- United States

- /

- Luxury

- /

- NYSE:ONON

The Bull Case For On Holding (ONON) Could Change Following Upgraded 2025 Sales and Margin Guidance

Reviewed by Simply Wall St

- On Holding AG recently raised its full-year 2025 guidance, now expecting at least a 31% year-over-year increase in net sales on a constant currency basis to a minimum of CHF 2.91 billion, and a higher gross profit margin of 60.5-61.0%.

- This guidance upgrade came after the company reported strong second-quarter and half-year sales growth, alongside enhanced profitability expectations despite posting a net loss in the recent quarter.

- We'll explore how On Holding's upgraded sales and margin guidance following robust quarterly results may influence its long-term growth outlook.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

On Holding Investment Narrative Recap

To own On Holding stock, an investor needs to believe the company can sustain rapid revenue growth and margin expansion as it scales its global premium sportswear brand, even with macroeconomic and competitive uncertainties ahead. The company’s upgraded 2025 outlook for both sales and gross margin suggests strong underlying demand and improved profitability, boosting the key near-term catalyst: accelerating direct-to-consumer growth. However, risks tied to premium pricing and heavy investment remain; this news does not remove those headwinds.

The latest earnings announcement was central to the guidance upgrade, as On Holding reported robust year-over-year sales growth in the second quarter but swung to a net loss. The strong revenue numbers provided the basis for higher full-year sales expectations, but also highlighted ongoing margin pressure as the company continues rapid global expansion and invests heavily in brand, retail, and supply chain initiatives.

On the other hand, investors should be aware that elevated premium pricing and ongoing cost pressures could still...

Read the full narrative on On Holding (it's free!)

On Holding's outlook anticipates CHF5.1 billion in revenue and CHF561.3 million in earnings by 2028. Achieving this would require annual revenue growth of 22.9% and a CHF425.4 million increase in earnings from the current level of CHF135.9 million.

Uncover how On Holding's forecasts yield a $65.66 fair value, a 41% upside to its current price.

Exploring Other Perspectives

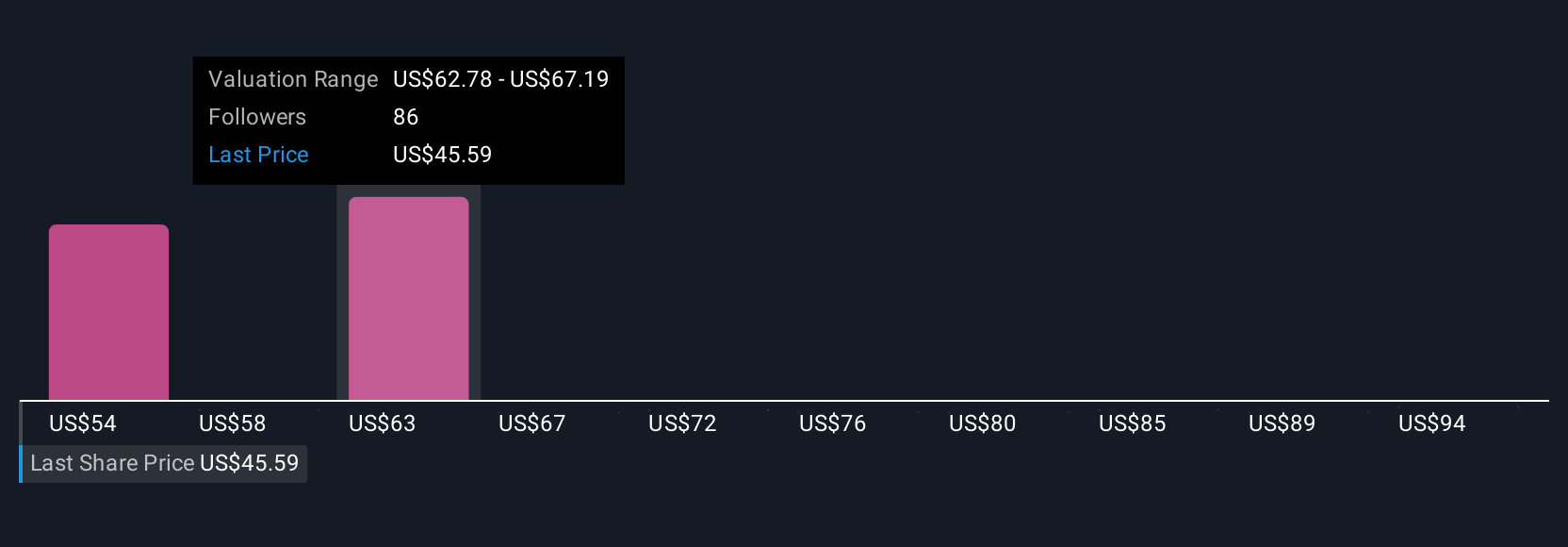

Fair value estimates from nine Simply Wall St Community members range from CHF54.32 to CHF98.04 per share, reflecting widely different views. Amid this diversity, the company’s guidance for faster direct-to-consumer growth could ultimately prove decisive for future earnings potential.

Explore 9 other fair value estimates on On Holding - why the stock might be worth just $54.32!

Build Your Own On Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your On Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free On Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate On Holding's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ONON

On Holding

Engages in the development and distribution of sports products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives