cheesecake Factory’s intrinsic value at $33.10 per share. With the current stock price at $53.34, the DCF analysis indicates the shares are trading at a 61.2% premium to their calculated fair value, suggesting the stock is significantly overvalued based on these cash flow assumptions.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cheesecake Factory may be overvalued by 61.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Cheesecake Factory Price vs Earnings

For mature, profitable companies like Cheesecake Factory, the Price-to-Earnings (PE) ratio is commonly used to gauge valuation. The PE ratio measures how much investors are willing to pay today for a dollar of current earnings. This makes it a useful barometer of market sentiment regarding growth prospects and company quality.

It is important to remember that what counts as a “normal” or “fair” PE ratio can shift with expectations about future growth and the risks facing the business. Companies with faster-growing or more stable profits often carry higher PE ratios, while weaker prospects or increased risks can lower the ratio.

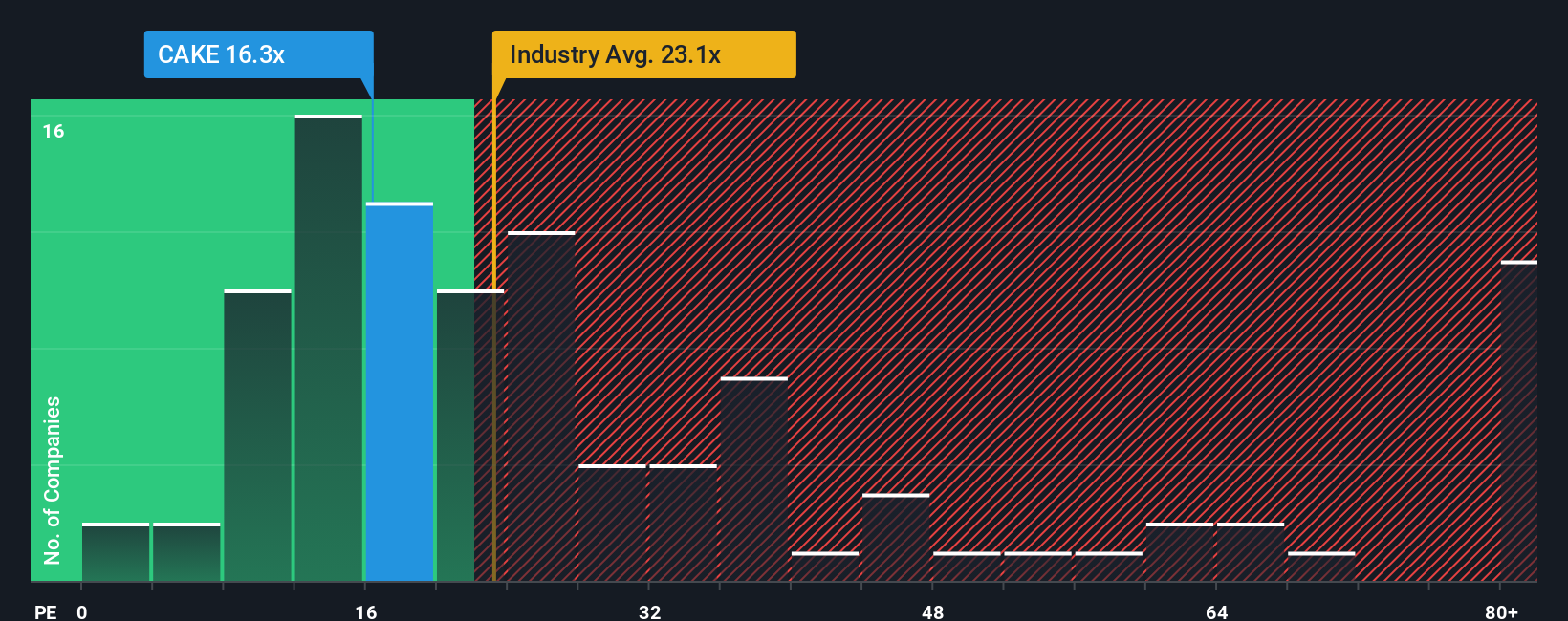

Cheesecake Factory currently trades at a PE ratio of 16.7x. Compared to the Hospitality industry average of 24.8x and a peer average of 59.3x, Cheesecake Factory appears attractively priced. However, raw comparisons can sometimes be misleading because they do not account for each company’s unique characteristics.

This is where Simply Wall St’s “Fair Ratio” provides a sharper perspective. The Fair Ratio (21.8x for Cheesecake Factory) is custom-calculated, factoring in elements such as the company’s earnings growth, profit margins, market cap, industry positioning, and risks. By tailoring the PE benchmark specifically to Cheesecake Factory, the Fair Ratio offers a more nuanced view of valuation beyond surface-level comparisons.

Since the current PE ratio of 16.7x is materially below the Fair Ratio of 21.8x, Cheesecake Factory may be undervalued based on this key earnings measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cheesecake Factory Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal story or perspective about a company, connecting the facts and figures such as fair value, revenue, earnings, and margins to the bigger picture you see unfolding for that business. Rather than relying on a single model or generic analyst consensus, Narratives help you link your own expectations about Cheesecake Factory’s future to a concrete estimate of what the stock is truly worth.

On Simply Wall St’s Community page, millions of investors use Narratives as an easy tool to document their view, set assumptions, and compare fair value to the current share price, making buy, hold, or sell decisions simpler and more transparent. Narratives dynamically update as new news or earnings reports arrive, so your investment thesis remains relevant even as the situation evolves.

For example, one investor’s Narrative might see Cheesecake Factory as an emerging long-term growth leader worth up to $105.90 per share based on rapid expansion and strong margins, while another might be cautious and assign a value near $47.00, concerned about industry headwinds. This shows how a Narrative transforms market noise into a clear, actionable viewpoint.

Do you think there's more to the story for Cheesecake Factory? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CAKE

Cheesecake Factory

Operates and licenses restaurants in the United States and Canada.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives