- United States

- /

- Luxury

- /

- NYSE:ONON

Top 3 US Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As U.S. markets continue to rally, with the S&P 500 and Nasdaq Composite extending their winning streaks, investors are closely watching for opportunities in growth companies. In this favorable market environment, stocks with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.6% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.6% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.8% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.1% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 32.3% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.9% |

| On Holding (NYSE:ONON) | 28.4% | 24.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.9% |

| BBB Foods (NYSE:TBBB) | 22.9% | 70.7% |

Let's review some notable picks from our screened stocks.

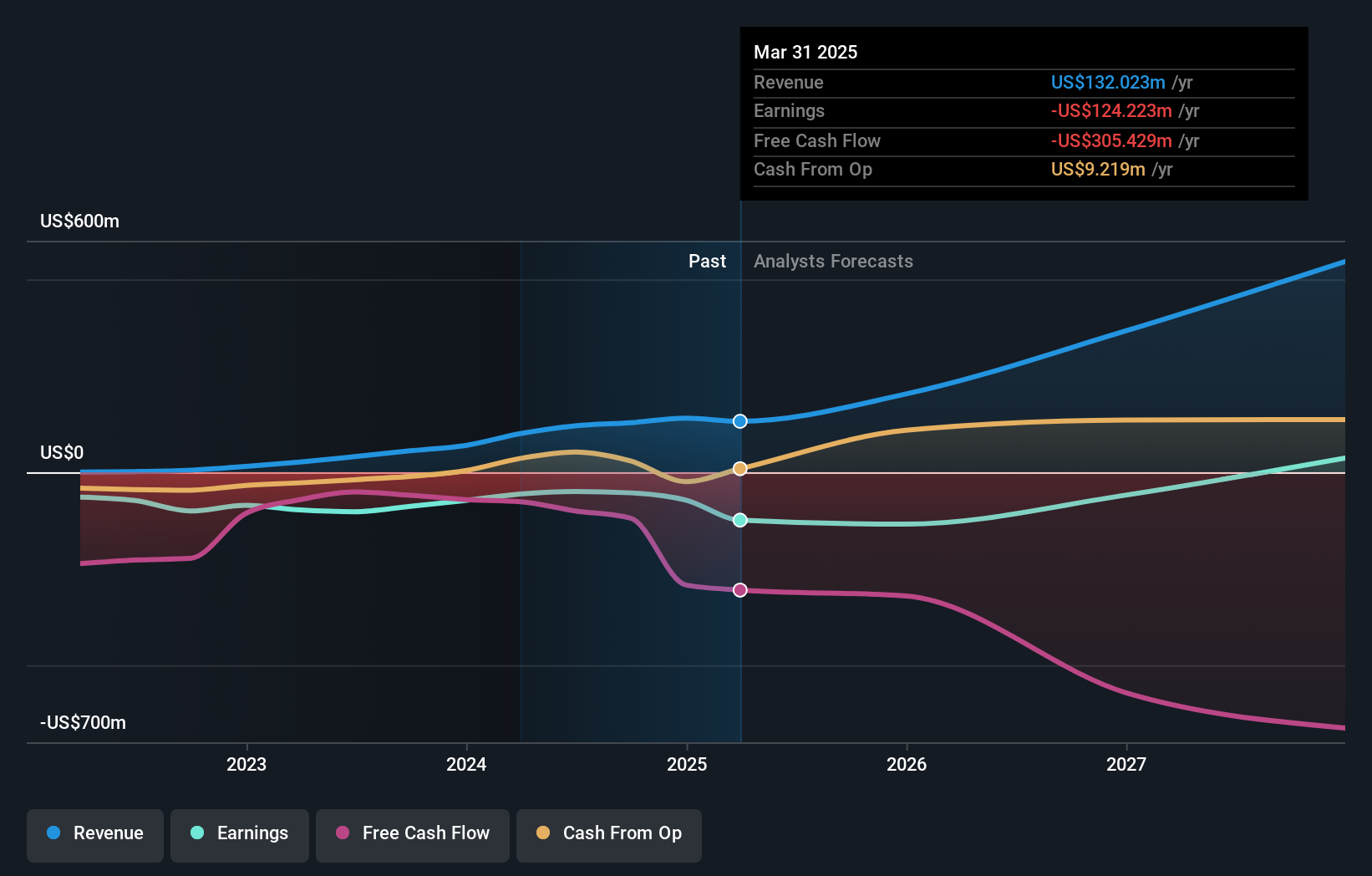

TeraWulf (NasdaqCM:WULF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TeraWulf Inc., along with its subsidiaries, operates as a digital asset technology company in the United States and has a market cap of approximately $1.54 billion.

Operations: The company generates revenue primarily from digital currency mining, amounting to $120.25 million.

Insider Ownership: 15.1%

TeraWulf, a growth company with high insider ownership, is forecast to achieve significant revenue growth of 46% annually and become profitable within three years. Despite substantial dilution over the past year and a highly volatile share price, insiders have bought more shares than sold recently. Recent earnings show sales of US$35.57 million for Q2 2024, up from US$15.46 million a year ago, though net loss narrowed to US$10.88 million from US$17.54 million.

- Unlock comprehensive insights into our analysis of TeraWulf stock in this growth report.

- The analysis detailed in our TeraWulf valuation report hints at an inflated share price compared to its estimated value.

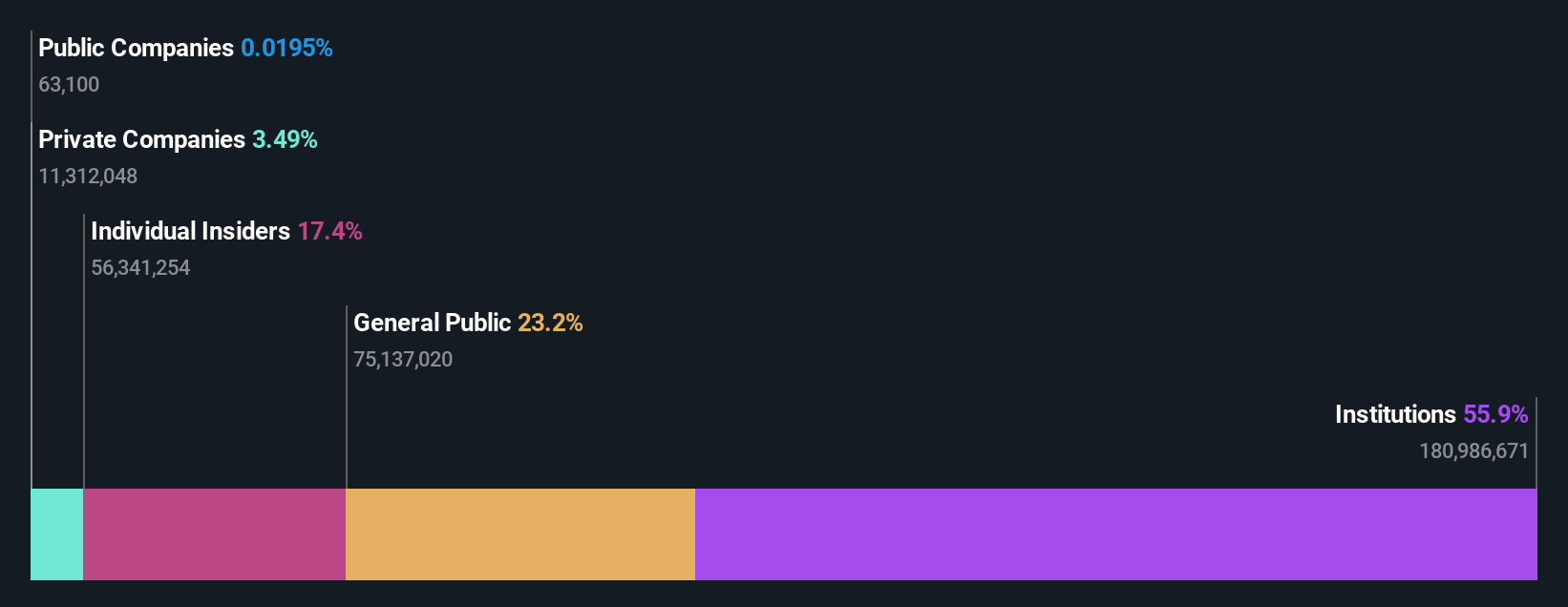

On Holding (NYSE:ONON)

Simply Wall St Growth Rating: ★★★★★★

Overview: On Holding AG develops and distributes sports products globally, with a market cap of $13.62 billion (NYSE:ONON).

Operations: On Holding's revenue primarily comes from its Athletic Footwear segment, which generated CHF 2.00 billion.

Insider Ownership: 28.4%

On Holding, known for high insider ownership, reported strong Q2 2024 results with sales of CHF 567.7 million and net income of CHF 30.8 million, up significantly from the previous year. The company reiterated its full-year guidance, expecting at least 30% growth in constant currency terms. On's revenue is forecast to grow faster than the US market at 20.1% annually, with earnings projected to increase by 24.66% per year over the next three years.

- Click here and access our complete growth analysis report to understand the dynamics of On Holding.

- According our valuation report, there's an indication that On Holding's share price might be on the expensive side.

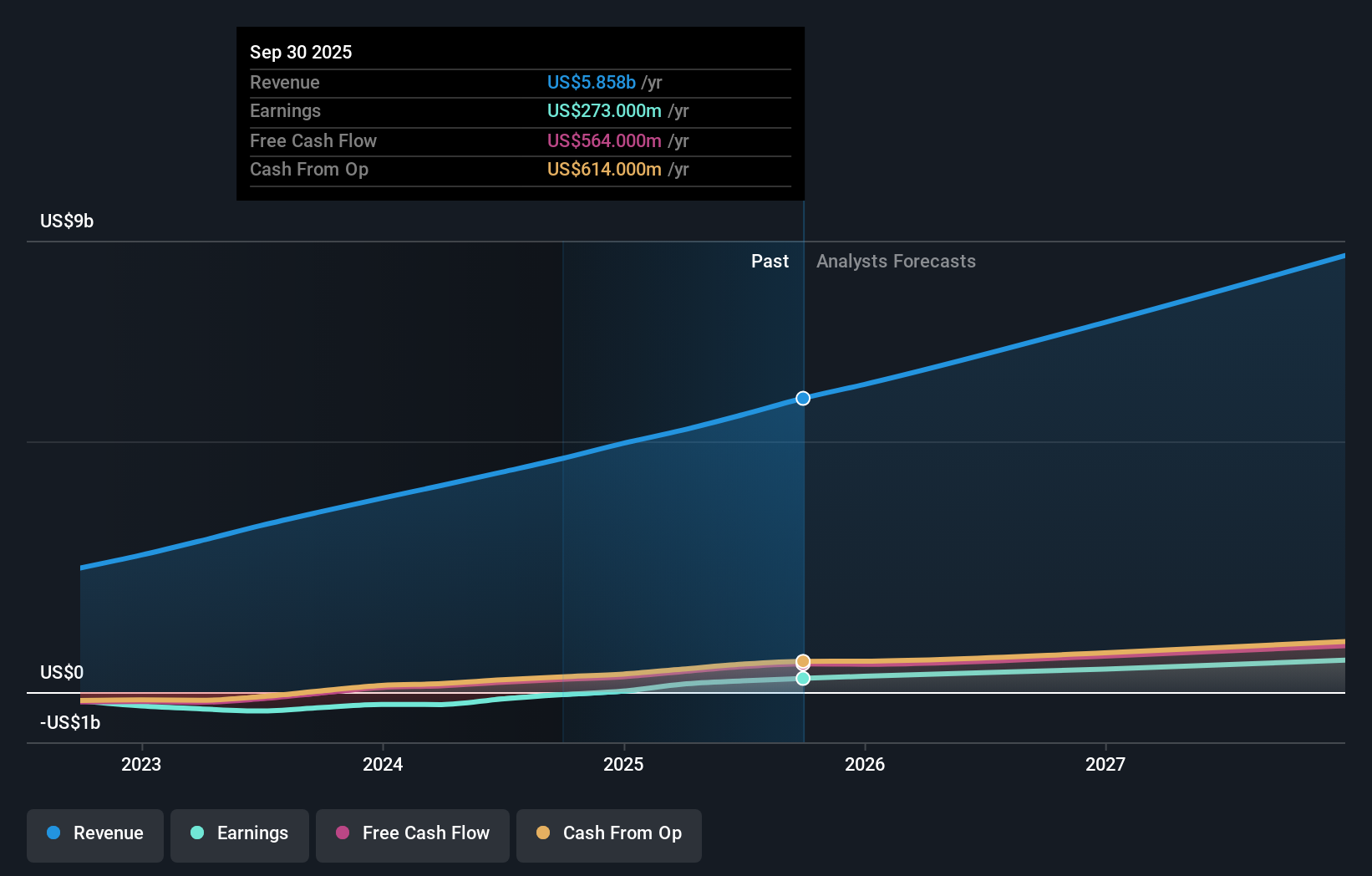

Toast (NYSE:TOST)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Toast, Inc. operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, and India with a market cap of $13.90 billion.

Operations: Toast's revenue segments include Data Processing, which generated $4.39 billion.

Insider Ownership: 21.4%

Toast, Inc. demonstrates strong growth potential with high insider ownership. Recent Q2 2024 earnings showed significant improvement, with revenue reaching US$1.24 billion and net income of US$14 million compared to a net loss the previous year. The company is forecasted to achieve above-average market profit growth over the next three years and expects annual revenue growth of 16.7%. Despite past shareholder dilution, Toast's focus on organic investment and strategic M&A supports its long-term growth trajectory.

- Navigate through the intricacies of Toast with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Toast's shares may be trading at a premium.

Turning Ideas Into Actions

- Click this link to deep-dive into the 177 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ONON

On Holding

Engages in the development and distribution of sports products worldwide.

Exceptional growth potential with flawless balance sheet.