- United States

- /

- Capital Markets

- /

- NasdaqGS:TRIN

Exploring Undervalued Small Caps With Insider Action In November 2025

Reviewed by Simply Wall St

As the U.S. market navigates the complexities of a government shutdown and fluctuating indices, with the Dow Jones Industrial Average reaching new heights while the Nasdaq experiences slight declines, investor attention is increasingly turning to small-cap stocks. In this environment, identifying promising small-cap opportunities often involves looking at companies with strong fundamentals and insider activity that may signal confidence in their potential for growth amidst broader market volatility.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Merchants Bancorp | 7.5x | 2.5x | 49.40% | ★★★★★★ |

| Hanmi Financial | 11.1x | 3.2x | 31.77% | ★★★★★☆ |

| PCB Bancorp | 9.0x | 2.9x | 29.11% | ★★★★★☆ |

| Ellington Financial | 11.7x | 4.5x | 33.38% | ★★★★★☆ |

| Peoples Bancorp | 10.2x | 1.9x | 45.21% | ★★★★★☆ |

| S&T Bancorp | 11.2x | 3.8x | 38.59% | ★★★★☆☆ |

| Farmland Partners | 6.4x | 7.9x | -39.24% | ★★★★☆☆ |

| Citizens & Northern | 12.8x | 3.2x | 45.36% | ★★★☆☆☆ |

| CNB Financial | 17.1x | 3.2x | 48.38% | ★★★☆☆☆ |

| Shore Bancshares | 9.6x | 2.6x | -53.65% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

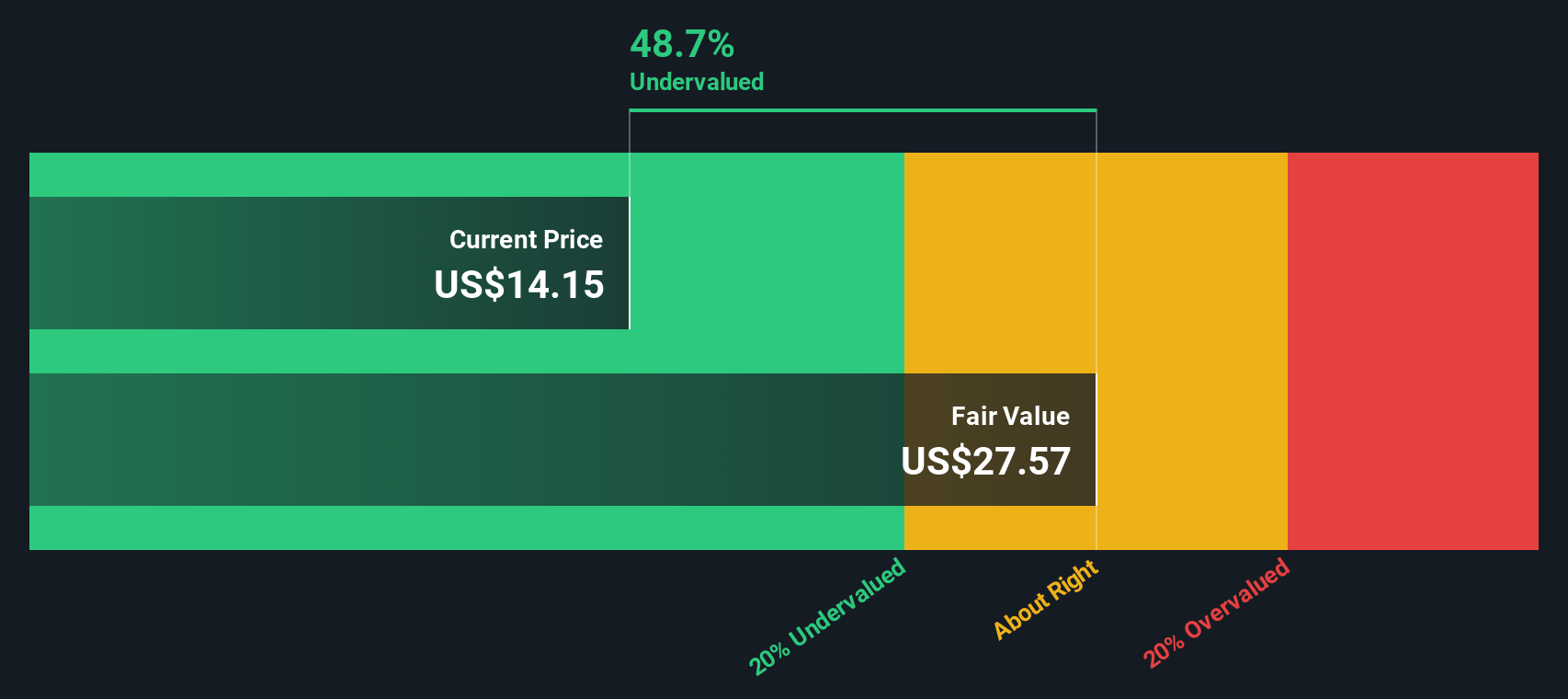

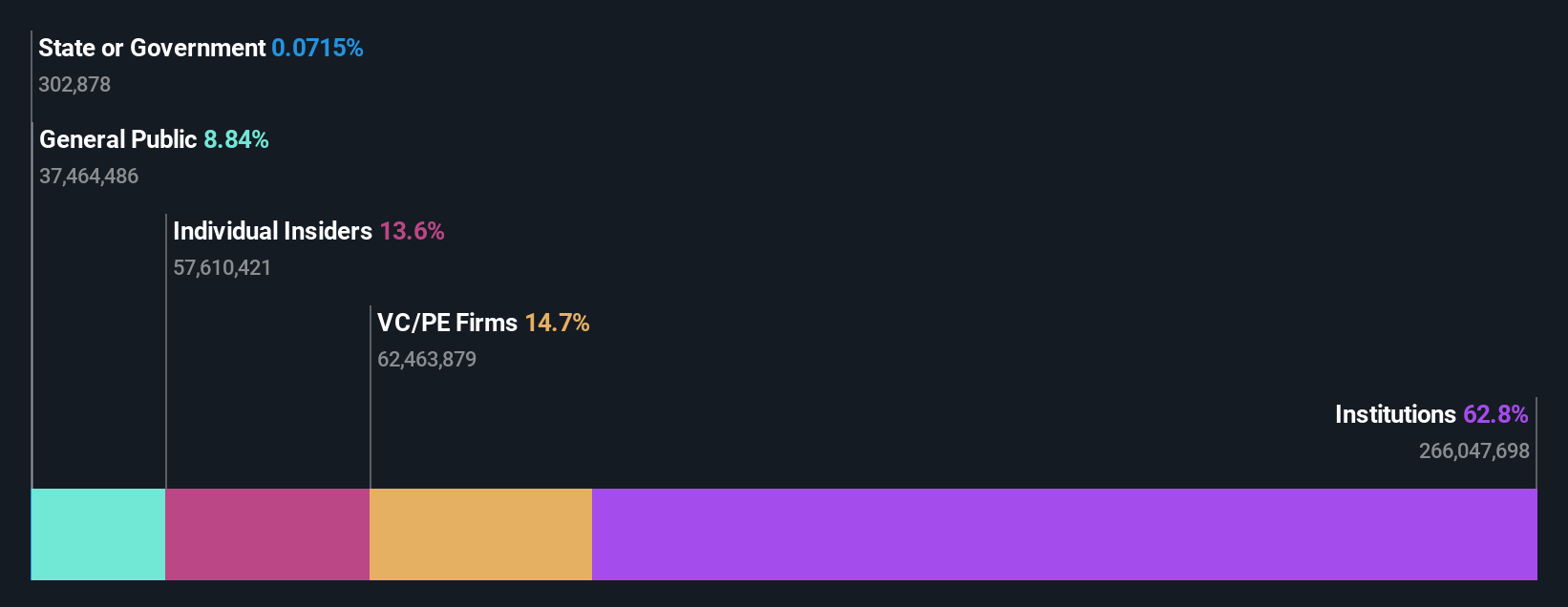

Trinity Capital (TRIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Trinity Capital is a financial services company specializing in providing venture capital and financing solutions, with a market capitalization of $0.76 billion.

Operations: The primary revenue stream is derived from venture capital activities, with the latest reported revenue at $268.27 million. Operating expenses have shown a gradual increase over time, reaching $66.34 million in the most recent period. The company consistently achieved a gross profit margin of 100% across all periods analyzed, indicating no cost of goods sold was recorded during this timeframe. Net income margin has fluctuated significantly, peaking at 54.44% and experiencing negative values in earlier periods before stabilizing around 52.93%.

PE: 8.0x

Trinity Capital, a smaller U.S. company, recently reported Q3 revenue of US$75.55 million, up from US$61.77 million the prior year, reflecting growth despite challenges in covering interest payments with earnings. Insider confidence is evident with recent purchases by executives in 2025. The company expanded its credit facility to US$690 million and appointed new directors to drive growth in life sciences and equipment finance sectors across the U.S. and Europe, suggesting strategic positioning for future expansion opportunities.

- Click here to discover the nuances of Trinity Capital with our detailed analytical valuation report.

Gain insights into Trinity Capital's past trends and performance with our Past report.

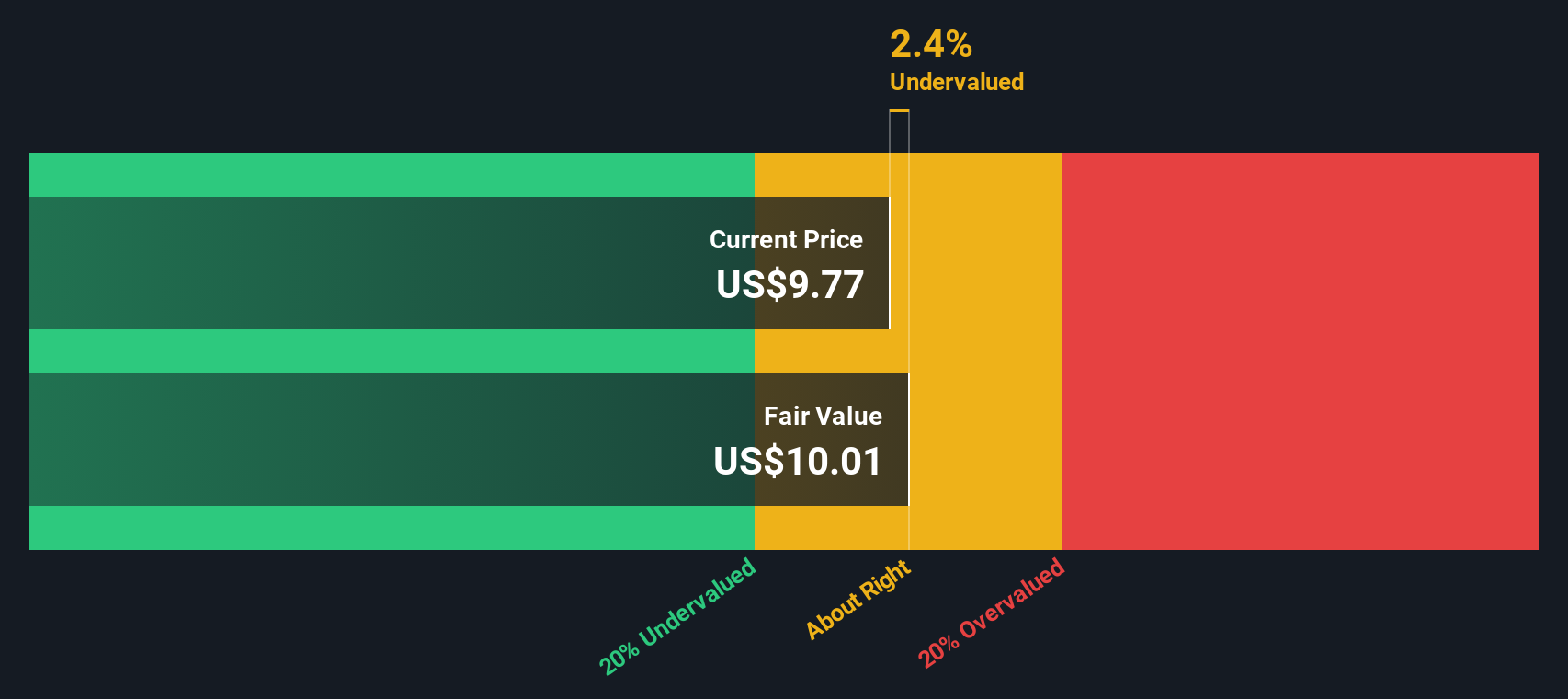

Pebblebrook Hotel Trust (PEB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Pebblebrook Hotel Trust is a real estate investment trust that primarily invests in upscale, full-service hotels and resorts across major urban and resort markets, with a market capitalization of approximately $2.06 billion.

Operations: The company generates revenue primarily from its hotels and motels, with a recent quarterly revenue of $1.46 billion. Its gross profit margin has shown variation, currently at 23.74%. Operating expenses include significant allocations for depreciation and amortization, as well as general and administrative costs.

PE: -9.1x

Pebblebrook Hotel Trust, a player in the hospitality sector, faces challenges with its recent financial performance. For Q3 2025, it reported a net loss of US$33.07 million compared to last year's profit. Despite this, insider confidence is evident with recent stock purchases by company insiders from September 2025 onwards. The company has announced plans to repurchase up to US$150 million of its shares and completed a US$350 million fixed-income offering in September 2025. Although earnings guidance for the year was revised down due to external factors like the federal government shutdown impacting travel demand, there's potential for recovery as earnings are forecasted to grow significantly annually.

Under Armour (UAA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Under Armour is a global athletic apparel and footwear company with operations spanning North America, EMEA, Asia-Pacific, and Latin America.

Operations: Under Armour generates revenue primarily from North America, contributing significantly to its total sales, followed by EMEA and Asia-Pacific regions. The company's cost of goods sold (COGS) has been a major component of expenses, impacting its gross profit margin which was 47.92% in the most recent period. Operating expenses are largely driven by general and administrative costs along with significant investment in sales and marketing efforts.

PE: -23.3x

Under Armour, a smaller company in the U.S. market, recently reported a net loss of US$18.81 million for Q2 2025, contrasting with last year's profit of US$170.38 million. Despite this downturn, insider confidence is evident as they have been purchasing shares over recent months. The upcoming leadership change with Reza Taleghani as CFO in February 2026 could drive strategic shifts, given his successful track record at Samsonite Group S.A., potentially improving financial performance and addressing current challenges like decreasing revenues and high-risk funding sources.

- Navigate through the intricacies of Under Armour with our comprehensive valuation report here.

Understand Under Armour's track record by examining our Past report.

Where To Now?

- Access the full spectrum of 61 Undervalued US Small Caps With Insider Buying by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trinity Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRIN

Trinity Capital

A business development company specializing in term loans, equipment financing, and private equity-related investments.

Undervalued with proven track record.

Market Insights

Community Narratives