- United States

- /

- Consumer Durables

- /

- NYSE:TOL

Toll Brothers (TOL): Assessing Valuation as Luxury Community Launches Spur Fresh Investor Optimism

Reviewed by Kshitija Bhandaru

When a company like Toll Brothers (TOL) suddenly announces a flurry of new luxury communities, stretching from Arizona all the way to Florida, it is bound to catch any investor’s attention. Over just the past week, Toll Brothers has rolled out plans for exclusive enclaves in key, affluent regions, at a time when many rivals are tightening their belts. With these recent announcements, the company is clearly signaling an intention to double down on its core strength: upscale homes in markets where supply remains tight and demand for high-end amenities is proving resilient.

Amid this wave of expansion, Toll Brothers’ share price has been gaining ground lately, even as the stock remains well below its highs from earlier in the year. Despite a double-digit drop over the past year, momentum has started to build again in the past three months, further fueled by upbeat analyst sentiment around the company’s valuation and regional focus. Toll Brothers stands out for targeting areas with relatively stable luxury demand, a strategy that could offer some insulation from the softness now weighing on broader homebuilder peers.

So after this active push into fresh markets and signs of renewed momentum, is Toll Brothers setting up for a genuine buying opportunity, or has the market already factored in all of its growth potential?

Most Popular Narrative: 8.5% Undervalued

The leading narrative indicates that Toll Brothers is undervalued by 8.5% against its estimated fair value, driven by bullish expectations around revenue growth, margins, and an expanding community count in high-demand luxury markets.

Upcoming expansions in community count (projected 8 to 10 percent year-over-year growth and similar outlook for next year) position Toll Brothers to capture more buyers in supply-constrained housing markets, supporting revenue and earnings growth as new communities open in high-demand, affluent regions.

Curious what makes analysts so confident in this luxury homebuilder? There is a numbers-driven method behind why the current market price is seen as a bargain, one closely linked to ambitious assumptions for future sales, profit margins, and company growth. Want to uncover the inside track fueling this bullish valuation? See how ambitious projections for home deliveries and profitability combine to create a fair value calculation that could surprise you.

Result: Fair Value of $149.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent reliance on speculative builds and rising incentives may pressure margins. This could challenge the bullish outlook if buyer demand softens unexpectedly.

Find out about the key risks to this Toll Brothers narrative.Another View: What Does the DCF Model Say?

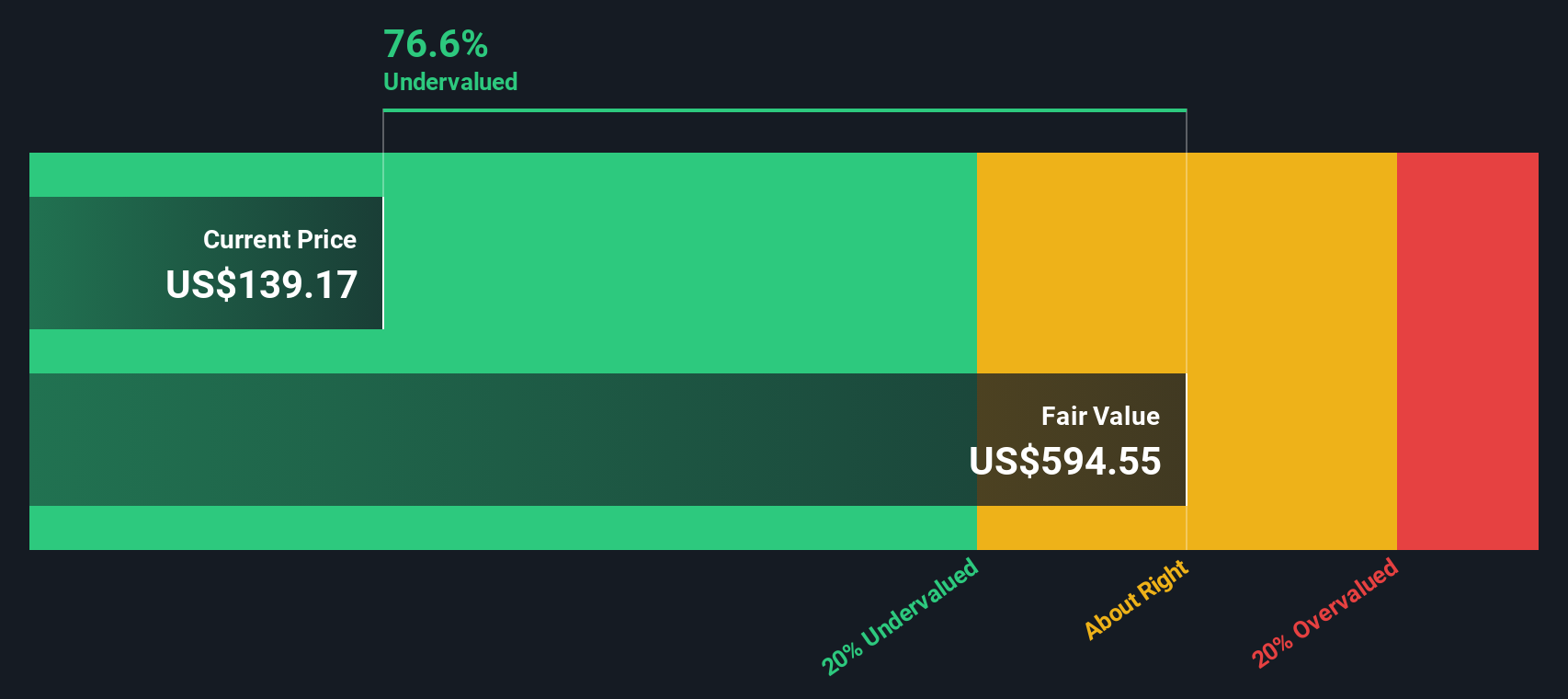

While analysts rely on future earnings and price targets, the Simply Wall St DCF model comes to a different conclusion by using projected cash flows and discount rates. Could this alternative lens change how you view Toll Brothers’ value?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toll Brothers for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toll Brothers Narrative

If you see things differently or want to draw your own conclusions, you can quickly build and test your own perspective on Toll Brothers. Do it your way

A great starting point for your Toll Brothers research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t let promising opportunities pass you by. Get ahead of the next market trend by searching for stocks that fit your personal strategy using these expert-curated ideas:

- Spot undervalued gems with solid earnings forecasts by checking out undervalued stocks based on cash flows before the crowd catches on.

- Power up your portfolio with future-focused artificial intelligence players using our list of AI penny stocks generating headlines and returns.

- Fuel your income goals with high-yielders by targeting dividend stocks with yields > 3% that consistently reward shareholders, even in tricky markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toll Brothers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TOL

Toll Brothers

Designs, builds, markets, sells, and arranges finance for a range of detached and attached homes in luxury residential communities in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives