Stock Analysis

- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TBLA

3 High Insider Ownership US Stocks With Up To 20% Revenue Growth

Reviewed by Simply Wall St

The U.S. stock market has recently experienced a notable surge, buoyed by a tech sector recovery, robust earnings reports, and positive inflation data that may lead to anticipated interest rate cuts by the Federal Reserve. In this climate, investors might consider the potential stability and growth prospects of companies with high insider ownership and significant revenue growth.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 25.2% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.6% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 34% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 39% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

Underneath we present a selection of stocks filtered out by our screen.

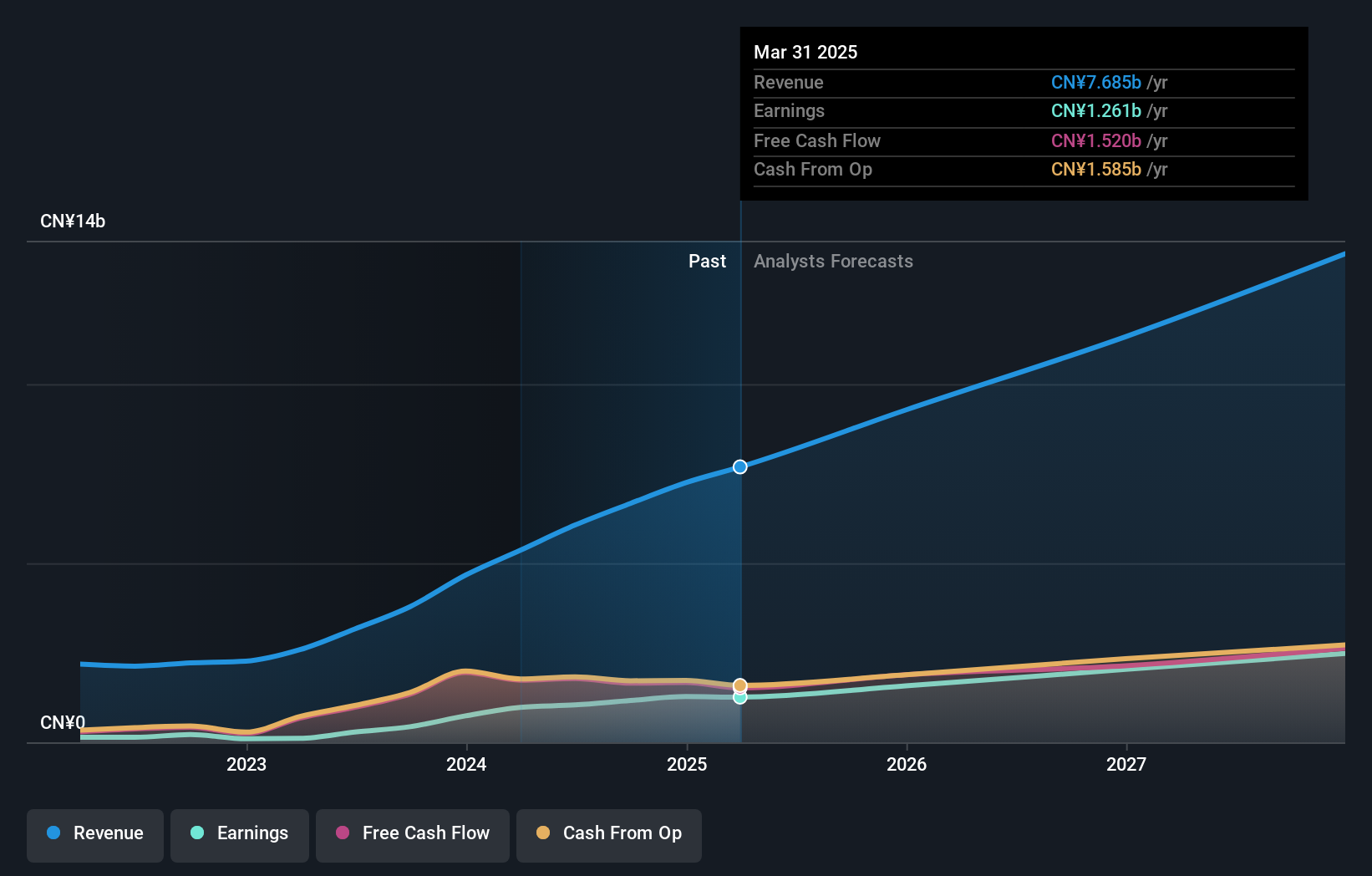

Atour Lifestyle Holdings (NasdaqGS:ATAT)

Simply Wall St Growth Rating: ★★★★★★

Overview: Atour Lifestyle Holdings Limited operates in the People's Republic of China, focusing on developing lifestyle brands centered around its hotel offerings, with a market capitalization of approximately $2.31 billion.

Operations: The company generates revenue primarily from its Atour Group segment, which reported earnings of CN¥5.36 billion.

Insider Ownership: 26%

Revenue Growth Forecast: 20.3% p.a.

Atour Lifestyle Holdings has shown robust financial performance, with a significant increase in net income and revenue in the first quarter of 2024. The company's revenue growth is projected to outpace the US market significantly, suggesting strong future potential. Recent executive changes and a successful equity offering indicate strategic adjustments and capital strengthening. However, shareholder dilution over the past year poses a concern despite high insider ownership which aligns management with shareholder interests.

- Dive into the specifics of Atour Lifestyle Holdings here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Atour Lifestyle Holdings is trading behind its estimated value.

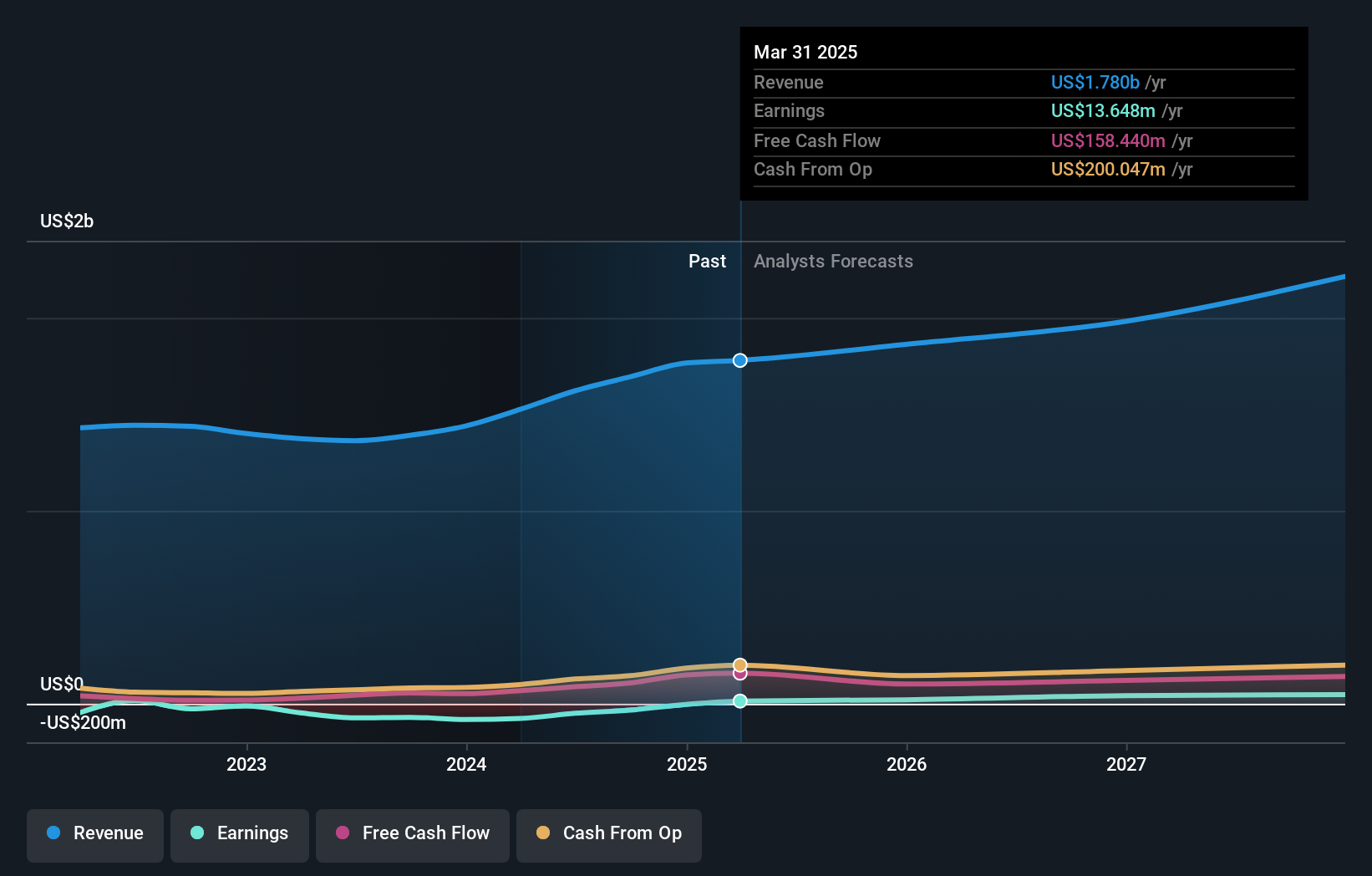

Taboola.com (NasdaqGS:TBLA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Taboola.com Ltd. operates a global artificial intelligence-driven algorithmic engine platform, with a market capitalization of approximately $1.10 billion.

Operations: The company generates revenue primarily through its advertising segment, which brought in $1.53 billion.

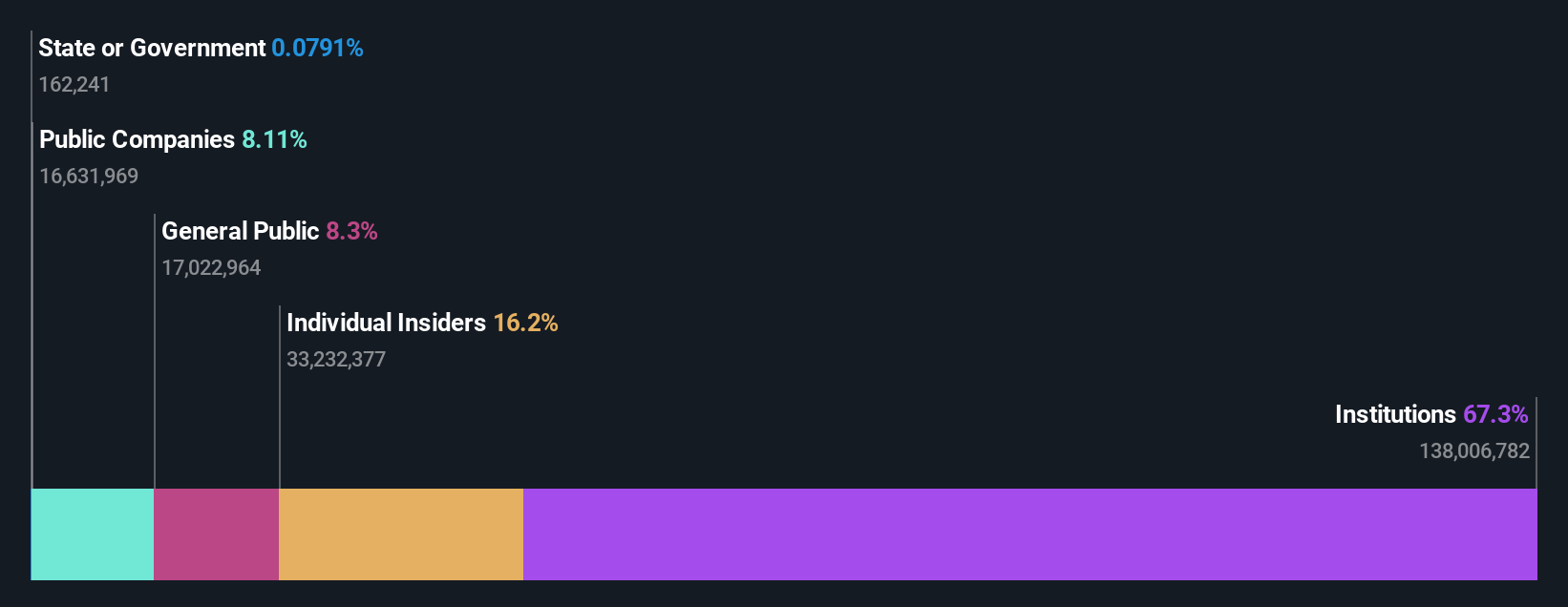

Insider Ownership: 13.1%

Revenue Growth Forecast: 14.5% p.a.

Taboola.com has recently launched 'Taboola for Audience,' an AI-driven platform enhancing publisher traffic amidst evolving digital landscapes. This innovation follows their strategic partnership with Foundry to optimize engagement across global digital properties. Financially, Taboola anticipates a revenue between US$410 million and US$440 million for Q2 2024, aiming for annual revenues up to US$1.94 billion. Despite a net loss in Q1 2024, revenue growth outpaces the market, with profitability expected within three years, underscoring potential amidst high insider ownership without substantial recent trading by insiders.

- Click here to discover the nuances of Taboola.com with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Taboola.com's current price could be quite moderate.

Spotify Technology (NYSE:SPOT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Spotify Technology S.A. operates globally, offering audio streaming subscription services with a market capitalization of approximately $67.58 billion.

Operations: The company generates revenue primarily through two segments: Premium services at €12.68 billion and Ad-Supported services at €1.79 billion.

Insider Ownership: 17.8%

Revenue Growth Forecast: 12% p.a.

Spotify Technology recently turned profitable, with a significant Q2 earnings jump to €274 million from a prior loss, on sales of €3.81 billion. This growth aligns with forecasts predicting robust annual earnings increases and revenue growth outpacing the US market average. Despite dropping from certain indices, Spotify was added to the Russell Top 200 Growth Index, reflecting its potential in a competitive landscape. However, recent shareholder dilution and absence of insider trading may temper investor enthusiasm.

- Get an in-depth perspective on Spotify Technology's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Spotify Technology's shares may be trading at a premium.

Taking Advantage

- Delve into our full catalog of 183 Fast Growing US Companies With High Insider Ownership here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Taboola.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TBLA

Taboola.com

Operates an artificial intelligence-based algorithmic engine platform in Israel, the United States, the United Kingdom, Germany, and internationally.

Very undervalued with excellent balance sheet.