- United States

- /

- Hospitality

- /

- NasdaqGS:ABNB

How Investors Are Reacting To Airbnb (ABNB) Expanding Deeper Into the Hotel Booking Market

Reviewed by Sasha Jovanovic

- In recent weeks, Airbnb has accelerated its expansion into the global hotel sector, recruiting for hotel-focused roles across the U.S., Europe, and Africa and onboarding boutique and independent hotels onto its platform leveraging HotelTonight's infrastructure. This marks an important evolution in Airbnb's business, as the company seeks to diversify beyond home-sharing and attract new user segments through broader accommodation offerings.

- This deliberate push beyond traditional home rentals underscores Airbnb's ambition to become a comprehensive travel platform and signals its response to shifting travel behaviors and expansionary goals.

- We'll now explore how Airbnb's push into global hotels shapes its investment narrative and long-term market positioning.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Airbnb Investment Narrative Recap

To be a shareholder in Airbnb, you have to believe that the company can successfully evolve from a pure home-sharing platform to a broader travel ecosystem, capturing growth from new user segments and international expansion. While Airbnb’s push into the global hotel sector could act as a short-term catalyst by expanding listings and market share, it does not materially address the biggest immediate risk: intensifying regulatory scrutiny in key urban markets.

Among recent announcements, the upcoming Q3 2025 earnings release on November 6 is particularly relevant, as it will provide insight into how Airbnb’s hotel expansion and diversification efforts are translating into financial results. Investors may look for early signs of increased bookings or revenue contributions from the hotel vertical as a measure of progress on this new growth initiative.

In contrast, investors should also be aware that mounting regulatory pressures in major cities could...

Read the full narrative on Airbnb (it's free!)

Airbnb's outlook projects $15.4 billion in revenue and $3.7 billion in earnings by 2028. This is based on a 10.0% annual revenue growth rate and an earnings increase of $1.1 billion from the current $2.6 billion.

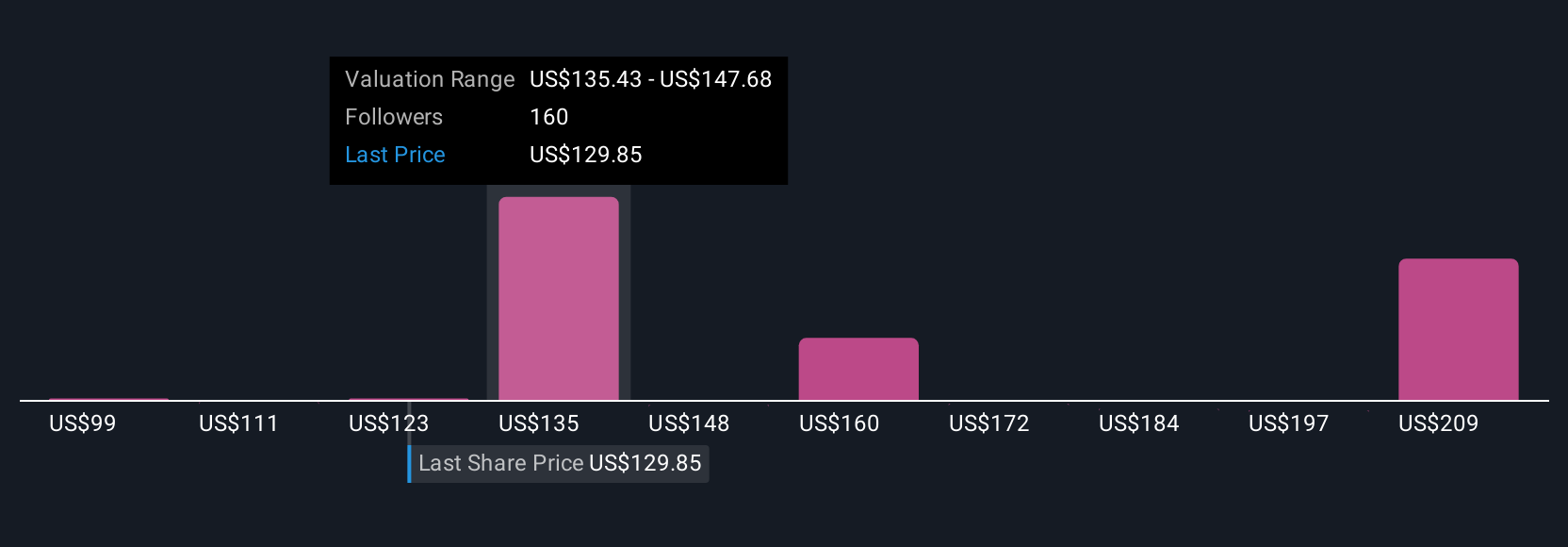

Uncover how Airbnb's forecasts yield a $138.12 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Before this recent hotel expansion, the most optimistic analysts expected Airbnb’s annual revenue to reach US$16.5 billion and earnings of US$4.3 billion by 2028. Their view is that global growth and diversified offerings could drive much faster gains than consensus. As this news unfolds, your own outlook may shift, so be open to both the upbeat and more cautious perspectives you’ll find in the next section.

Explore 33 other fair value estimates on Airbnb - why the stock might be worth as much as 75% more than the current price!

Build Your Own Airbnb Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Airbnb research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Airbnb research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Airbnb's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABNB

Airbnb

Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives