- United States

- /

- Food and Staples Retail

- /

- NYSE:TGT

Target (NYSE:TGT) Expands TRUBARTM Distribution Across U.S. With Simply Better Brands

Reviewed by Simply Wall St

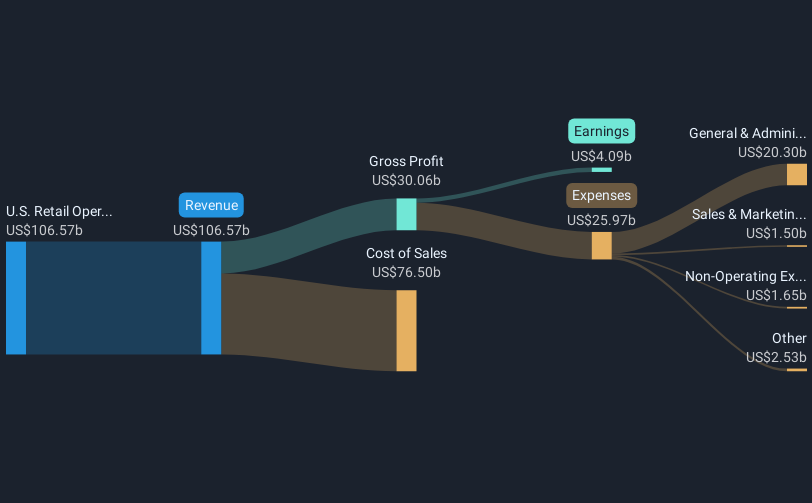

Simply Better Brands Corp. began offering its TRUBARTM line in select Target (NYSE:TGT) stores across the country, reflecting the brand’s ongoing expansion. During the past week, Target's stock performance was largely flat, moving in line with broader market trends. Market movements showed positive sentiment influenced by gains in banks and tech stocks, while U.S.-China trade tensions exerted some pressure. Meanwhile, Target's association with new product offerings from Simply Better Brands and ButcherBox on its platforms could add value but didn't significantly shift the share price during the period analyzed. Overall, these developments contributed to stability amid broader market gains.

Every company has risks, and we've spotted 2 risks for Target you should know about.

Target's collaboration with Simply Better Brands and ButcherBox, as discussed in the introduction, could enhance consumer engagement, potentially leading to increased foot traffic and online sales, thus contributing to revenue growth. However, the broader impact on Target's overall financial performance remains uncertain as recent share price movements have not yet reflected significant shifts from these initiatives.

Over the five-year period, Target's total return, including dividends, was a 2.22% decline, underscoring the challenges it faces. In comparison, over the past year, Target underperformed the Consumer Retailing industry, which returned 33.5%, and the US Market, which saw a return of 5.9%, highlighting Target's relative struggles in the more immediate timeframe.

The new product offerings align with Target's strategy to leverage digital and loyalty programs for future revenue and earnings growth. Analysts forecast a moderate revenue increase and gradual margin improvement. Yet, economic uncertainty and reliance on discretionary spending pose potential risks to these forecasts. Current share price stability might reflect investor caution, despite a consensus price target of US$133.97, indicating a potential upside compared to the current US$88.76 per share.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Target, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Target might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TGT

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives