- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:DLTR

Dollar Tree (NasdaqGS:DLTR) Appoints Roxanne Weng As New Chief Supply Chain Officer

Reviewed by Simply Wall St

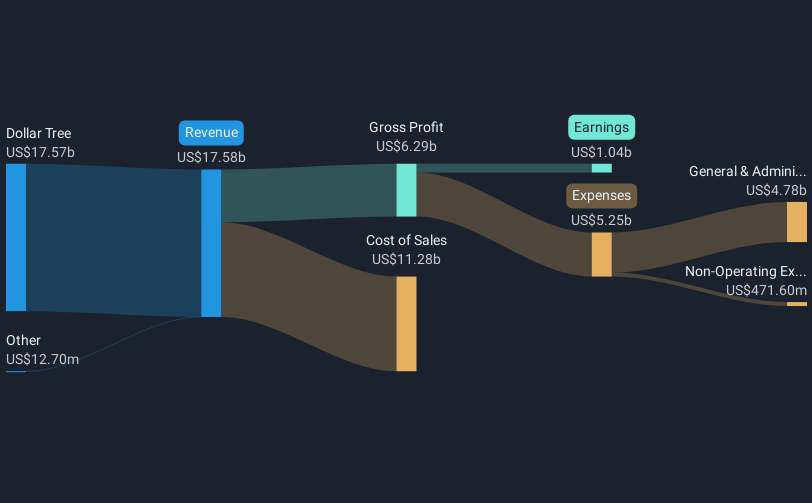

Dollar Tree (NasdaqGS:DLTR) recently announced a change in supply chain leadership, promoting Roxanne Weng to the role of Chief Supply Chain Officer. Additionally, the company outlined plans to build a new distribution center in Marietta, OK. Despite a broader downturn in the stock market, with the Dow Jones and S&P 500 experiencing declines, Dollar Tree’s 11% rise over the last month stands out. These organizational changes and growth plans may have supported this price movement, countering the general market trends, particularly as tech stocks faced downward pressure during the same period.

We've identified 1 possible red flag for Dollar Tree that you should be aware of.

The recent promotion of Roxanne Weng and the establishment of a new distribution center in Marietta, OK, may have significant implications for Dollar Tree's supply chain and operational efficiency. These changes could bolster the narrative by potentially improving logistics and distribution processes, which may enhance revenue and streamline costs. Although the broader market faces pressure, these developments might support the company's projected revenue growth and contribute to expected earnings improvements, which analysts forecast to increase by 6.3% per year.

Looking at the longer-term context, Dollar Tree's total shareholder return, including both share price and dividends, was 3.53% over the past five years. This moderate performance contrasts with a downturn against the broader market over the last year, where Dollar Tree underperformed the US Consumer Retailing industry, which saw a rise. This underperformance may indicate challenges in capturing market gains during periods when industry peers advanced.

The recent share price increase of 11% over the last month, potentially driven by organizational changes and growth plans, has brought the stock closer to the analyst consensus price target of US$83.71. With a current share price of around US$82.16, the close alignment suggests that the market perceives Dollar Tree as nearly fairly valued based on earnings and revenue expectations for the coming years. Investors should consider these nuanced elements of revenue and operational enhancements in context with broader market dynamics when evaluating Dollar Tree's future potential.

Explore historical data to track Dollar Tree's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DLTR

Dollar Tree

Operates retail discount stores under the Dollar Tree and Dollar Tree Canada brands in the United States and Canada.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives