- United States

- /

- Consumer Durables

- /

- NYSE:TOL

What Toll Brothers (TOL)'s Luxury Sunbelt Expansion Means For Shareholders

Reviewed by Sasha Jovanovic

- Toll Brothers has recently expanded its luxury footprint with new and upcoming communities across Washington, Florida, Nevada, Georgia, and North Carolina, featuring high-end single-family homes, townhomes, and 55+ active-adult offerings priced from the mid-US$500,000s to the mid-US$900,000s.

- These openings and new phases highlight the company’s focus on amenity-rich, design-customizable communities in supply-constrained, higher-income markets from Seattle’s suburbs to historic St. Augustine.

- With analysts watching earnings closely, we’ll examine how Toll Brothers’ push into amenity-rich, higher-priced communities might influence its investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Toll Brothers Investment Narrative Recap

To own Toll Brothers, you need to believe in ongoing demand for premium, amenity-rich housing and the company’s ability to protect margins despite higher incentives and rising spec exposure. The latest wave of upscale openings in Washington, Florida, Nevada, Georgia, and North Carolina reinforces the community growth catalyst ahead of the upcoming earnings report, but it does not materially change the biggest near term risk around margin pressure if demand cools.

Among the recent announcements, the new phase at Regency at Olde Towne in Raleigh stands out because it expands the 55+ Excursion Collection, a segment aligned with Toll Brothers’ focus on affluent, lifestyle-focused buyers. As the company leans on community count growth to support earnings, active adult communities like this help broaden the customer base while still fitting its higher price point, amenity-driven model.

But while Toll Brothers continues to open higher priced communities in attractive markets, investors should also be aware of the growing reliance on spec homes and what that could mean if...

Read the full narrative on Toll Brothers (it's free!)

Toll Brothers’ narrative projects $13.1 billion revenue and $1.7 billion earnings by 2028.

Uncover how Toll Brothers' forecasts yield a $149.94 fair value, a 5% upside to its current price.

Exploring Other Perspectives

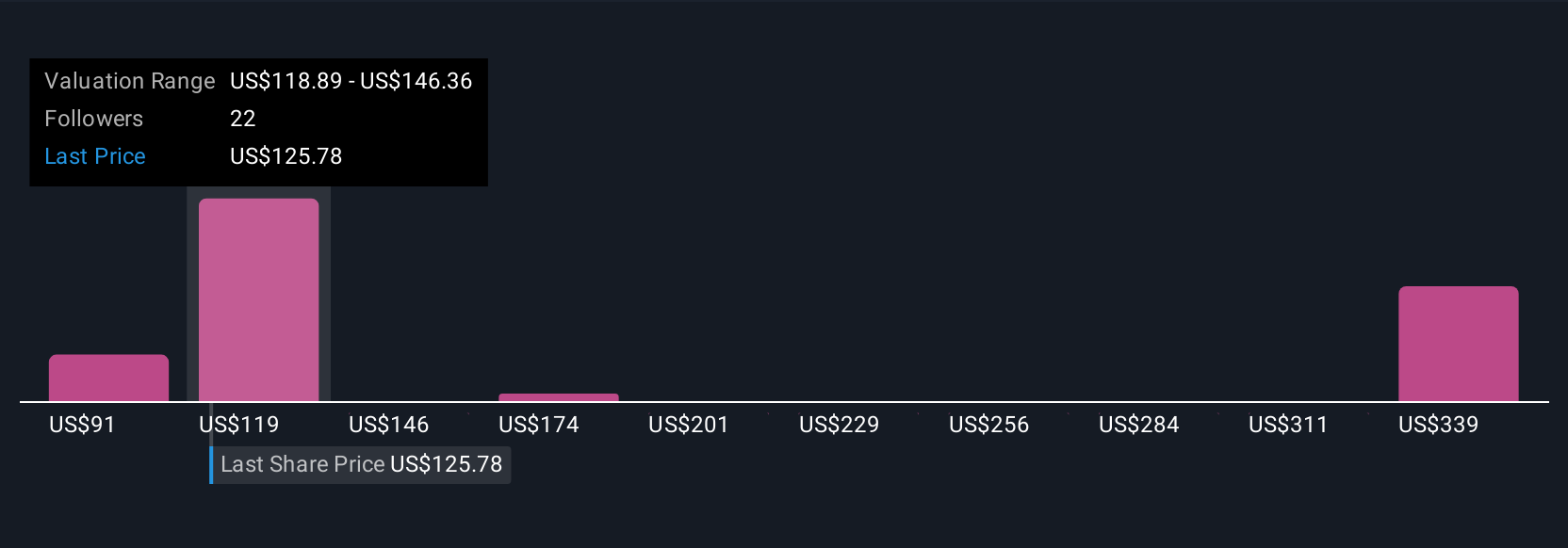

Ten members of the Simply Wall St Community currently see Toll Brothers’ fair value between US$91.41 and US$191.37, reflecting wide differences in individual forecasts. Against that backdrop, the company’s push to grow its community count in supply constrained, higher income markets could be an important swing factor for future performance, so it is worth comparing several of these viewpoints before deciding how you see the stock.

Explore 10 other fair value estimates on Toll Brothers - why the stock might be worth 36% less than the current price!

Build Your Own Toll Brothers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Toll Brothers research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Toll Brothers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Toll Brothers' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toll Brothers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TOL

Toll Brothers

Designs, builds, markets, sells, and arranges finance for a range of detached and attached homes in luxury residential communities in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026