- United States

- /

- Consumer Durables

- /

- NYSE:TMHC

Is Taylor Morrison Stock Offering Value After Recent 9.8% Drop?

Reviewed by Bailey Pemberton

Thinking about what to do with Taylor Morrison Home stock? You’re not alone, and the timing to revisit the story is interesting. Over the last week, shares dropped by 9.8%, extending a rocky stretch that has seen the stock fall 12.0% in the last 30 days. Looking at the bigger picture, the return for the year so far is just 1.2%, and the last twelve months show a small dip of 9.1%. But don’t let the recent turbulence distract you from the longer-term climb. Three- and five-year returns stand at 147.6% and 126.3% respectively. That demonstrates notable staying power, especially considering the wider forces at play in the housing market right now, including fluctuating mortgage rates and shifting buyer demand that have affected investor sentiment across the sector.

What really stands out for Taylor Morrison Home is its value score: a perfect 6 out of 6. This means the stock is seen as undervalued in every single one of the six checks we track. But what do all those different valuation methods actually mean for investors like you? Let’s break down what goes into each approach, and keep reading for a perspective you may find especially useful.

Approach 1: Taylor Morrison Home Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting future cash flows and discounting them back to today’s value. This approach focuses on how much cash Taylor Morrison Home is expected to generate in the coming years, which gives investors an idea of what the stock is really worth based on its underlying business.

Currently, Taylor Morrison Home reports Free Cash Flow (FCF) of $489 million. Analysts expect this figure to increase steadily, projecting $619.5 million in FCF by the end of 2026. Looking out ten years, the model extrapolates future cash flows, with estimates reaching nearly $945 million for 2035. All amounts refer to USD and remain in the millions over this period, indicating consistent growth instead of dramatic leaps.

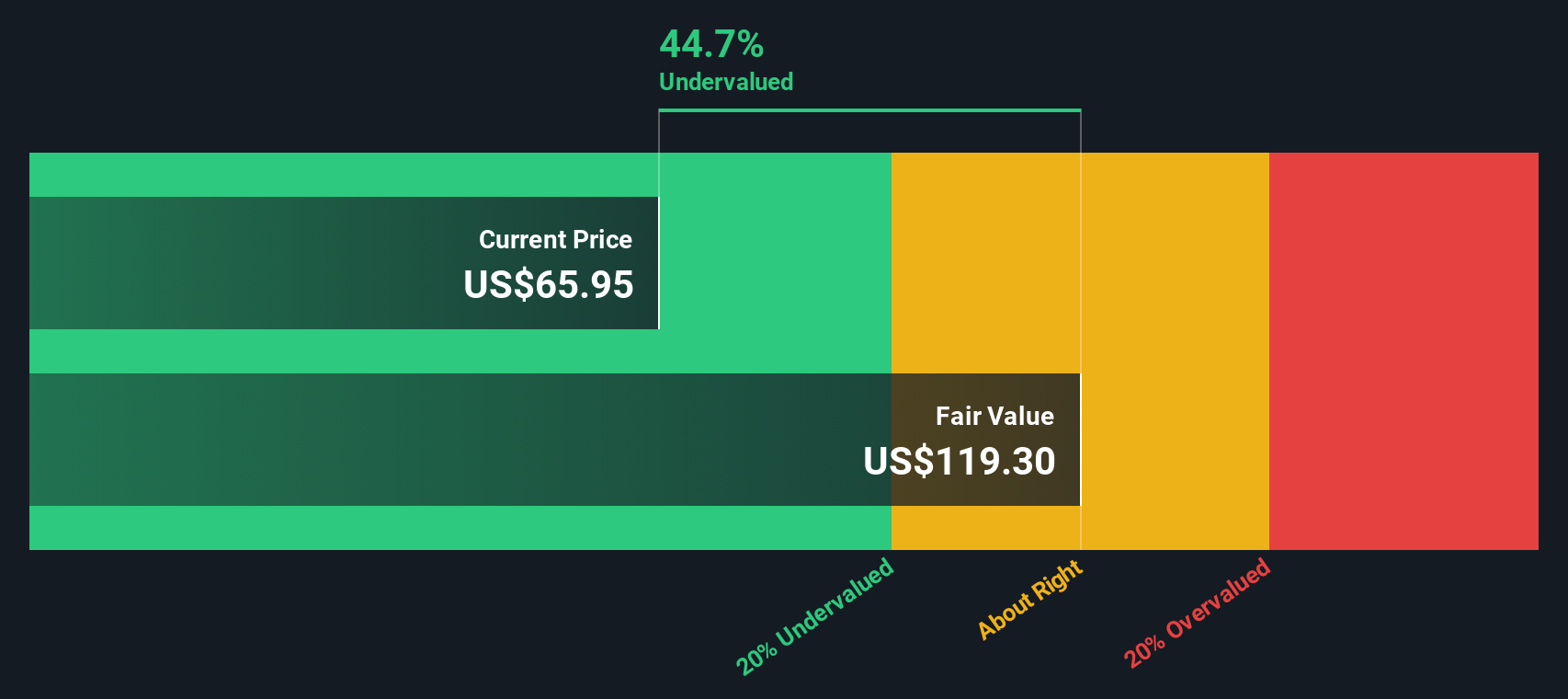

Based on these projections, the DCF analysis calculates an intrinsic value of $117.63 per share. Compared to recent trading levels, this suggests the stock is about 47.9% undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Taylor Morrison Home is undervalued by 47.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Taylor Morrison Home Price vs Earnings

The price-to-earnings (PE) multiple is a tried-and-true way to value profitable companies, like Taylor Morrison Home. It works well in this case because it directly compares the price of the stock to the company’s current earnings, offering investors an intuitive "how much are you paying for every dollar of profit?" snapshot. A higher PE ratio often points to strong growth expectations or lower perceived risk, while a lower ratio might signal caution from the market or below-average growth prospects.

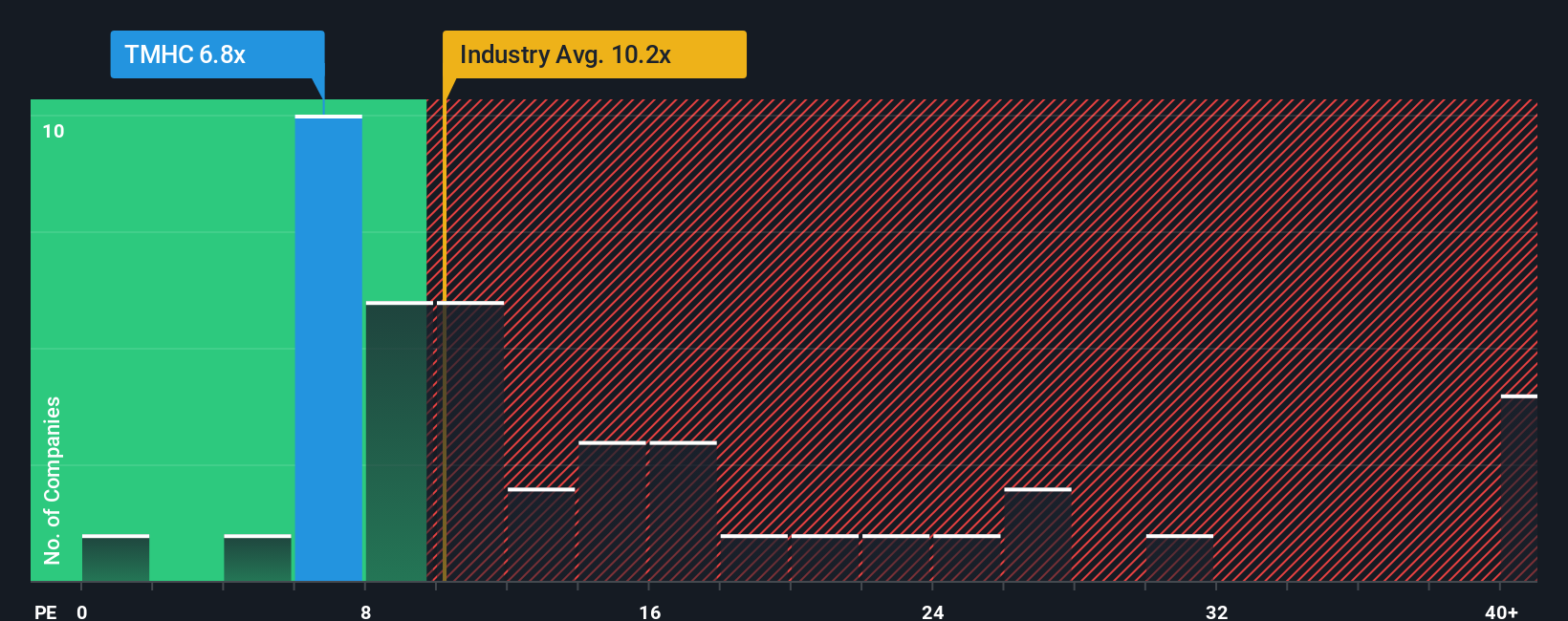

Currently, Taylor Morrison Home trades at a PE of 6.7x. In comparison, the average PE for similar Consumer Durables companies is about 10.2x, while the average for close peers sits even higher at 15.4x. This means Taylor Morrison Home is clearly priced lower than both its industry and peer group by this measure.

But just comparing to peers does not tell the whole story. The proprietary "Fair Ratio" from Simply Wall St takes a broader view, weighing factors like earnings growth, profit margins, company size, and risk alongside those industry benchmarks. For Taylor Morrison Home, the Fair Ratio stands at 12.7x. Because the Fair Ratio puts all the relevant pieces together, rather than focusing on only one aspect, it is a more reliable guide for what the stock should reasonably be valued at in today’s market.

Since Taylor Morrison Home’s current PE of 6.7x is notably below its Fair Ratio, this suggests the stock is undervalued on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Taylor Morrison Home Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative goes beyond the numbers by allowing you to apply your own storyline to a company, combining your assumptions about fair value, future revenue, earnings, and margins with an explanation of why you believe those outcomes will happen.

Think of a Narrative as the bridge between a company’s story and your financial forecast. It connects what you know about the business and industry to a calculated fair value. Narratives are accessible and easy to use, right inside the Simply Wall St Community (where millions of investors engage daily), so investors at any level can build their own or see others’ perspectives quickly.

These Narratives help you make more confident buy or sell decisions by directly comparing your fair value to the market price. Because Narratives update automatically as new news or earnings arrive, your perspective stays up to date with the latest information.

For Taylor Morrison Home, some investors have a cautious view, seeing modest future revenue growth and softer margins. Others see opportunity in strong demographics, product diversification, and resilient profitability. This results in a wide range of fair values, from $65 on the bearish end to $85 on the bullish side, all grounded in distinct stories that guide each investor’s strategy.

Do you think there's more to the story for Taylor Morrison Home? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taylor Morrison Home might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TMHC

Taylor Morrison Home

Operates as a land developer and homebuilder in the United States.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives