- United States

- /

- Luxury

- /

- NYSE:ONON

On Holding (NYSE:ONON) Reports Increase In Sales To CHF 727M; Net Income Down

Reviewed by Simply Wall St

On Holding (NYSE:ONON) has experienced a notable 32% increase in its share price over the last month. The company's latest earnings announcement on May 13, 2025, showed strong sales growth of CHF 726.6 million for the first quarter, although net income fell to CHF 56.7 million. This mixed financial performance reflects both positive revenue growth and challenges with profitability that align with market trends. During this period, the broader market rose by nearly 4%. While On Holding's results could have influenced its stock performance, the company’s growth narrative may have added weight to the overall market's upward trajectory.

Buy, Hold or Sell On Holding? View our complete analysis and fair value estimate and you decide.

The recent surge in On Holding's stock, following its earnings announcement, underscores the positive market sentiment towards its growth prospects despite net income challenges. Over the longer term, the company's shares delivered a total return of 178.41% across three years, showcasing substantial growth in shareholder value. In contrast, over the past year, On Holding's performance notably exceeded the US Luxury industry, which saw a decline of 10.8%.

The company's revenue forecast remains buoyant, with anticipated contributions from expanding Direct-to-Consumer channels and market expansion in Asia Pacific. These developments align with the strategic initiatives inferred from the May 13 earnings update. However, the mixed earnings results also highlight ongoing challenges that might affect profit margins, as evidenced by the current decline from 10.5%, expected to further decrease over the next three years.

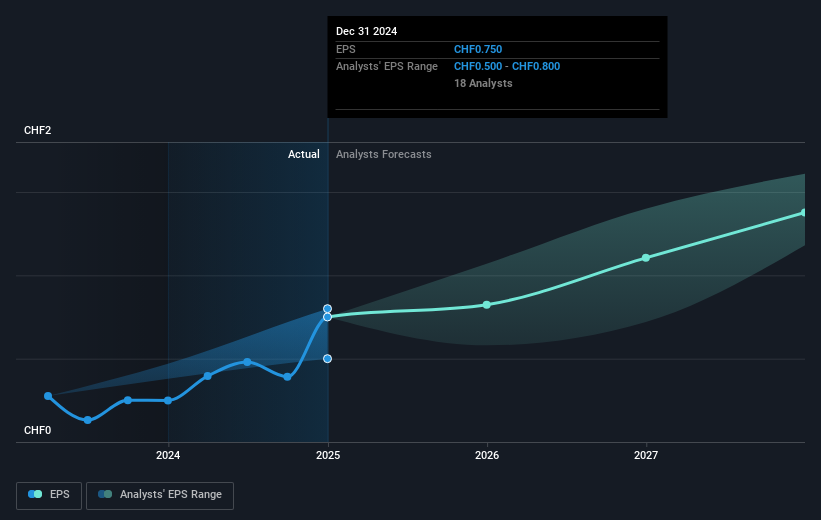

With On Holding's stock currently trading at CHF47.9, it stands at a discount to the consensus price target of CHF61.75. This suggests investor optimism regarding future growth that aligns with increasing analyst expectations. The combination of share price movement and positive market trends indicates a confident outlook among stakeholders regarding the company's ability to capitalize on its growth drivers and strategic collaborations.

Gain insights into On Holding's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ONON

On Holding

Engages in the development and distribution of sports products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives