- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:CASY

Does Casey's General Stores (NASDAQ:CASY) Deserve A Spot On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Casey's General Stores (NASDAQ:CASY). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Casey's General Stores

How Quickly Is Casey's General Stores Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. Over the last three years, Casey's General Stores has grown EPS by 14% per year. That's a good rate of growth, if it can be sustained.

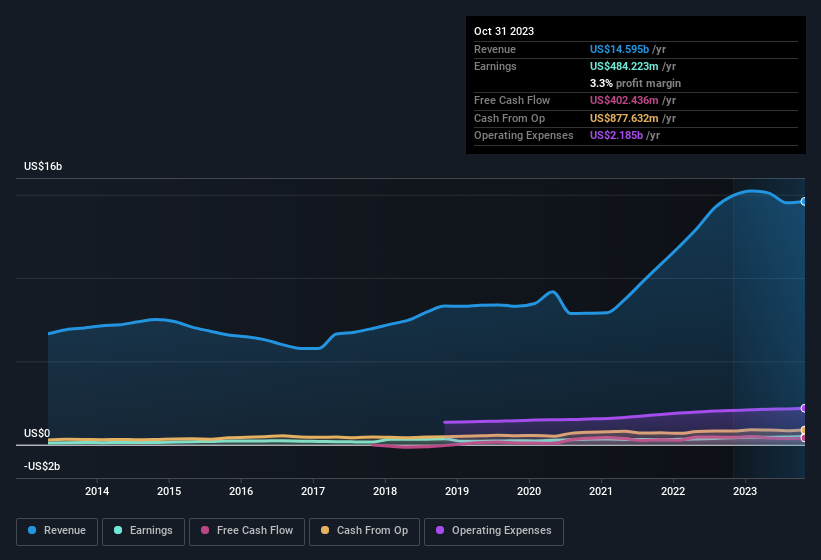

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Despite consistency in EBIT margins year on year, Casey's General Stores has actually recorded a dip in revenue. Suffice it to say that is not a great sign of growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Casey's General Stores' future profits.

Are Casey's General Stores Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$11b company like Casey's General Stores. But we do take comfort from the fact that they are investors in the company. Given insiders own a significant chunk of shares, currently valued at US$52m, they have plenty of motivation to push the business to succeed. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations over US$8.0b, like Casey's General Stores, the median CEO pay is around US$12m.

Casey's General Stores offered total compensation worth US$11m to its CEO in the year to April 2023. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Does Casey's General Stores Deserve A Spot On Your Watchlist?

As previously touched on, Casey's General Stores is a growing business, which is encouraging. Earnings growth might be the main attraction for Casey's General Stores, but the fun does not stop there. Boasting both modest CEO pay and considerable insider ownership, you'd argue this one is worthy of the watchlist, at least. Of course, just because Casey's General Stores is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CASY

Casey's General Stores

Operates convenience stores under the Casey's and Casey’s General Store names.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives