- United States

- /

- Real Estate

- /

- NYSE:MMI

Top Growth Companies With Significant Insider Ownership October 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape marked by strong bank earnings and ongoing trade tensions with China, investors are seeking stability amidst volatility. In this environment, growth companies with significant insider ownership can be appealing due to their potential alignment of interests between management and shareholders, offering a sense of confidence in uncertain times.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Prairie Operating (PROP) | 31.3% | 86.6% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.2% | 67.4% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.1% | 30.3% |

| Celsius Holdings (CELH) | 10.8% | 32.1% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.5% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

Here we highlight a subset of our preferred stocks from the screener.

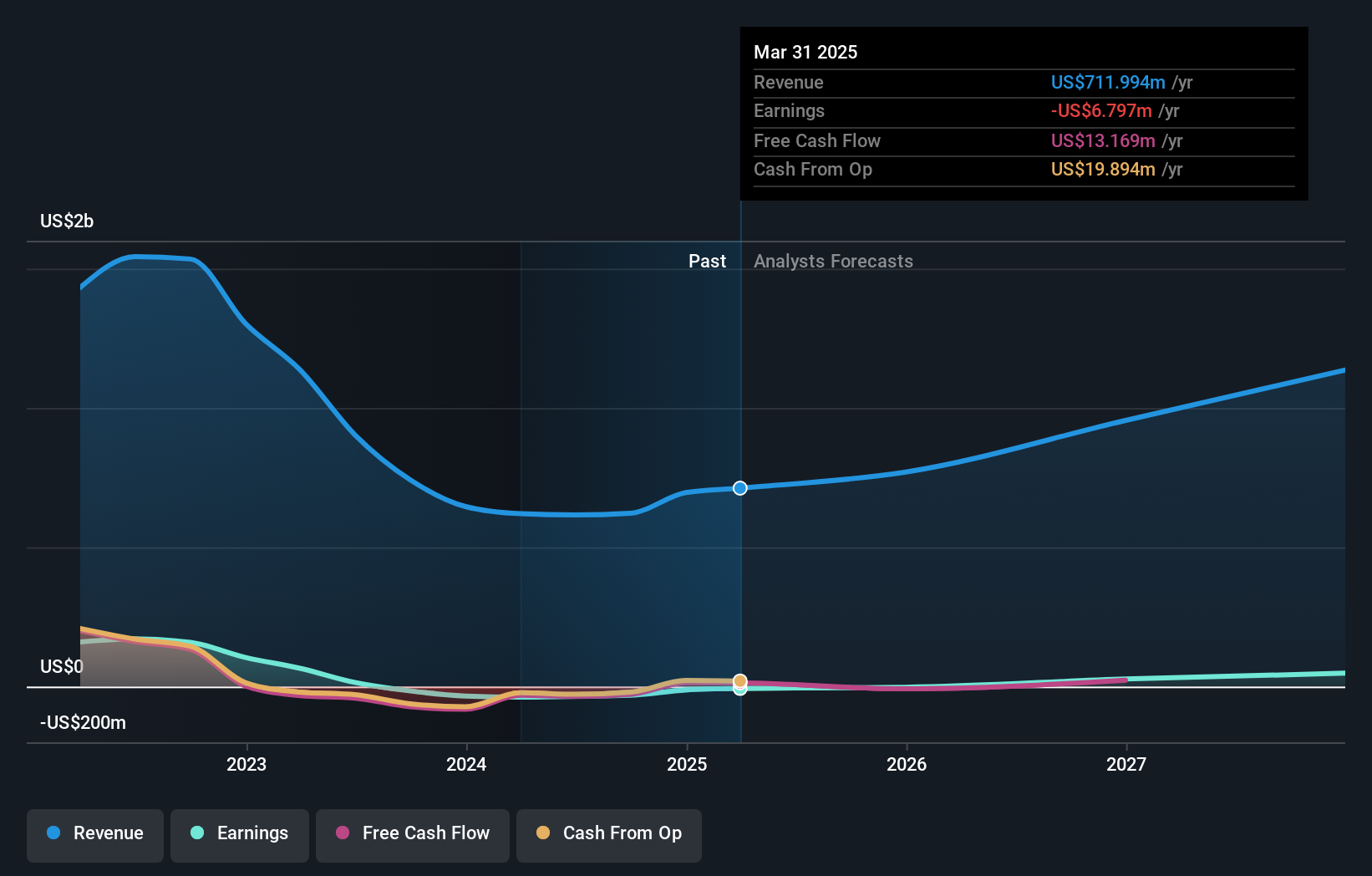

Westrock Coffee (WEST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Westrock Coffee Company, LLC operates as an integrated provider of coffee, tea, flavors, extracts, and ingredient solutions both in the United States and internationally with a market cap of $421.45 million.

Operations: The company's revenue segments include Beverage Solutions, generating $710.96 million, and Sustainable Sourcing & Traceability, contributing $247.63 million.

Insider Ownership: 14.5%

Westrock Coffee is experiencing robust revenue growth, forecasted at 17.1% annually, outpacing the US market average. Despite a current net loss, the company is expected to become profitable within three years. Insider activity shows more buying than selling recently, indicating confidence in future prospects. The expansion of its manufacturing capabilities with a new facility in Arkansas aligns with increasing global demand for single-serve coffee products and positions Westrock for continued growth in this lucrative market segment.

- Navigate through the intricacies of Westrock Coffee with our comprehensive analyst estimates report here.

- The analysis detailed in our Westrock Coffee valuation report hints at an deflated share price compared to its estimated value.

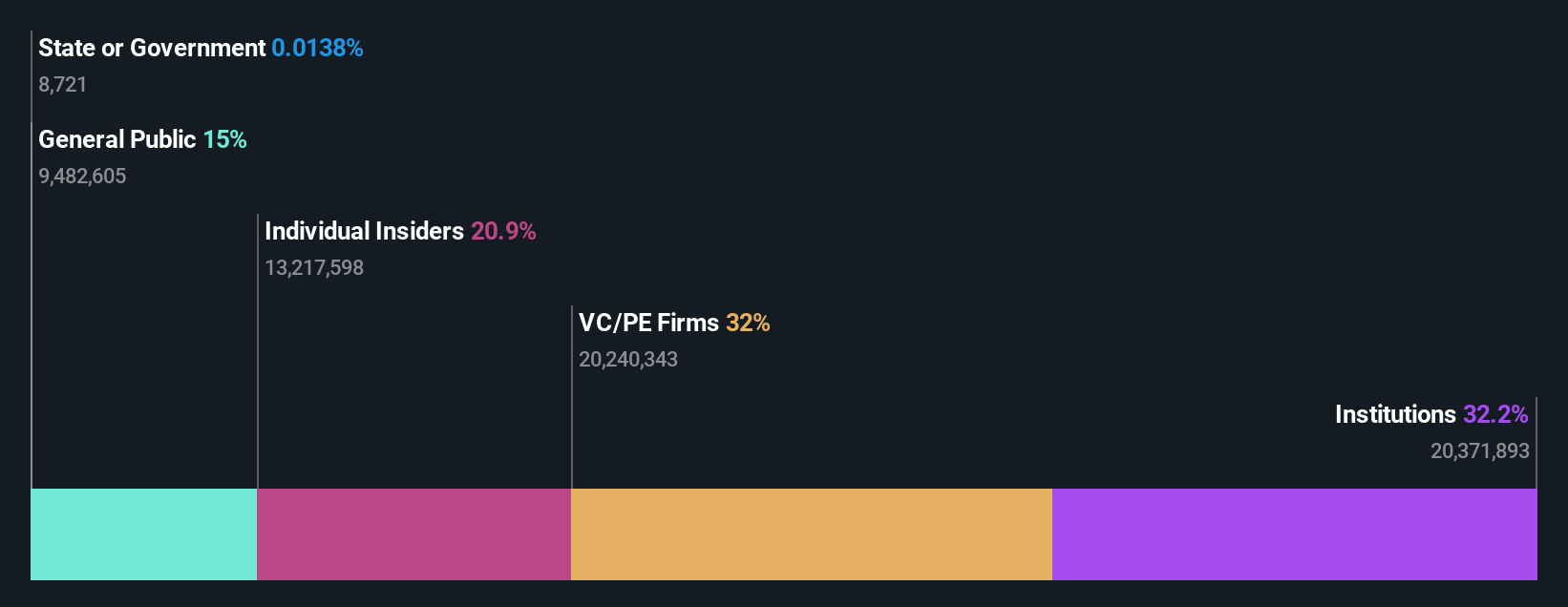

Guardian Pharmacy Services (GRDN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guardian Pharmacy Services, Inc. is a pharmacy service company that offers technology-enabled services to support residents of long-term health care facilities in the United States, with a market cap of approximately $1.48 billion.

Operations: The company's revenue is primarily derived from its Pharmaceutical and Medical Products segment, which generated $1.33 billion.

Insider Ownership: 20.9%

Guardian Pharmacy Services is experiencing significant growth, with recent revenue guidance raised to US$1.39 billion - US$1.41 billion for 2025, reflecting strong performance. Despite slower forecasted revenue growth of 6.2% annually compared to the broader market, earnings are expected to grow at a robust 78.78% per year, indicating profitability within three years. Recent inclusion in the S&P Retail Select Industry Index highlights its expanding footprint, while strategic acquisitions continue to bolster its growth trajectory.

- Delve into the full analysis future growth report here for a deeper understanding of Guardian Pharmacy Services.

- The valuation report we've compiled suggests that Guardian Pharmacy Services' current price could be inflated.

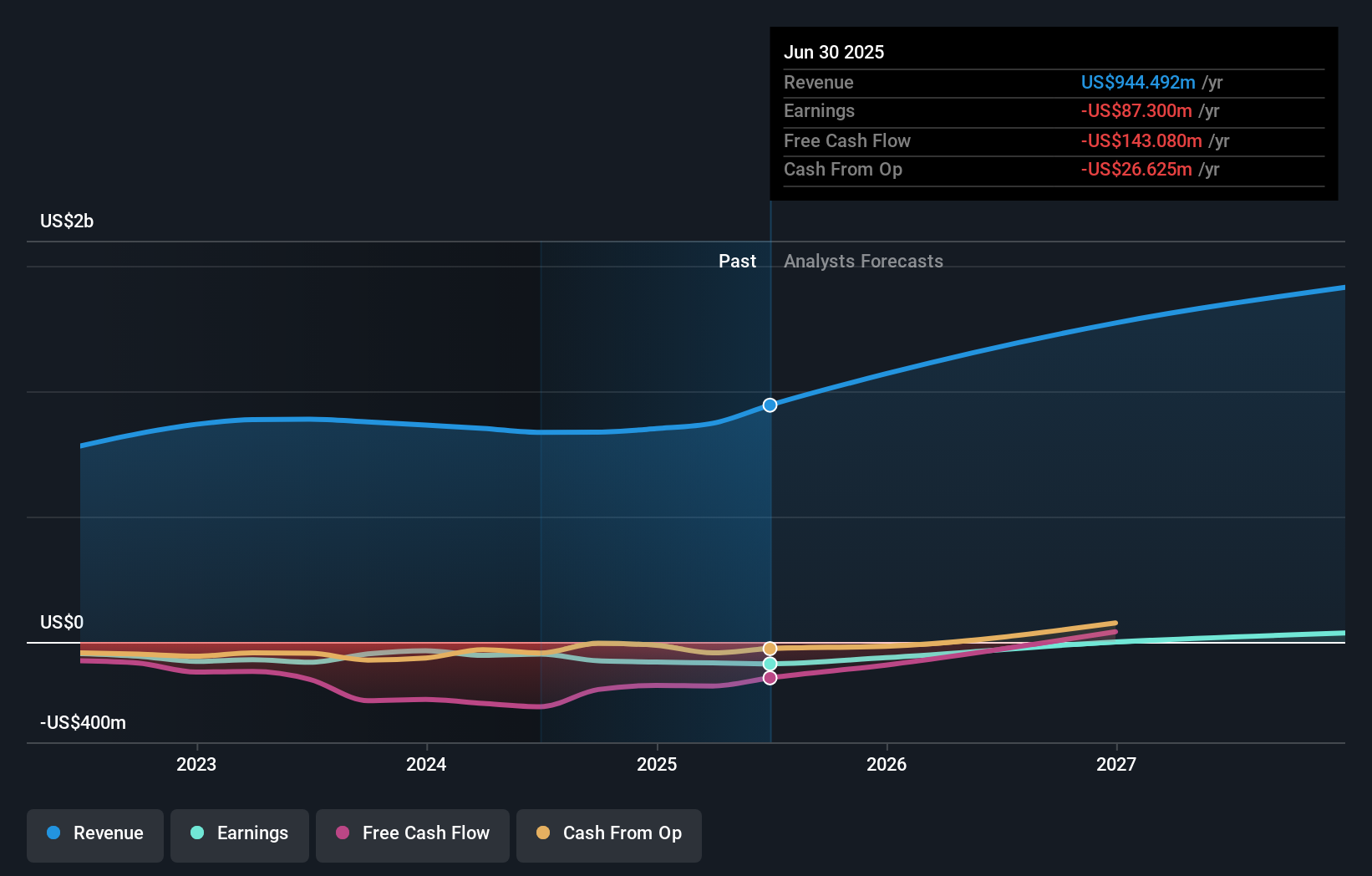

Marcus & Millichap (MMI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Marcus & Millichap, Inc. is an investment brokerage company offering real estate investment brokerage and financing services to commercial real estate buyers and sellers in the United States and Canada, with a market cap of approximately $1.07 billion.

Operations: The company generates revenue primarily through the delivery of commercial real estate services, amounting to $725.90 million.

Insider Ownership: 37.5%

Marcus & Millichap is poised for growth with insider buying activity and a forecasted revenue increase of 17.7% annually, outpacing the US market. Despite recent losses, earnings are expected to grow by 110.8% per year, potentially achieving profitability within three years. The company actively seeks acquisitions to expand its platform and has repurchased shares worth $76.45 million since August 2022, demonstrating commitment to shareholder value amidst ongoing strategic presentations and discussions on potential acquisitions.

- Get an in-depth perspective on Marcus & Millichap's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Marcus & Millichap is priced higher than what may be justified by its financials.

Summing It All Up

- Gain an insight into the universe of 200 Fast Growing US Companies With High Insider Ownership by clicking here.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMI

Marcus & Millichap

An investment brokerage company, provides real estate investment brokerage and financing services to sellers and buyers of commercial real estate in the United States and Canada.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives