- United States

- /

- Luxury

- /

- NYSE:ONON

On Holding (NYSE:ONON) Appoints New Executives as Part of Leadership Changes

Reviewed by Simply Wall St

On Holding (NYSE:ONON) recently announced significant leadership changes, including appointing new senior executives and transitioning to a single-CEO structure. These moves likely reinforced the company's image of strong governance and strategic focus, aligning with its growth ambitions. Amid a generally declining market, with indices dropping as much as 4%, On's stock saw a notable 14% increase last week. These internal enhancements provided a positive sentiment amid broader market volatility influenced by ongoing tariff uncertainties. As major indices grappled with economic concerns, On's developments stood out, contributing to its distinct upward trajectory against market trends.

Buy, Hold or Sell On Holding? View our complete analysis and fair value estimate and you decide.

The recent leadership changes at On Holding could fortify the company's governance and strategic alignment, potentially enhancing investor confidence. Over the past three years, On Holding's total return, which includes share price appreciation and dividends, rose significantly by 73.33%, indicating robust long-term performance. This growth contrasts with the previous year's performance, where On Holding's returns surpassed both the broader market at 4.7% and the US Luxury industry at 17.6% decline. These distinctions underscore On Holding's resilient positioning relative to broader industry and market conditions.

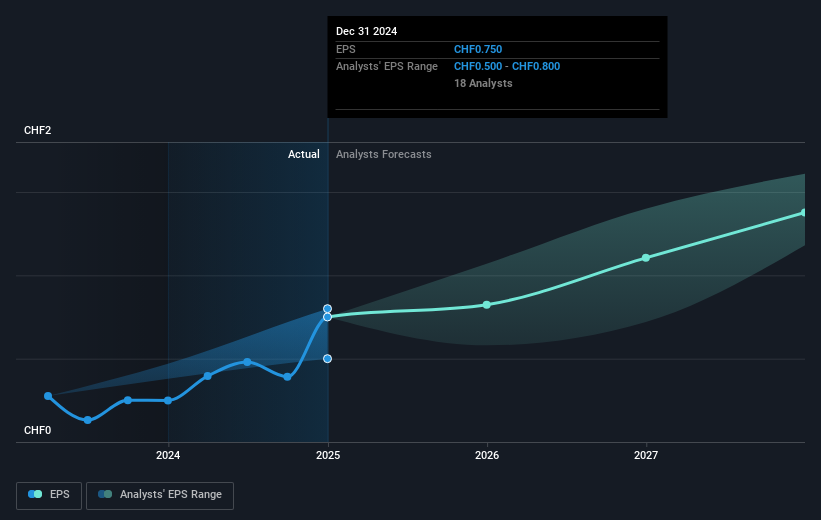

The leadership shifts, coupled with strategic initiatives such as collaborative innovations and global expansions, are anticipated to bolster revenue and earnings. Analysts forecasted annual revenue growth at 18%, highlighting continued confidence despite projected margin reductions. With the current share price standing at US$43.02, below the analysts' consensus price target of US$65.99, expectations of improved financial performance are yet to be fully reflected in the stock price. This gap may suggest potential upside if the company can effectively execute its growth strategies and meet earnings expectations, enhancing its valuation in line with market anticipations.

Our expertly prepared valuation report On Holding implies its share price may be too high.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ONON

On Holding

Engages in the development and distribution of sports products worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives