- United States

- /

- Hospitality

- /

- NasdaqGS:ATAT

November 2025's Top Value Picks For Potential Market Opportunities

Reviewed by Simply Wall St

As the U.S. stock market navigates a mixed landscape with tech shares rebounding and the Dow Jones Industrial Average experiencing declines, investors are closely watching for opportunities amid fluctuating indices. In this environment, identifying undervalued stocks becomes crucial, as they may present potential value plays despite broader market volatility and economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wix.com (WIX) | $126.92 | $249.01 | 49% |

| TransMedics Group (TMDX) | $115.55 | $229.20 | 49.6% |

| Phibro Animal Health (PAHC) | $44.70 | $87.83 | 49.1% |

| Old National Bancorp (ONB) | $20.79 | $40.98 | 49.3% |

| Lyft (LYFT) | $23.80 | $47.52 | 49.9% |

| Huntington Bancshares (HBAN) | $15.71 | $31.07 | 49.4% |

| First Busey (BUSE) | $23.01 | $45.34 | 49.3% |

| Caris Life Sciences (CAI) | $24.30 | $47.82 | 49.2% |

| BioLife Solutions (BLFS) | $25.14 | $49.66 | 49.4% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $18.70 | $37.29 | 49.8% |

We're going to check out a few of the best picks from our screener tool.

Protagonist Therapeutics (PTGX)

Overview: Protagonist Therapeutics, Inc. is a biopharmaceutical company focused on developing peptide therapeutics for hematology, blood disorders, and inflammatory and immunomodulatory diseases, with a market cap of approximately $5.30 billion.

Operations: The company's revenue is primarily derived from its biotechnology segment focused on startups, totaling $209.22 million.

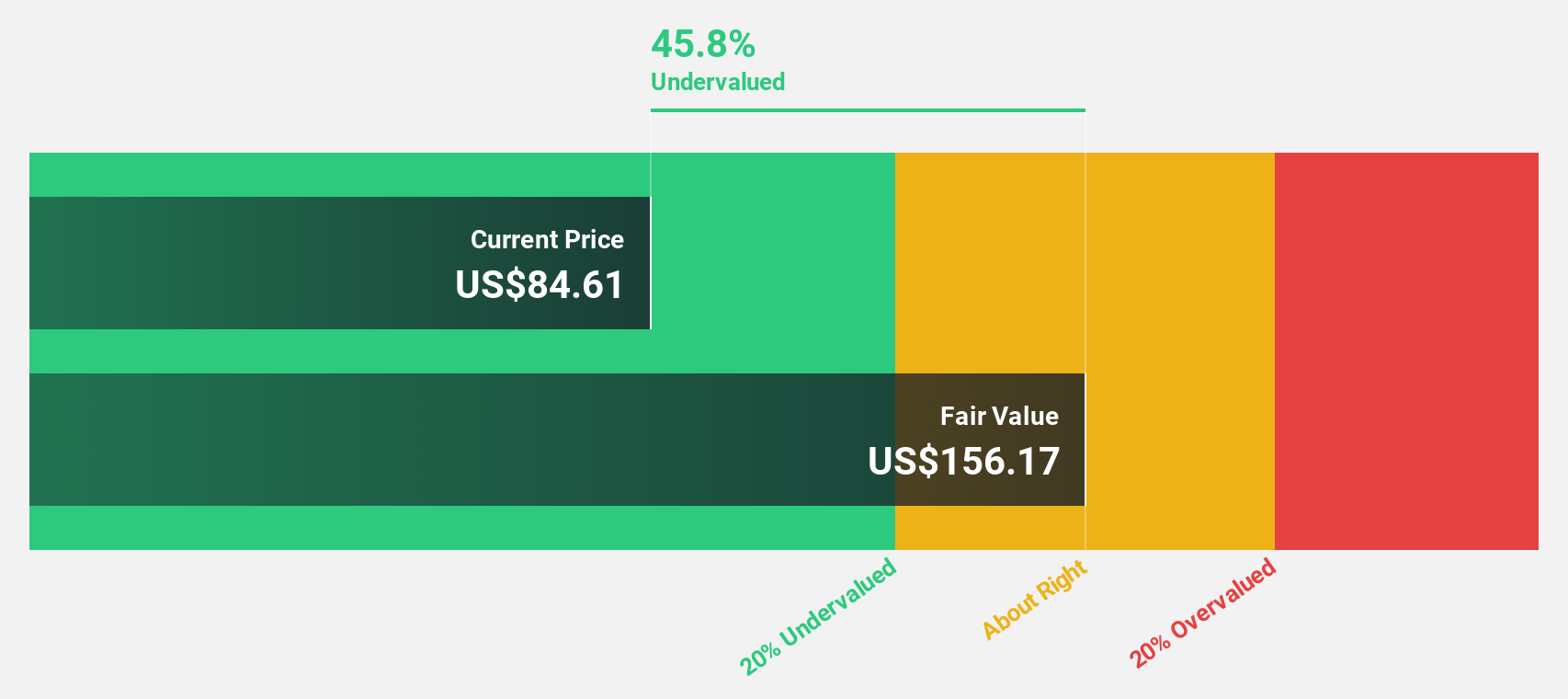

Estimated Discount To Fair Value: 46.3%

Protagonist Therapeutics, Inc. appears undervalued based on cash flows, trading at US$83.24 against an estimated fair value of US$155.02, a 46.3% discount. Despite recent losses, with a net loss of US$85.77 million for the nine months ending September 2025, its revenue and earnings are forecast to grow significantly above market averages at 24.7% and 42.1% per year respectively, suggesting potential long-term value amid acquisition talks with Johnson & Johnson.

- In light of our recent growth report, it seems possible that Protagonist Therapeutics' financial performance will exceed current levels.

- Take a closer look at Protagonist Therapeutics' balance sheet health here in our report.

Vertex (VERX)

Overview: Vertex, Inc. offers enterprise tax technology solutions for the retail trade, wholesale trade, and manufacturing industries both in the United States and internationally, with a market cap of $3.30 billion.

Operations: Revenue for Vertex's enterprise tax technology solutions primarily comes from its Software & Programming segment, amounting to $732.19 million.

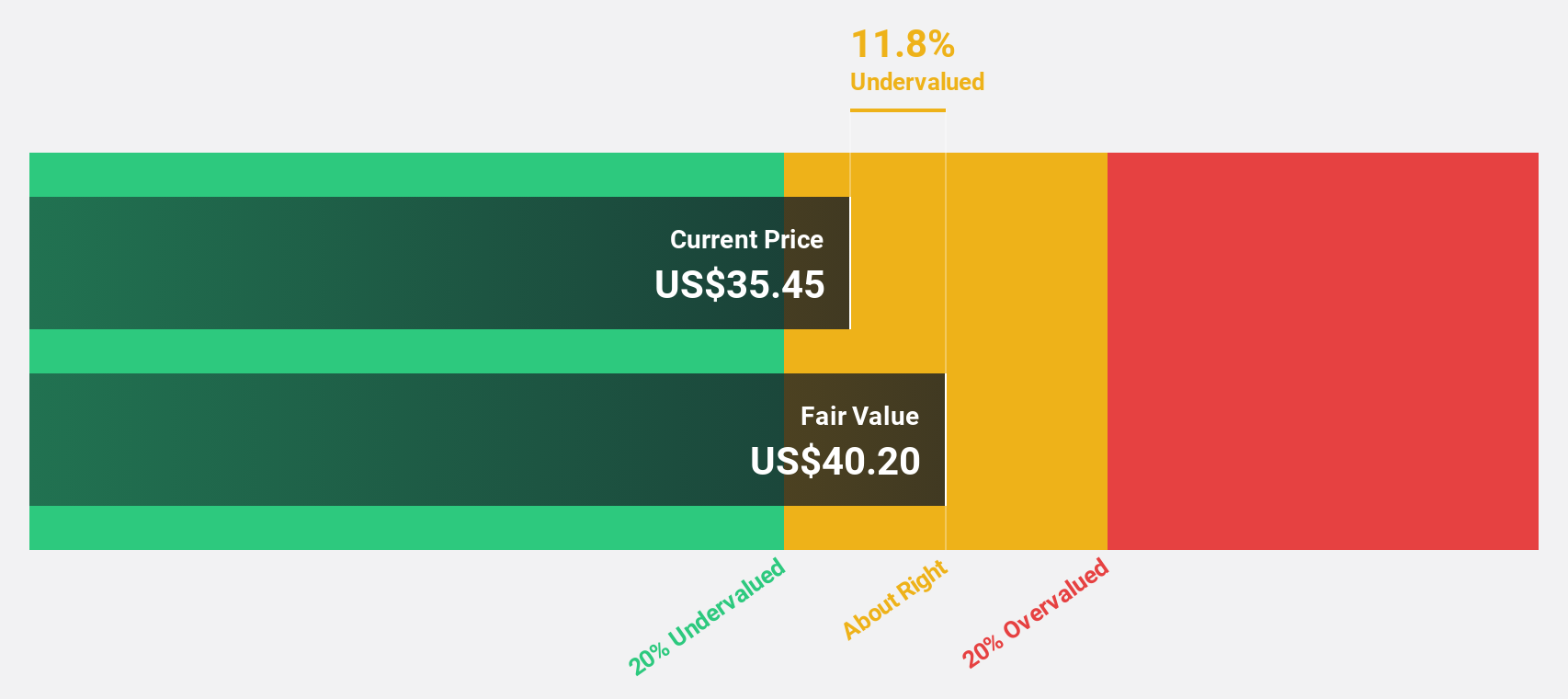

Estimated Discount To Fair Value: 38.7%

Vertex, Inc. is trading at US$20.37, significantly below its estimated fair value of US$33.2, suggesting it may be undervalued based on cash flows. Despite recent declines in net income to US$4.05 million for Q3 2025 from US$7.22 million a year ago, Vertex's revenue is forecasted to grow faster than the market average at 10.7% annually and the company anticipates becoming profitable within three years, supported by a robust share repurchase program worth up to US$150 million.

- According our earnings growth report, there's an indication that Vertex might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Vertex.

Atour Lifestyle Holdings (ATAT)

Overview: Atour Lifestyle Holdings Limited, with a market cap of $5.57 billion, operates through its subsidiaries to develop lifestyle brands centered around hotel offerings in the People's Republic of China.

Operations: The company generates revenue from its Atour Group segment, totaling CN¥8.36 billion.

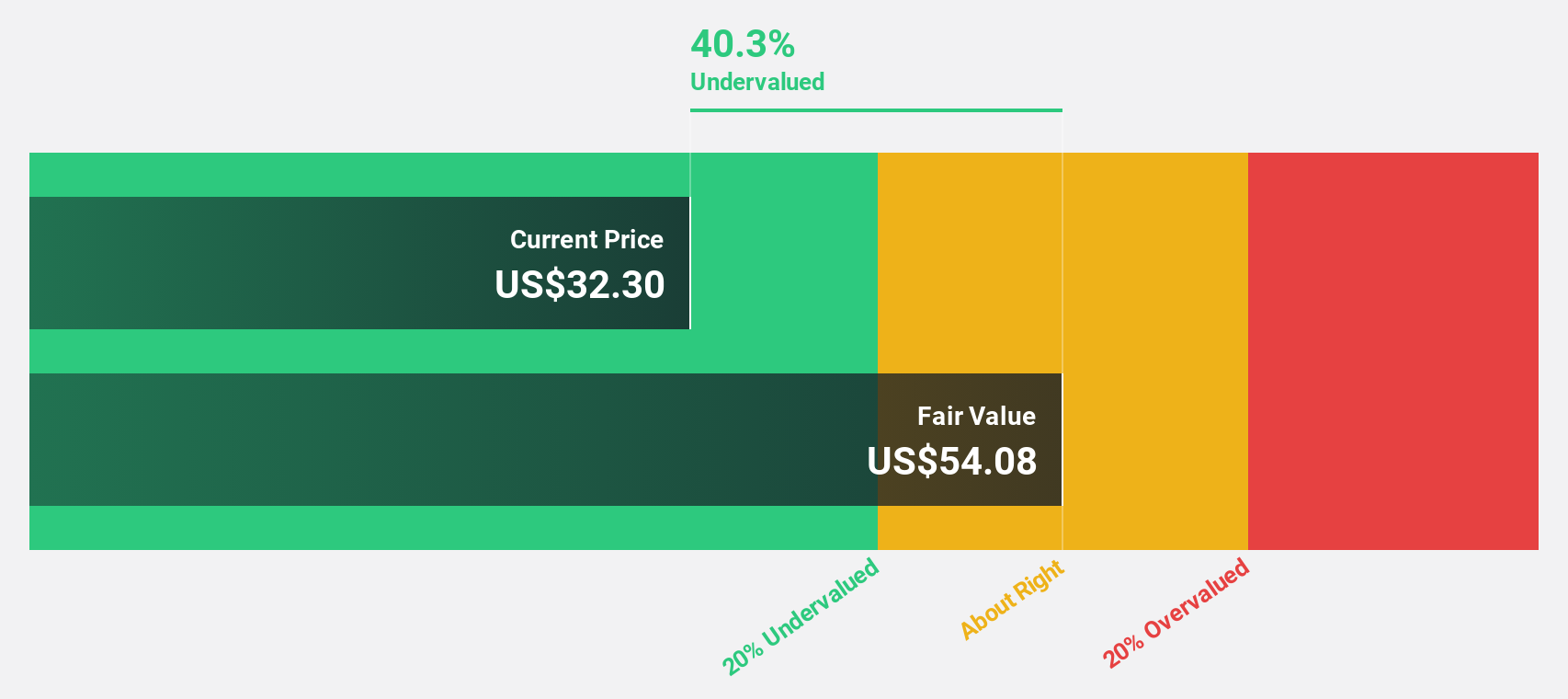

Estimated Discount To Fair Value: 31.6%

Atour Lifestyle Holdings, trading at US$40.31, is valued below its fair value estimate of US$58.95, presenting a potential undervaluation based on cash flows. The company's earnings are projected to grow significantly at 24.2% annually, outpacing the market average of 16%. Despite recent executive changes and a slight decrease in occupancy rates, Atour's revenue guidance indicates a robust 30% increase for 2025 compared to the previous year, reinforcing its growth trajectory.

- The analysis detailed in our Atour Lifestyle Holdings growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Atour Lifestyle Holdings stock in this financial health report.

Next Steps

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 196 more companies for you to explore.Click here to unveil our expertly curated list of 199 Undervalued US Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATAT

Atour Lifestyle Holdings

Through its subsidiaries, develops lifestyle brands around hotel offerings in the People’s Republic of China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives