- United States

- /

- Leisure

- /

- NYSE:PII

Polaris (NYSE:PII) Faces 13% Price Dip Amid Market Trade Tension Concerns

Reviewed by Simply Wall St

The past week has been turbulent for Polaris (NYSE: PII), marked by a 13% decline in its share price. This downturn coincides with broader concerns in the market, where major indexes have wavered amidst trade tensions and mixed economic data, resulting in a market drop of 3%. The imposition of U.S. tariffs on imports from Mexico and Canada, coupled with fluctuation in investor sentiment regarding the economy's health, likely contributed to the overall atmosphere of uncertainty. Simultaneously, sector-specific challenges could have further impacted Polaris's performance, with the auto industry facing scrutiny related to tariff policies. While some companies, like automakers, showed resilience amidst potential relief measures, Polaris may not have enjoyed similar optimism. In contrast to the broader market's 13% growth over the past year, Polaris's recent performance highlights the effects of both global trade dynamics and sector-specific pressures on its share price.

Click here and access our complete analysis report to understand the dynamics of Polaris.

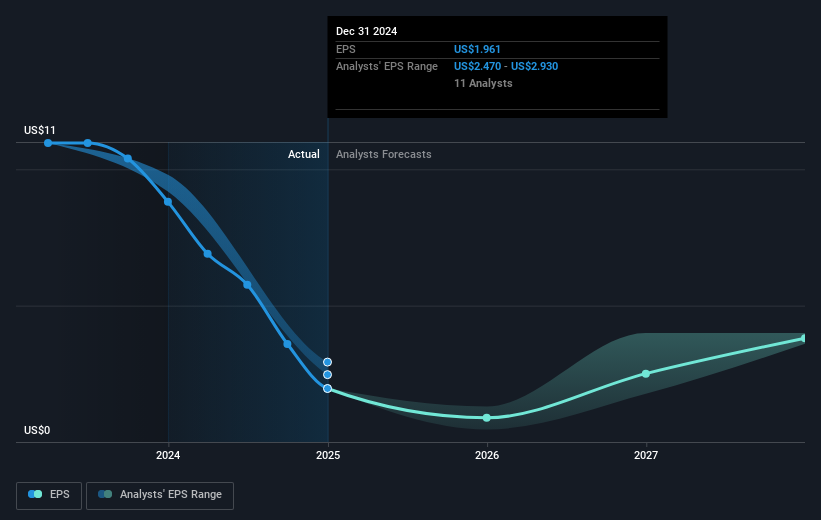

The last five years have seen Polaris Inc. (NYSE: PII) experience a total shareholder return (TSR) of 38.69%, a reflection of multiple challenges. Notable earnings disruptions were reported at the beginning of 2025, with annual sales dropping to US$7.18 billion from nearly US$8.93 billion in the previous year, contributing to a less favorable investor sentiment. Furthermore, the company's profitability was under pressure as full-year net income sharply decreased from US$502.8 million to US$110.8 million. These financial constraints also impacted dividend coverage, as dividends were not well sustained by earnings or free cash flows despite a 2% increase in the quarterly dividend payment.

Company-specific actions, such as launching a high-priced, innovative off-road vehicle in January 2025, highlighted its focus on niche markets, yet larger market dynamics and cost considerations continued to challenge broader investor perceptions. The introduction of an electric vehicle charging network and strategic partnerships, like the integration with Call of Duty, emphasized attempts to enhance brand visibility amidst undergoing financial strain.

- Discover whether Polaris is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Assess the potential risks impacting Polaris' growth trajectory—explore our risk evaluation report.

- Shareholder in Polaris? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PII

Polaris

Designs, engineers, manufactures, and markets powersports vehicles in the United States, Canada, and internationally.

Reasonable growth potential average dividend payer.