- United States

- /

- Hospitality

- /

- NasdaqGS:BLMN

Bloomin' Brands' (NASDAQ:BLMN) Shareholders Will Receive A Bigger Dividend Than Last Year

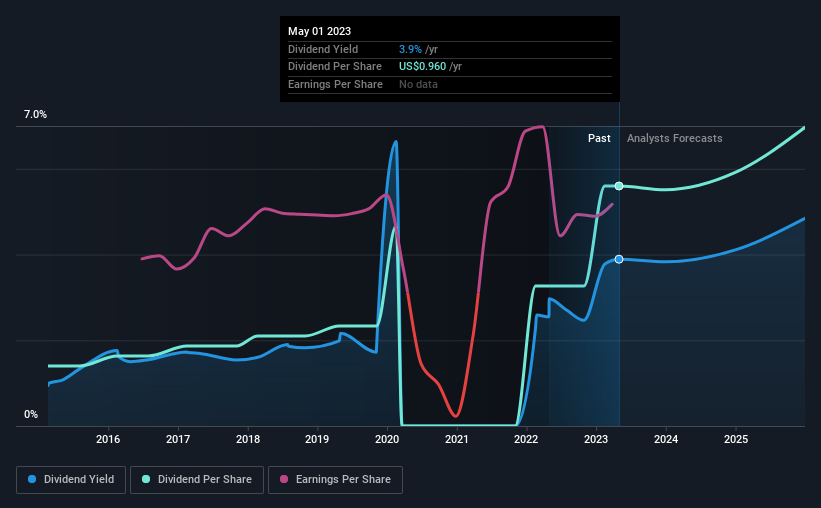

The board of Bloomin' Brands, Inc. (NASDAQ:BLMN) has announced that it will be paying its dividend of $0.24 on the 24th of May, an increased payment from last year's comparable dividend. This will take the annual payment to 3.9% of the stock price, which is above what most companies in the industry pay.

See our latest analysis for Bloomin' Brands

Bloomin' Brands' Dividend Is Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. Based on the last payment, Bloomin' Brands was quite comfortably earning enough to cover the dividend. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

Looking forward, earnings per share is forecast to rise by 139.9% over the next year. If the dividend continues on this path, the payout ratio could be 22% by next year, which we think can be pretty sustainable going forward.

Bloomin' Brands' Dividend Has Lacked Consistency

Looking back, Bloomin' Brands' dividend hasn't been particularly consistent. This suggests that the dividend might not be the most reliable. Since 2015, the dividend has gone from $0.24 total annually to $0.96. This works out to be a compound annual growth rate (CAGR) of approximately 19% a year over that time. Despite the rapid growth in the dividend over the past number of years, we have seen the payments go down the past as well, so that makes us cautious.

Bloomin' Brands May Find It Hard To Grow The Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Earnings per share has been crawling upwards at 3.0% per year. Growth of 3.0% per annum is not particularly high, which might explain why the company is paying out a higher proportion of earnings. This isn't necessarily bad, but we wouldn't expect rapid dividend growth in the future.

In Summary

Overall, this is a reasonable dividend, and it being raised is an added bonus. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 5 warning signs for Bloomin' Brands (of which 1 is significant!) you should know about. Is Bloomin' Brands not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Bloomin' Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BLMN

Bloomin' Brands

Bloomin’ Brands, Inc., through its subsidiaries, owns and operates casual, upscale casual, and fine dining restaurants in the United States and internationally.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives