- United States

- /

- Capital Markets

- /

- NasdaqGS:VCTR

3 High Growth Companies Insiders Are Eager To Hold

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, though it is up 5.7% over the past year with earnings forecasted to grow by 13% annually. In this environment, companies with strong growth potential and significant insider ownership can be particularly appealing as they may signal confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.2% | 29.8% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37.2% |

| Hims & Hers Health (NYSE:HIMS) | 13.3% | 21.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.3% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.8% | 61.4% |

| Red Cat Holdings (NasdaqCM:RCAT) | 19.4% | 123% |

| Niu Technologies (NasdaqGM:NIU) | 36.2% | 82.8% |

| Clene (NasdaqCM:CLNN) | 19.5% | 63.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.2% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.8% |

Here we highlight a subset of our preferred stocks from the screener.

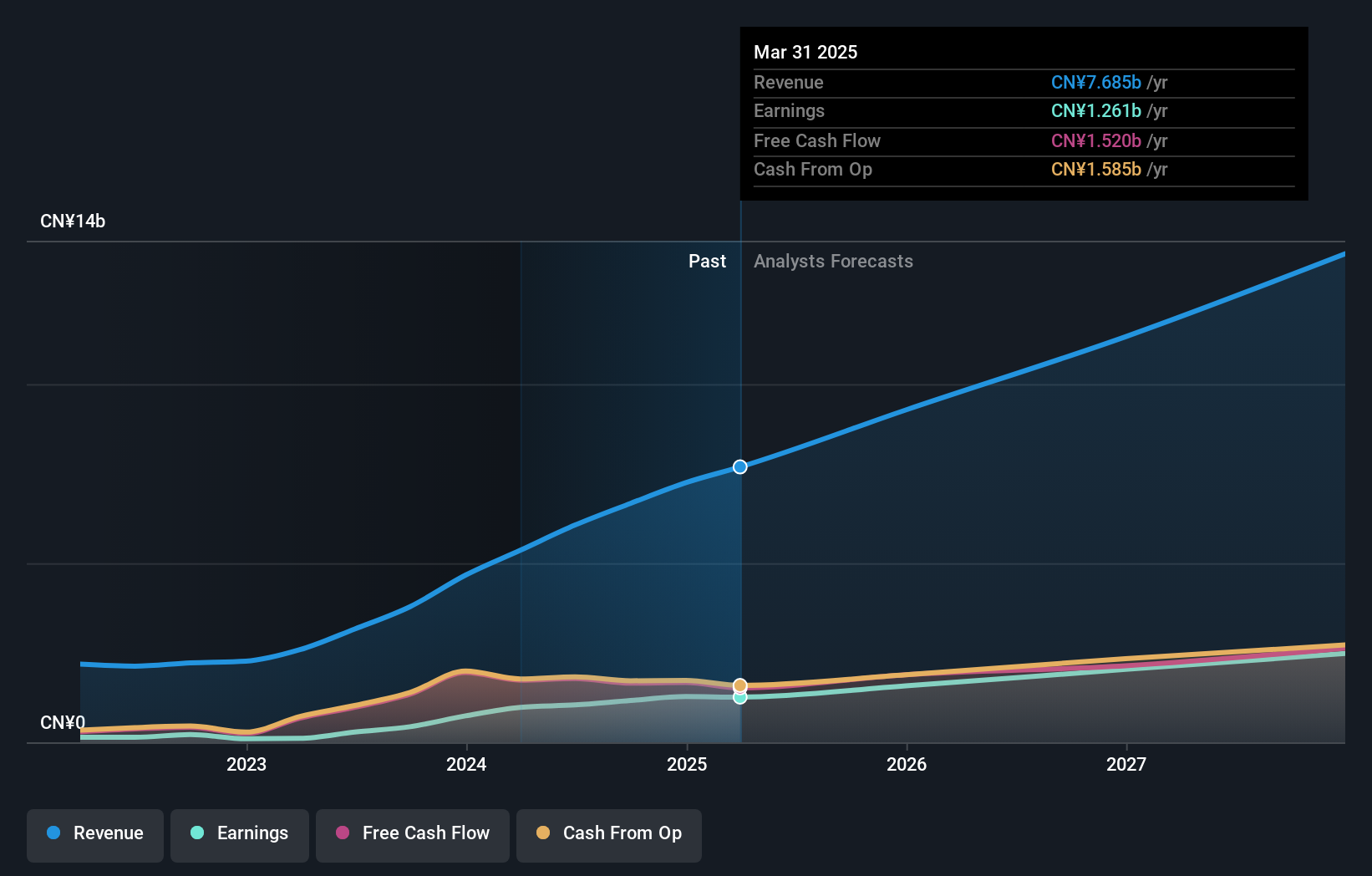

Atour Lifestyle Holdings (NasdaqGS:ATAT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Atour Lifestyle Holdings Limited, with a market cap of $3.29 billion, operates through its subsidiaries to develop lifestyle brands centered around hotel offerings in the People's Republic of China.

Operations: The company generates revenue of CN¥7.25 billion through its Atour Group segment, focusing on lifestyle brands related to hotel offerings in China.

Insider Ownership: 25.4%

Return On Equity Forecast: 41% (2027 estimate)

Atour Lifestyle Holdings demonstrates strong growth potential with earnings forecasted to grow significantly at 21.5% annually, outpacing the US market. The company is trading well below its estimated fair value and analysts anticipate a notable price increase. Recent results show robust performance with net income rising to CNY 1.28 billion for 2024, while revenue grew substantially year-over-year. Despite slower projected revenue growth at 19.4%, it remains above the market average of 8.2%.

- Get an in-depth perspective on Atour Lifestyle Holdings' performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Atour Lifestyle Holdings implies its share price may be lower than expected.

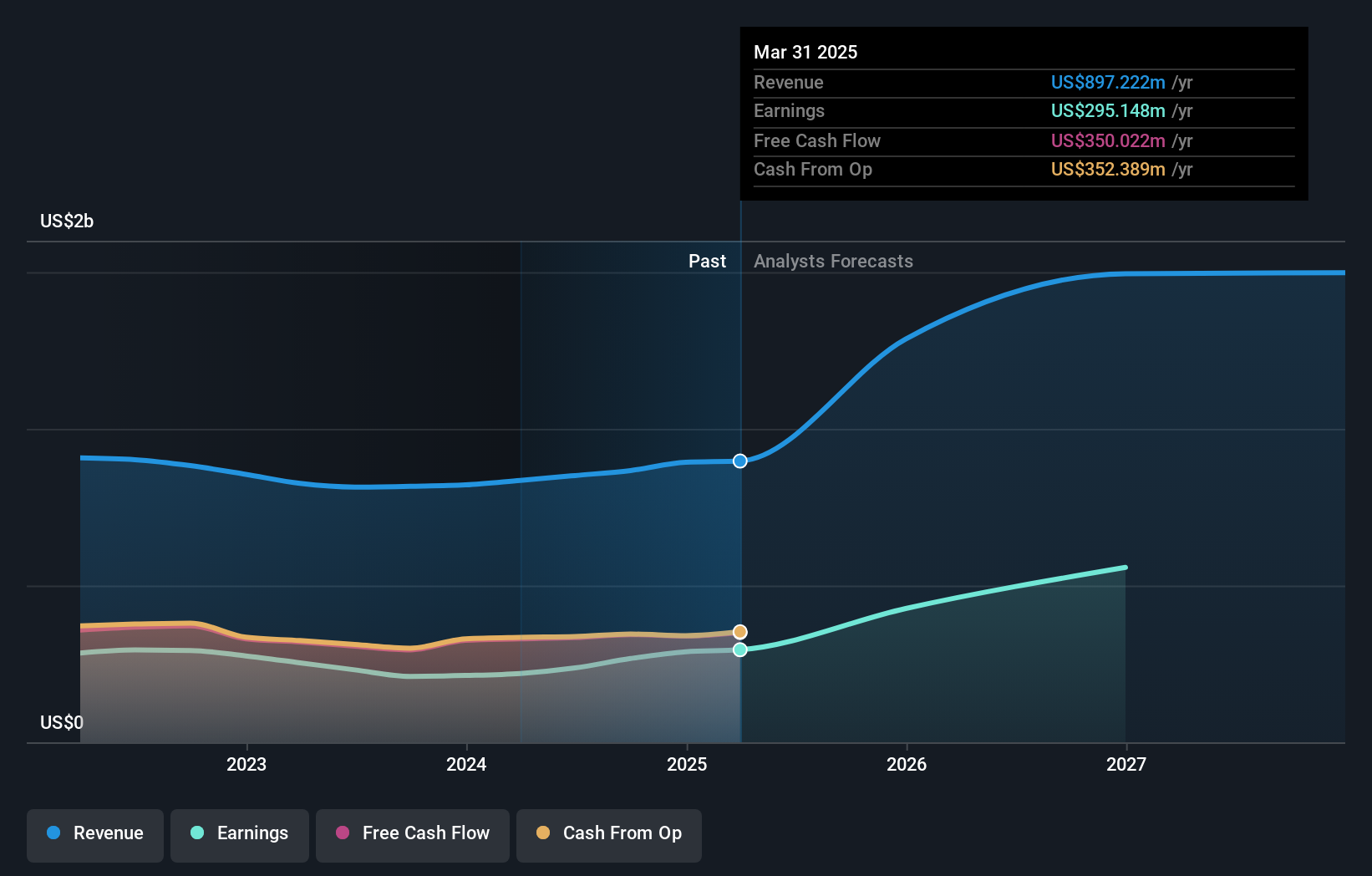

Victory Capital Holdings (NasdaqGS:VCTR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Victory Capital Holdings, Inc. operates as an asset management company both in the United States and internationally, with a market cap of approximately $3.74 billion.

Operations: The company's revenue is primarily derived from providing investment management services and products, totaling $893.48 million.

Insider Ownership: 10%

Return On Equity Forecast: 38% (2027 estimate)

Victory Capital Holdings shows promising growth with earnings expected to rise significantly at 28.4% annually, surpassing the US market average. The stock trades at a good value compared to peers and is priced below fair value estimates, with analysts predicting a 25.5% price increase. Despite high debt levels, recent strategic moves include board changes and acquisition plans to enhance shareholder returns, supported by strong financial performance in 2024 with net income reaching US$288.86 million.

- Take a closer look at Victory Capital Holdings' potential here in our earnings growth report.

- The valuation report we've compiled suggests that Victory Capital Holdings' current price could be quite moderate.

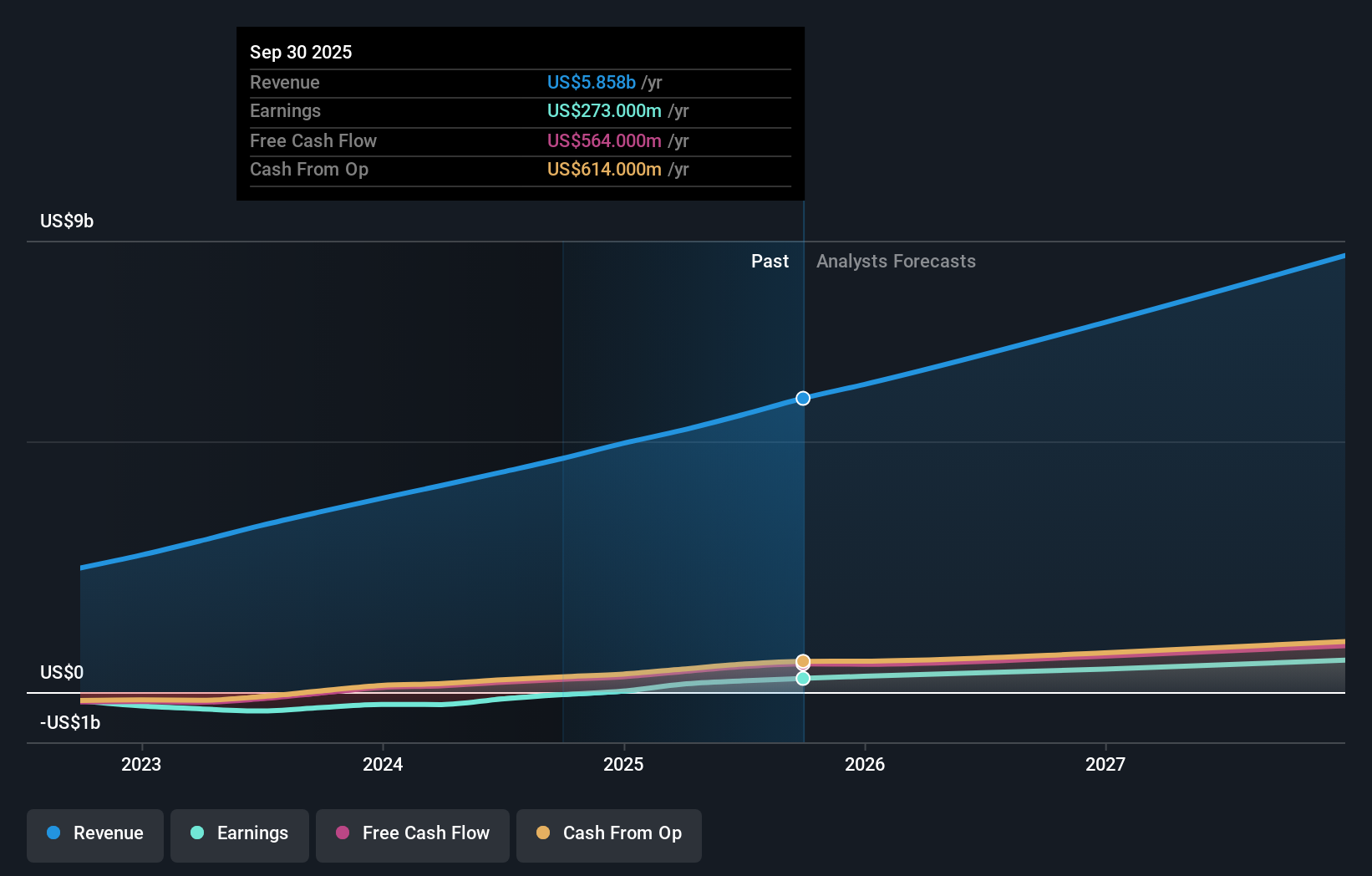

Toast (NYSE:TOST)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Toast, Inc. provides a cloud-based digital technology platform for the restaurant industry across various countries, with a market cap of approximately $19.72 billion.

Operations: The company's revenue segment includes Data Processing, generating $4.96 billion.

Insider Ownership: 19.9%

Return On Equity Forecast: 24% (2027 estimate)

Toast's recent agreement with Applebee's to implement its technology highlights its growth trajectory and potential for increased market penetration. Despite significant insider selling in the past quarter, the company remains focused on expansion, evidenced by a substantial increase in revenue from US$3.87 billion to US$4.96 billion year-over-year and achieving profitability with a net income of US$19 million. Analysts forecast Toast's earnings to grow at 38.1% annually, outpacing market averages significantly.

- Delve into the full analysis future growth report here for a deeper understanding of Toast.

- Our expertly prepared valuation report Toast implies its share price may be too high.

Key Takeaways

- Embark on your investment journey to our 201 Fast Growing US Companies With High Insider Ownership selection here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VCTR

Victory Capital Holdings

Operates as an asset management company in the United States and internationally.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives