- United States

- /

- Machinery

- /

- NYSE:WOR

Worthington Enterprises (NYSE:WOR) Eyes Growth with M&A Initiatives Amid Revenue Challenges

Reviewed by Simply Wall St

See the full analysis report here for a deeper understanding of Worthington Enterprises.

Core Advantages Driving Sustained Success for Worthington Enterprises

Worthington Enterprises demonstrates strong financial health, with expected annual profit growth forecasted at 44.7%, significantly outpacing the US market average of 15.4%. This growth potential is underpinned by a satisfactory net debt to equity ratio of 13.4%, reflecting prudent financial management. The company's solid balance sheet is further evidenced by a net debt to trailing EBITDA leverage ratio of approximately 0.5 turn, complemented by a $500 million undrawn bank credit facility, as highlighted by CFO Joseph Hayek. Additionally, substantial insider buying signals management's confidence in the company's trajectory. Worthington's market-leading products and brands, as noted by CEO Andy Rose, position it well to capitalize on long-term secular trends and a favorable interest rate environment.

Vulnerabilities Impacting Worthington Enterprises

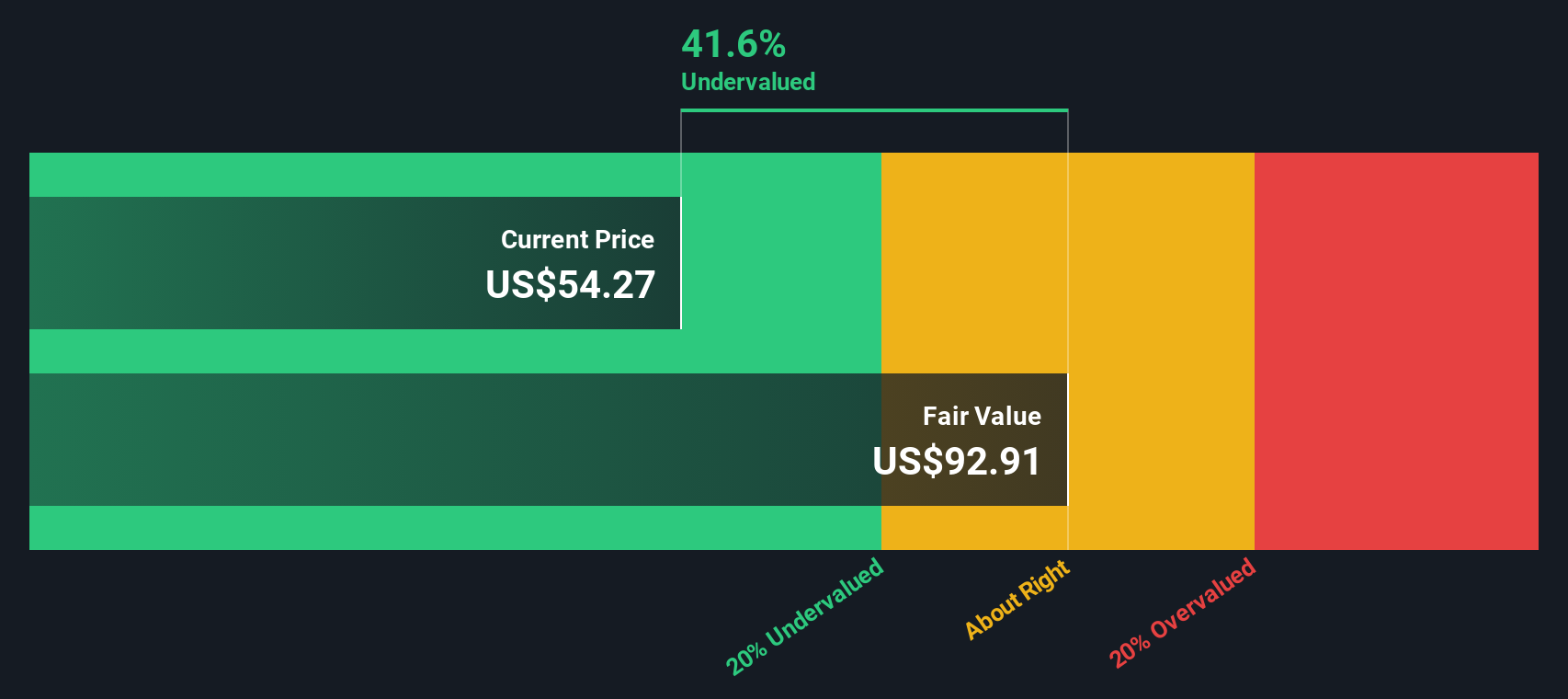

However, Worthington faces challenges with its revenue growth, projected at only 1.1% per year, which is below the market average of 8.9%. The company has experienced a 17.1% decline in earnings annually over the past five years, reflecting operational inefficiencies. The Building Products segment, in particular, has struggled, with net sales dropping by 16% and a significant decrease in adjusted EBITDA margin from 36% to 28.4%. Additionally, the dividend payout ratio of 138.8% suggests dividends are not well supported by earnings. These financial strains are compounded by the company's high Price-To-Earnings Ratio of 73x, which, despite trading below its estimated fair value of $60.67, indicates it is expensive relative to industry peers.

Potential Strategies for Leveraging Growth and Competitive Advantage

Opportunities for Worthington include enhancing its M&A pipeline and innovation capabilities, as emphasized by Andy Rose. By acquiring companies aligned with its strategic goals, Worthington aims to bolster its market position and product offerings. The company is optimistic about its long-term outlook, supported by steady business segments and improving markets. Furthermore, a potential 50 basis point decline in interest rates could stimulate consumer spending, benefiting Worthington's product sales. The target price set by analysts, which is over 20% higher than the current share price, suggests room for price appreciation.

External Factors Threatening Worthington Enterprises

Nonetheless, macroeconomic uncertainty and steel price volatility pose significant threats. Fluctuating steel prices, as noted by Andy Rose, can compress margins and challenge competitive positioning, particularly affecting the ClarkDietrich segment. Additionally, Worthington faces competitive pressures from smaller regional players who can leverage spot market advantages. The company's financial results are further impacted by large one-off losses, which detract from overall earnings quality. These external factors underscore the need for strategic agility in navigating a complex market environment.

Conclusion

Worthington Enterprises presents a compelling growth narrative with a projected annual profit increase of 44.7%, supported by a solid financial foundation, including a low net debt to equity ratio and substantial liquidity. However, the company faces significant challenges, such as stagnant revenue growth and operational inefficiencies, particularly in its Building Products segment, which could hinder its ability to sustain high earnings growth. The current share price, trading below its estimated fair value of $60.67, suggests potential for appreciation, yet the high Price-To-Earnings Ratio of 73x relative to industry peers raises concerns about its premium valuation. Moving forward, strategic initiatives such as enhancing M&A activities and capitalizing on favorable interest rate conditions could bolster Worthington's market position, but macroeconomic uncertainties and competitive pressures necessitate agile management to navigate these complexities effectively.

Summing It All Up

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

If you're looking to trade Worthington Enterprises, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Worthington Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:WOR

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives